Bitcoin has rebounded to stabilize at the $60,000 support level. This sparks discussions about its potential to hit $70,000 soon.

The recovery follows historical trends and market dynamics.

Is $60K the New Floor? Bullish Signs in Bitcoin Amid Market Variability

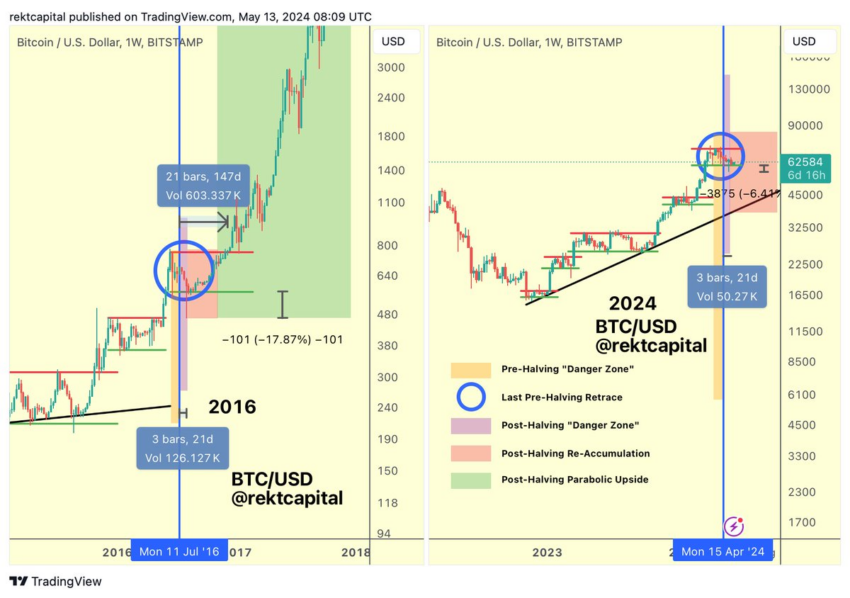

Technical analyst Rekt Capital sees a slowdown in its sell-side momentum. The currency maintains strong at $60,000. Holding this level could lead to price increases.

Bitcoin’s recent exit from the Post-Halving “Danger Zone” supports a positive outlook. The currency has rebounded strongly from its low.

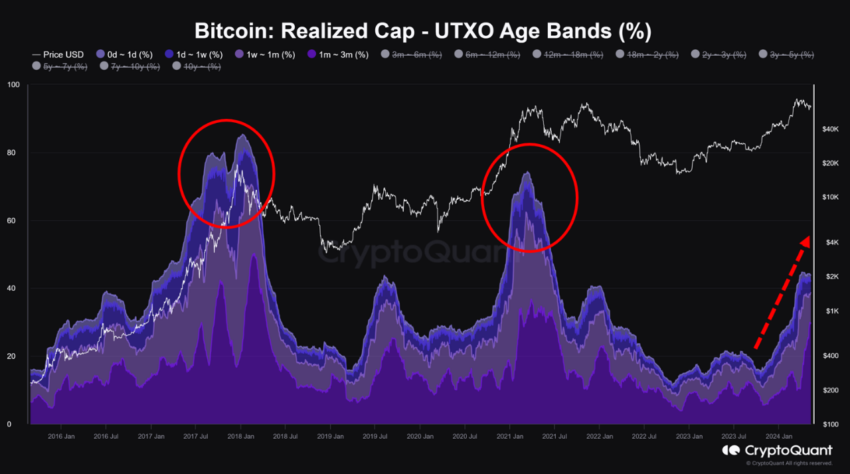

On-chain analyst Axel Adler Jr. reviews on-chain data. It shows no signs of a bull cycle ending.

“Despite all the negativity in the market, there are no signals in the on-chain data that could indicate the end of the bull cycle.” Adler Jr commented.

Crypto Rover, a crypto YouTuber, points out its fill of the CME Gap. This is a bullish sign. Rising above $70,000 could cause over $8.6 billion in short liquidations.

This would drive prices past existing resistance (Red zone) levels.

Macro Sentiment Lifts BTC: Market Displays Strong Bullish Momentum

On-chain analyst Binhdangg mentions a drop in selling pressure from long-term holders. The market seems optimistic, possibly due to upcoming CPI data.

“IMO the market is mainly waiting for positive signals from CPI data.” Binjdangg conferred.

Crypto Dan observes changes in money inflow patterns compared to previous bull cycles. Despite smaller short-term inflows, positive factors like a BTC spot ETF approval and more institutional inflows strengthen the market.

“So the possibility that the peak of this bull cycle has yet been reached is low, around 20%,” he noted.

QCP Capital remarks on Bitcoin’s quick recovery from a recent 5% dip after hawkish comments from the Federal Reserve. Upcoming macroeconomic events are likely to affect the market. The firm remains bullish, expecting more consolidation at higher support levels.

Read more: Bitcoin Price Prediction 2024/2025/2030

The company pointed out that Bitcoin’s options market offers promising trading opportunities. Strategies like Unconditional Fixed Coupon Convertibles (UFCCs) are recommended to generate significant returns, showing strong investor confidence.

Bitcoin, holding steady at around $60,000, may surge toward $70,000. This depends on sustained support and favorable economic conditions. With strong market support and strategic large investments, Bitcoin could be positioned to test new highs soon.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.