Bitcoin (BTC) has decreased considerably over the past seven days but has reached a short-term confluence of support levels, which could help to boost the price.

Bitcoin has been falling since Feb 15, when it was rejected near the $44,200 resistance area for the second time (red icon). So far, it has reached a low of $36,350 on Feb 22.

Measuring from the Nov 10 all-time high price, BTC has decreased by 47%.

Short-term BTC breakdown

The six-hour chart shows that BTC has broken down from an ascending support line. Currently, it’s trading between the 0.618 and 0.786 Fib retracement support levels at $35,700-$37,700. This area is also a horizontal support level.

There are no clear bullish reversal signs beside the oversold RSI.

The RSI is a momentum indicator and readings below 30 are considered oversold. The previous time the RSI was this low was on Jan 23 and preceded a significant upward move.

The two-hour BTC chart is slightly more bullish and shows a very pronounced bullish divergence in the oversold RSI.

If an upward move follows, the closest resistance levels to watch are $39,600 and $40,575. Besides being the 0.382 and 0.5 Fib retracement resistance levels, they correspond with the previous support line and midline of a descending parallel channel. BTC previously broke down from this channel on Feb 18.

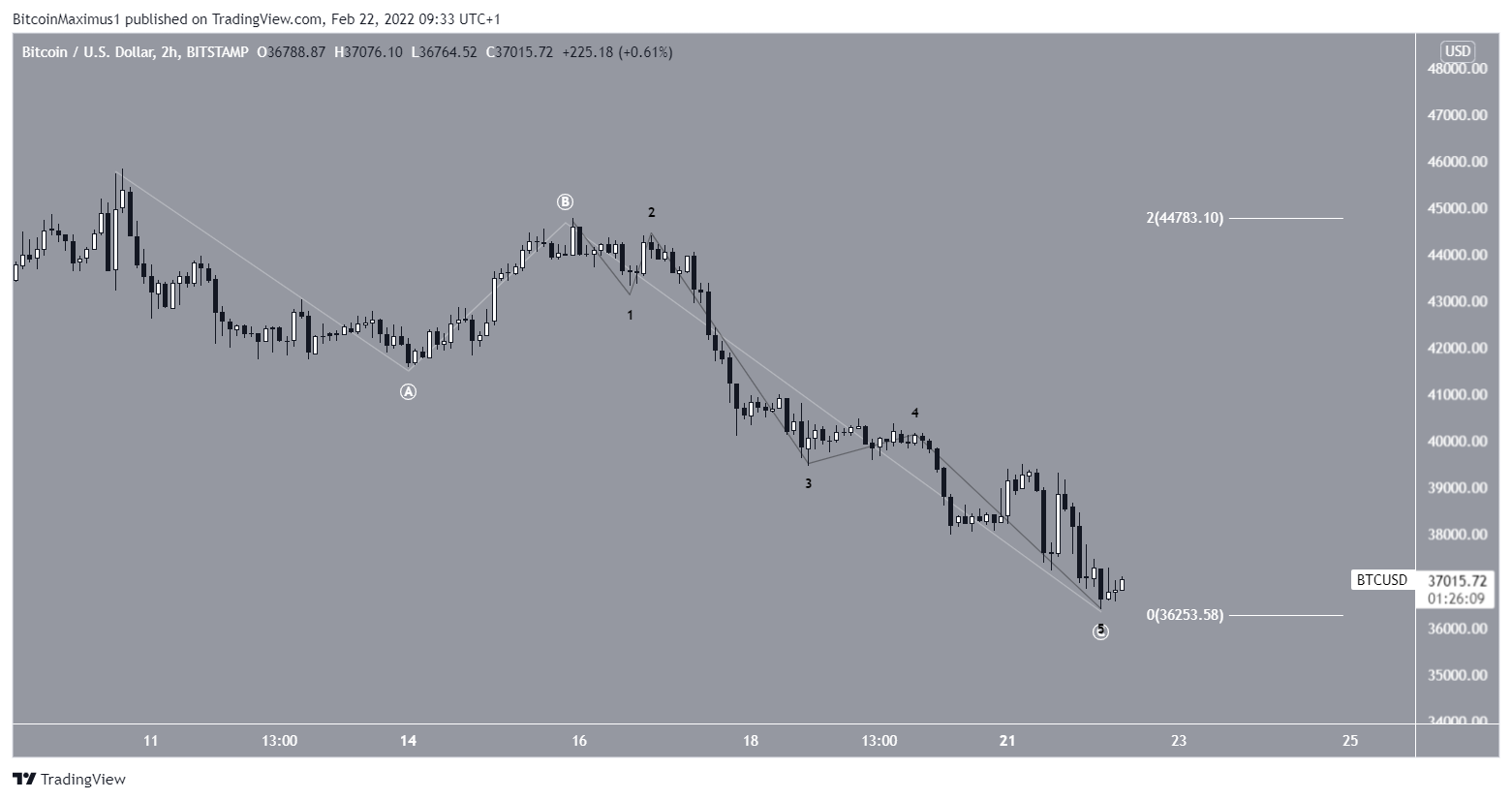

Wave count analysis

There are two likely possibilities for the long-term Bitcoin count.

As for the short-term wave count, the bullish scenario suggests that the downward movement is a completed A-B-C trading structure. In it, waves A and C had a 1:2 ratio, which is not uncommon.

The sub-division is interesting since it shows a fourth wave triangle followed by an ending diagonal. Ending diagonals are usually followed by a very significant rebound. This fits with the possibility that BTC will retest resistance levels at $39,600 and $40,575.

The bearish count suggests that the decrease is part of a bearish impulse instead. In it, BTC has just completed wave three of a five-wave downward pattern.

In this scenario, a smaller upward movement will follow, but will likely not break the wave one low at $41,575 (red line).

An increase above the line would confirm that the bullish count is transpiring and the short-term correction is complete.

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here