The difficulty of Bitcoin has risen by 5.11 percent in the last seven days, climbing to its three-month high after surging almost 25 percent in the last 90 days. Could this be an indicator that a price boom is on the horizon? Let’s take a closer look at why these changing figures matter and identify some of the key drivers behind its growth.

Historically, a linear relationship between the market price of Bitcoin (BTC) and its difficulty has always been observed.

Since the difficulty is a measure of how hard it is to find a hash lower than the target defined by the Bitcoin protocol, it becomes a natural determining factor of whether Bitcoin mining is profitable or not — since difficulty is negatively correlated with earning block rewards.

Does Increased Difficulty Mean Increased Value?

Since difficulty is intimately linked with hashrate, falling Bitcoin value may make it less profitable to mine — which, in turn, reduces the difficulty. On the flip side, when the Bitcoin price remains roughly stable, despite an increase in difficulty, then a price bump is often observed sometime later. In line with this, it appears that the current difficulty bump is a result of Bitcoin’s largely-stable prices over the past month — which is, in turn, driving speculators to predict that a price hike is on the horizon. Because of this, traders are hoping that the resulting price hike may push Bitcoin through its $4,000 resistance, which could break the prevailing 2019 bearish trend. However, a rising difficulty is not always a predictor of impending bullish movements. Just last year, the Bitcoin difficulty increased to its all-time high of almost 7.5 trillion during a period where Bitcoin lost close to 80 percent of its value. As it stands, Bitcoin’s current 6.4 trillion difficulty level is just over 14.4 percent lower than its all-time high but has lost more than 40 percent of its value since this point — demonstrating the somewhat fuzzy relationship between difficulty and market value.

The Relationship Between Difficulty and Hashrate

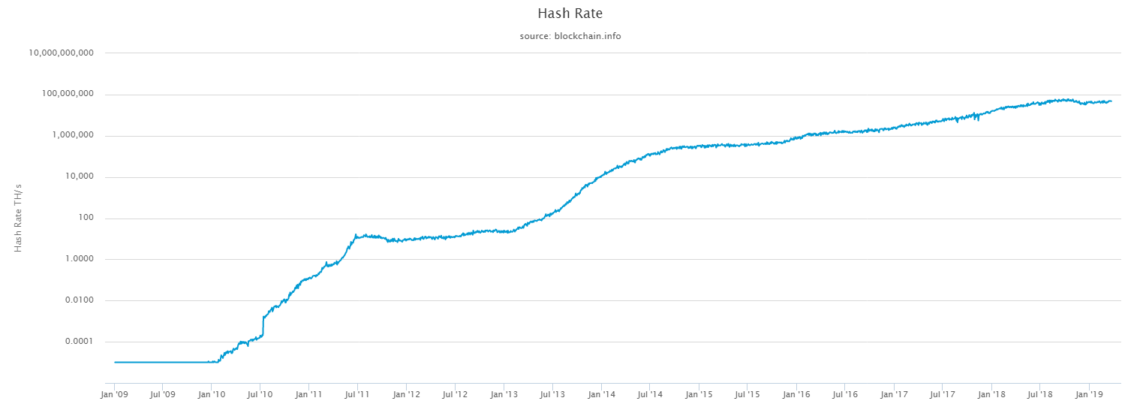

Another metric that closely follows Bitcoin prices and the difficulty value is the network’s global hashrate. Between January to March 2019, the average global hashrate per day has increased from 4.0 exahashes to 4.7 exahashes per second (Eh/s) — 16.2 percent growth in just two months. The network hashrate is the overall measure of the speed at which each hash from the Bitcoin code is solved by all the miners in the Bitcoin network. This represents the total computing power dedicated to securing the Bitcoin blockchain. Since the Bitcoin protocol will attempt to keep block discovery time at 10 minutes, the difficulty of discovering new blocks will be automatically adjusted to ensure this discovery time is maintained, whether by increasing difficulty when hashrate climbs or decreasing difficulty when hashrate drops. This process is known as difficulty retargeting. In most cases, a large spike in overall hashrate typically occurs as a result of either improved profitability due to a large price spike or as a result of much more powerful mining hardware coming online for the first time.

Why Did the Difficulty Increase?

Recently, Japanese banking giant SBI announced its venture into Bitcoin mining chip development. This news, coupled with the fact that Bitmain just deployed $80 million worth of new BTC miners, could be part of the reason behind the recent hashrate increase. According to local sources in the southwestern provinces of China, Bitmain is planning to deploy around 200,000 of its newly developed Antminer S11, S15 and T15 units. With the region supplying cheap excess hydroelectric power, Bitmain is more than likely looking to leverage this to recoup some of its extensive 2018 losses. On the other hand, SBI holdings’ new subsidiary, SBI Mining Chip Co., Ltd, has entered into a partnership with a US-based semiconductor development company to manufacture a new line of bitcoin mining chips — which could yield the next generation of Bitcoin ASIC miners. With the Bitcoin mining industry being engaged by several industry behemoths, experts have classified the current situation as being the ‘Cold War of Mining’, with the Bitcoin hash rate and difficulty set to increase dramatically as a result. Do you think the increased hash rate is a sign of an impending price spike? Is Bitcoin mining even profitable in your country? Let us know in the comments below!Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Daniel Phillips

After obtaining a Masters degree in Regenerative Medicine, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite any evidence to the contrary. Nowadays, Daniel works in the blockchain space full time, as both a copywriter and blockchain marketer.

After obtaining a Masters degree in Regenerative Medicine, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite any evidence to the contrary. Nowadays, Daniel works in the blockchain space full time, as both a copywriter and blockchain marketer.

READ FULL BIO

Sponsored

Sponsored