The Bitcoin (BTC) price decreased by 12.30% during the week of Aug 31-Sept 7.

It has reached a major long-term horizontal and Fibonacci support level, which may be enough to initiate a reversal.

Bitcoin Rests at Weekly Support

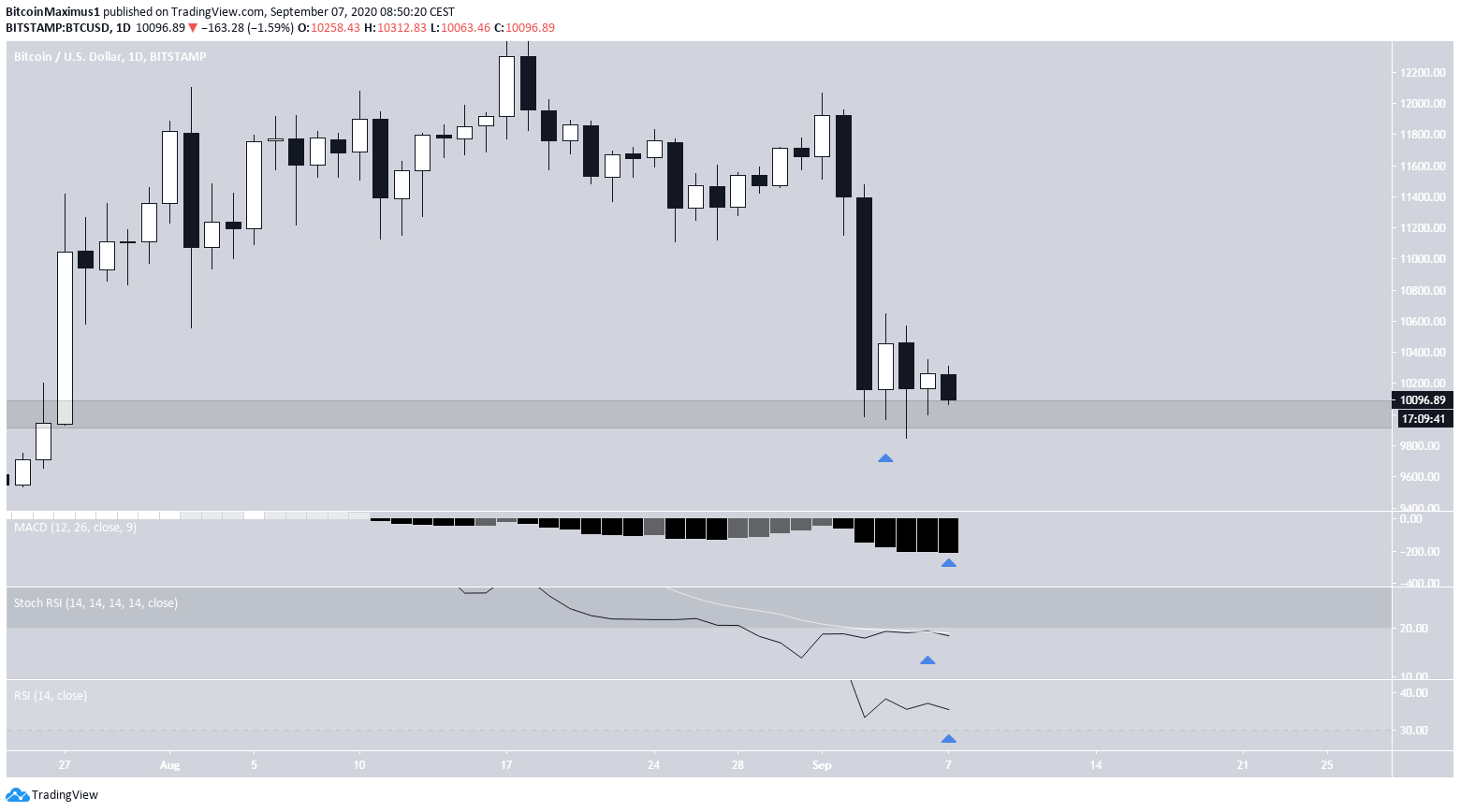

The Bitcoin price decreased considerably last week, creating a bearish engulfing candlestick and closing -12.30%. The price has fallen back to the $10,100 support area, which had previously been acting as a resistance between September 2019 and July 2020. The level is also very close to the long-term descending resistance line that the price had broken out from this past July. Technical indicators are leaning towards being bearish. The MACD has given a bearish reversal signal, and the stochastic RSI is in the process of generating a bearish cross. However, the cross could be rejected if the price creates a bullish candlestick this week. In addition, the RSI is still trending above 50. Therefore, the bearishness from weekly time-frame indicators is not sufficient to confirm that the trend is downward, especially since the price is trading above long-term support.

Short-Term Reversal

The daily chart shows that the price has created several long lower-wicks inside this aforementioned support area, a sign of buying pressure. The MACD, RSI, and Stochastic RSI have recorded their lowest values since the March crash. However, there is no bullish divergence nor bullish reversal signal in any of them.

BTC Wave Counts

It is likely that BTC has completed wave 4 of a five-wave bullish impulsive formation, by reaching a bottom of $9,825 on Sept 5. This bottom is both very near to the 0.786 Fib level of the entire wave 3 (in black below), and the 2.61 Fib of sub-wave W (red). In addition, the $9,825 bottom was reached at exactly twice the time it took to complete wave 3. While this is unusual, it is a complex correction, so the pattern remains a valid possibility. A decrease below the $9,450 high of wave 1 would invalidate this formation.

Alternative Wave Count

The alternative wave count would suggest that the price is still in wave 4, with another wave down to go. If this is correct, the price would likely retrace towards $10,650, before breaking down and reaching new local lows. However, this would not fit with the 1.61 Fib target and the new wave would have to be quite small since a decrease below $9,450 would invalidate the bullish wave count. To conclude, the Bitcoin price looks to have already completed its correction or is very close to doing so. A decrease below $9,450 would invalidate this particular scenario.

For BeInCrypto’s previous Bitcoin analysis, click here!

To conclude, the Bitcoin price looks to have already completed its correction or is very close to doing so. A decrease below $9,450 would invalidate this particular scenario.

For BeInCrypto’s previous Bitcoin analysis, click here!

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored