Bitcoin (BTC) managed to hold its ground in Q3 of 2022, posting a neutral performance despite overwhelmingly negative sentiment in traditional markets, created by another interest rate hike, increasing inflation and the partial mobilization of Russia in its ongoing conflict with Ukraine.

The calendar year can be divided into four quarters, that are usually abbreviated as Q1, Q2, Q3 and Q4. Q3 officially ends today, Sept. 30. With that in mind, it is worth analyzing the performance of Bitcoin (BTC) in previous Q3s and compare it to the current one.

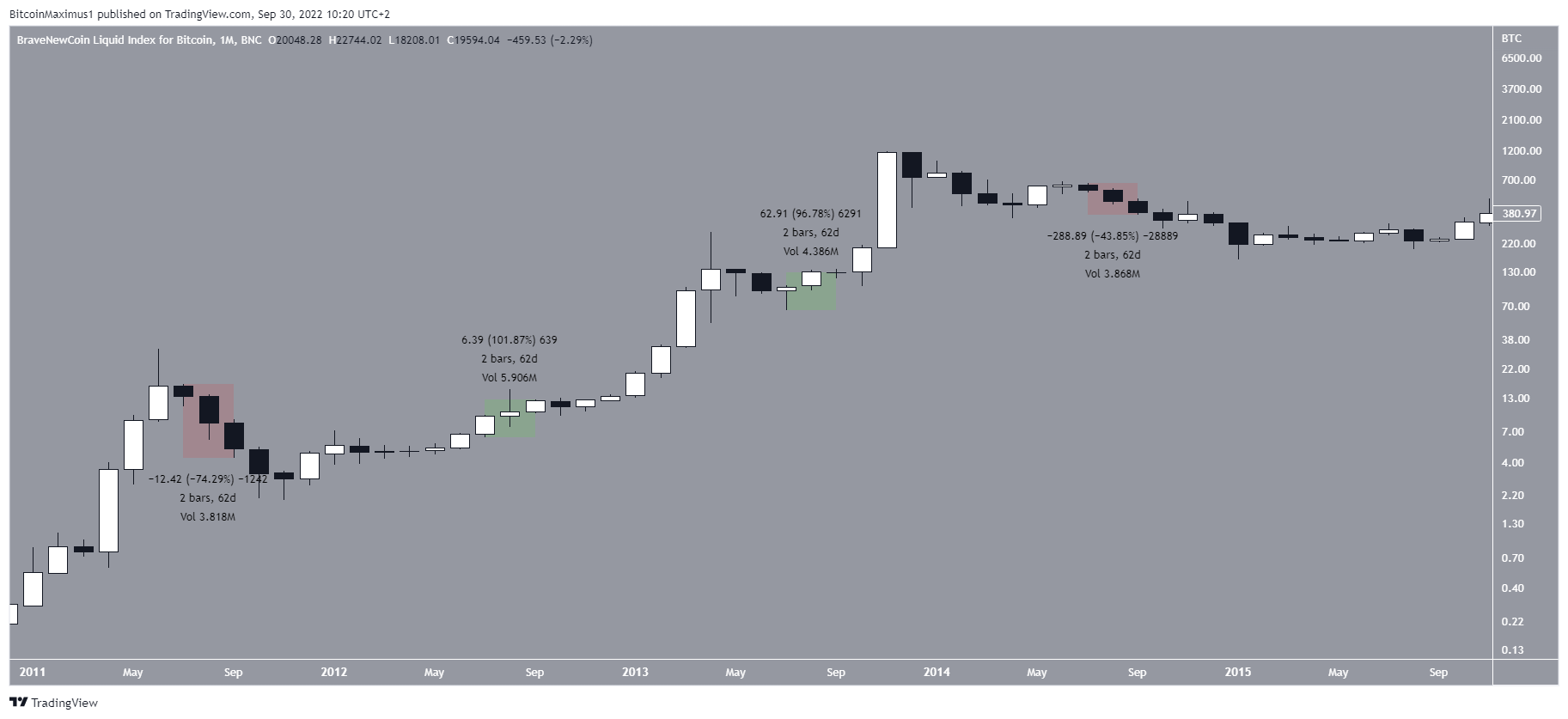

Historical price action between 2011 and 2014

The performance of BTC in each Q3 between 2011 and 2014 was different.

In 2011, the price decreased by a massive 74.29%. Since the then all-time high was reached in June, the downward movement began the next month and was extremely sharp.

Afterward, BTC had begun its recovery in 2012 and 2013, and increased by close to 100% each time.

Finally, the next all-time high was reached on Nov. 2013, so the price was in a downtrend in Q3 2014, falling by 43.85% in the process.

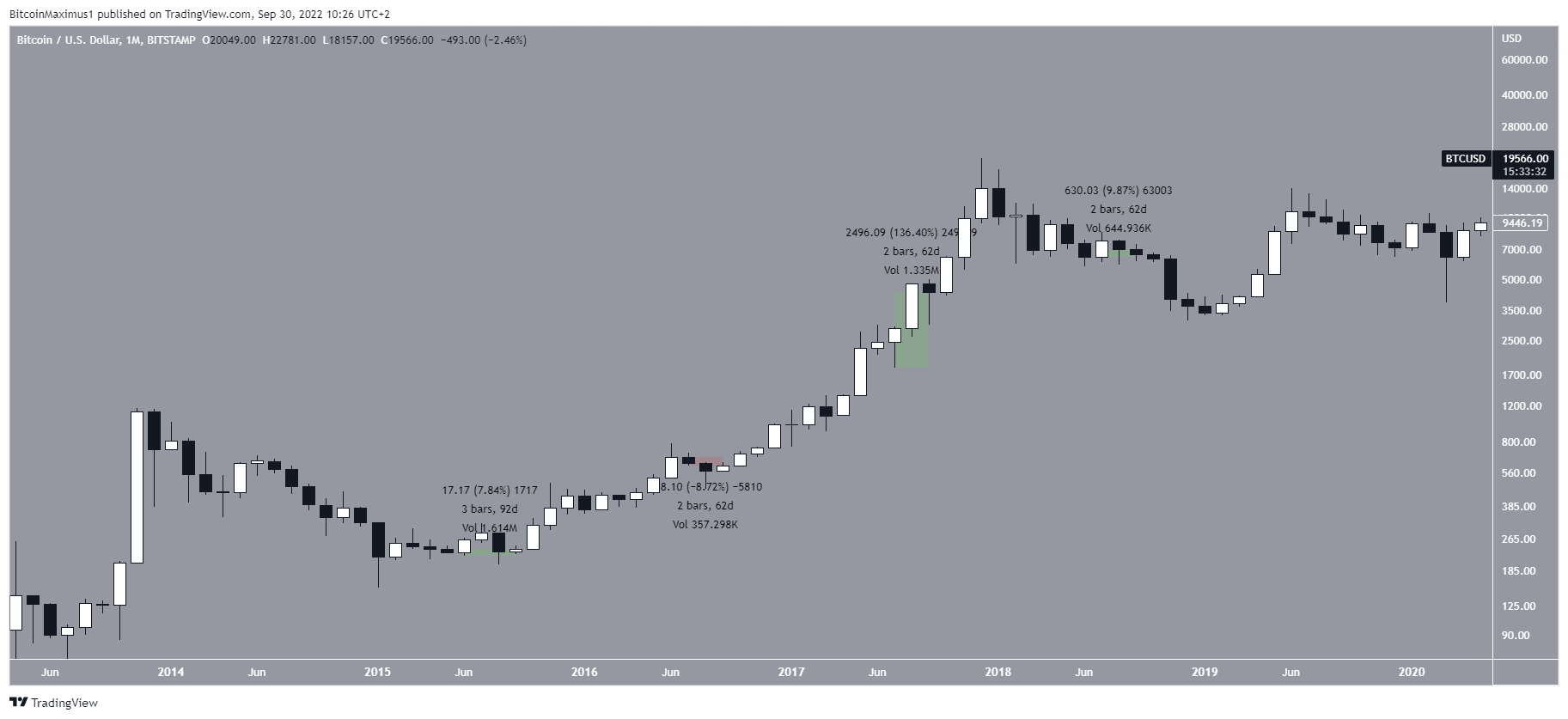

Bitcoin performance mixed between 2015 and 2018

The performance in 2014-2017 was similarly mixed. BTC increased by nearly 8% in 2015, and then fell by 9% in 2016. Afterward, Q3 2017 amounted to the highest percentage increase so far with an upward movement of 136.40%, before the price increased by nearly 10% in 2018.

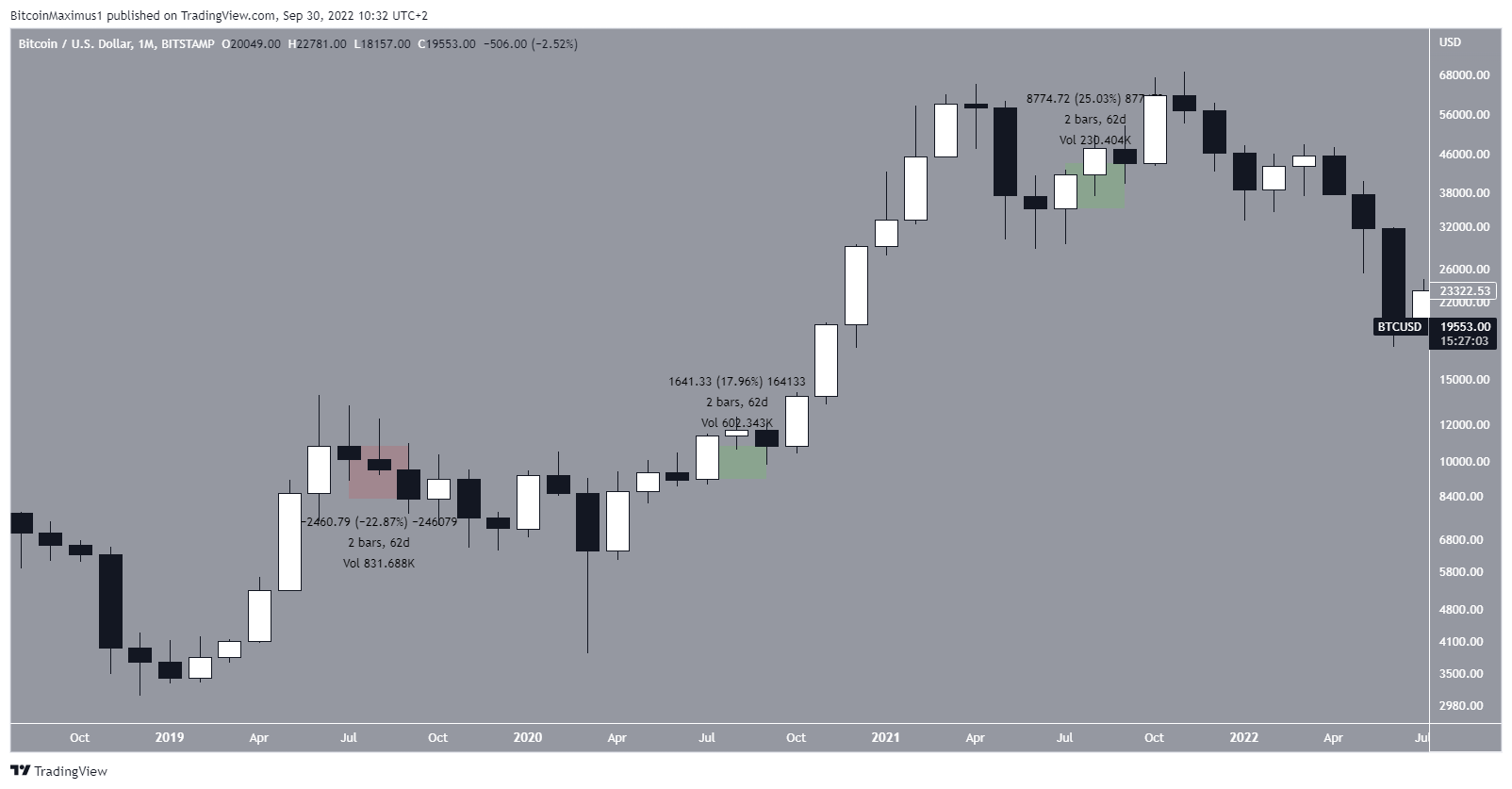

How has BTC performed more recently?

To continue the trend, BTC posted a mixed performance in Q3 each year between 2018-2021. The price increased fell by 23% in 2019, increased by 18% in 2020 and by 25% in 2021.

The price has barely moved in 2022, currently being 2% below the opening price in July. Therefore, this has concluded the trend that there are mixed performances each year in Q3, and there isn’t a pattern that could state that the price most often increases or falls in Q3.

What has affected this year’s performance?

Q3 of 2022 has been a very eventful period in both the cryptocurrency and traditional markets. On the cryptocurrency side, the biggest event was the Ethereum merge, which went live on Sept. 15.

Additionally, Ripple seems to have come out victorious in its ongoing case with the SEC. The news has not been entirely positive, since an Interpol “Red notice” has been released for Terra co-founder Do Kwon, casting even more negative sentiment in the Luna crash.

In the more traditional side of the market, the Federal Reserve (Fed) issued yet another rate hike of 75 bps, which in turn caused a sharp fall in the cryptocurrency markets.

And the president of Russia Vladimir Putin announced partial mobilization in another escalation of the ongoing Russia-Ukraine conflict. Finally, in Aug., U.S. inflation clocked in at 8.3%, slightly higher than expected.

With all these events which could have had a negative effect on price, it seems impressive that BTC has managed to post a neutral performance.

Additionally, the price seems to be trading inside a descending wedge, which is considered a bullish pattern. Therefore, a potential breakout from it and ensuing increase could in fact cause BTC to post a slightly positive performance for Q3 2022.

For Be[in]Crypto’s latest Bitcoin (BTC) analysis, click here