Since the Sept 2-4 drop in the market, Bitcoin (BTC) has been trading near the $10,000 support area and has created several long lower-wicks in the process.

Technical indicators are turning bullish, but it is not yet certain whether the correction for BTC has ended.

Bitcoin Daily Wicks Indicate Buying Pressure

Since closing Sept 3 at $10,150 with a wick down to $9,990, BTC has created five more long lower-wicks, which signifies buying pressure.

The Sept 8 close was the lowest since the initial drop, negating some of the bullishness coming from the preceding hammer candlestick and the buying pressure from the wicks.

The shorter-term chart is more bullish as it shows a pronounced bullish divergence that has developed in the RSI. In addition, the stochastic RSI has made a bullish cross and the MACD has crossed into positive territory.

If the divergence plays out, BTC could make an upward move towards the 0.5 Fib level of the entire decrease at $10,950.

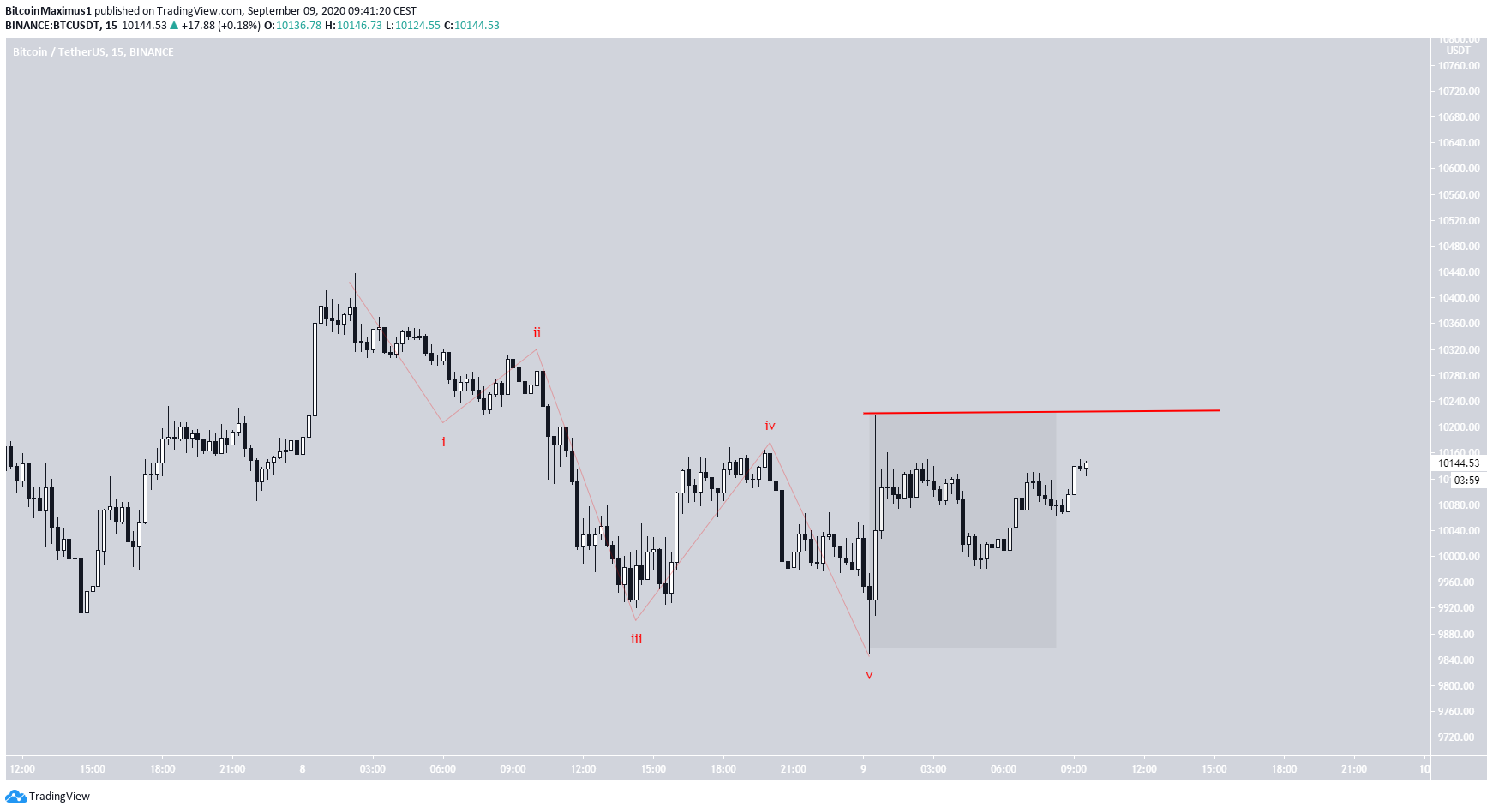

BTC Wave Counts

In BeInCrypto’s Sept 7 Bitcoin analysis, we stated that:

It is likely that BTC has completed wave 4 of a five-wave bullish impulsive formation, by reaching a bottom of $9,825 on Sept 5.

Yesterday’s movement makes it possible that wave 5 has ended, even though it was tiny compared to wave 3 (in orange below).

However, this is still a valid possibility due to the extension of wave 3.

The other possibility is that BTC is still in wave 4, which will end after an upward move takes the price towards $10,500-$10,600. The biggest factor in determining the correct count is establishing whether the movement outlined in black below is corrective or impulsive.

The preceding decrease looks like it transpired in five waves instead of three, supporting the possibility that the price has already completed wave 5.

If BTC breaks through the $10,218 high and does not touch it again on the way down, it would confirm that the price has begun an impulsive upward move.

If the increase is corrective, meaning there is considerable overlap, it would be more likely for the price to still be in wave 4.

To conclude, Bitcoin has either completed its correction or is likely very close to doing so. The price action after the low of Sept 8 will assist in determining the correct wave count.

For BeInCrypto’s previous Bitcoin analysis, click here!