Be[in]Crypto takes a look at Bitcoin (BTC) on-chain indicators that relate to miners, more specifically the difficulty ribbon compression and hash ribbon.

BTC difficulty

The Bitcoin mining difficulty is the estimated number of hashes that is required to mine a block.

The difficulty has been increasing rapidly since Aug and reached a new all-time high on May 23.

Despite the ongoing market correction, the difficulty is still close to its all-time high levels.

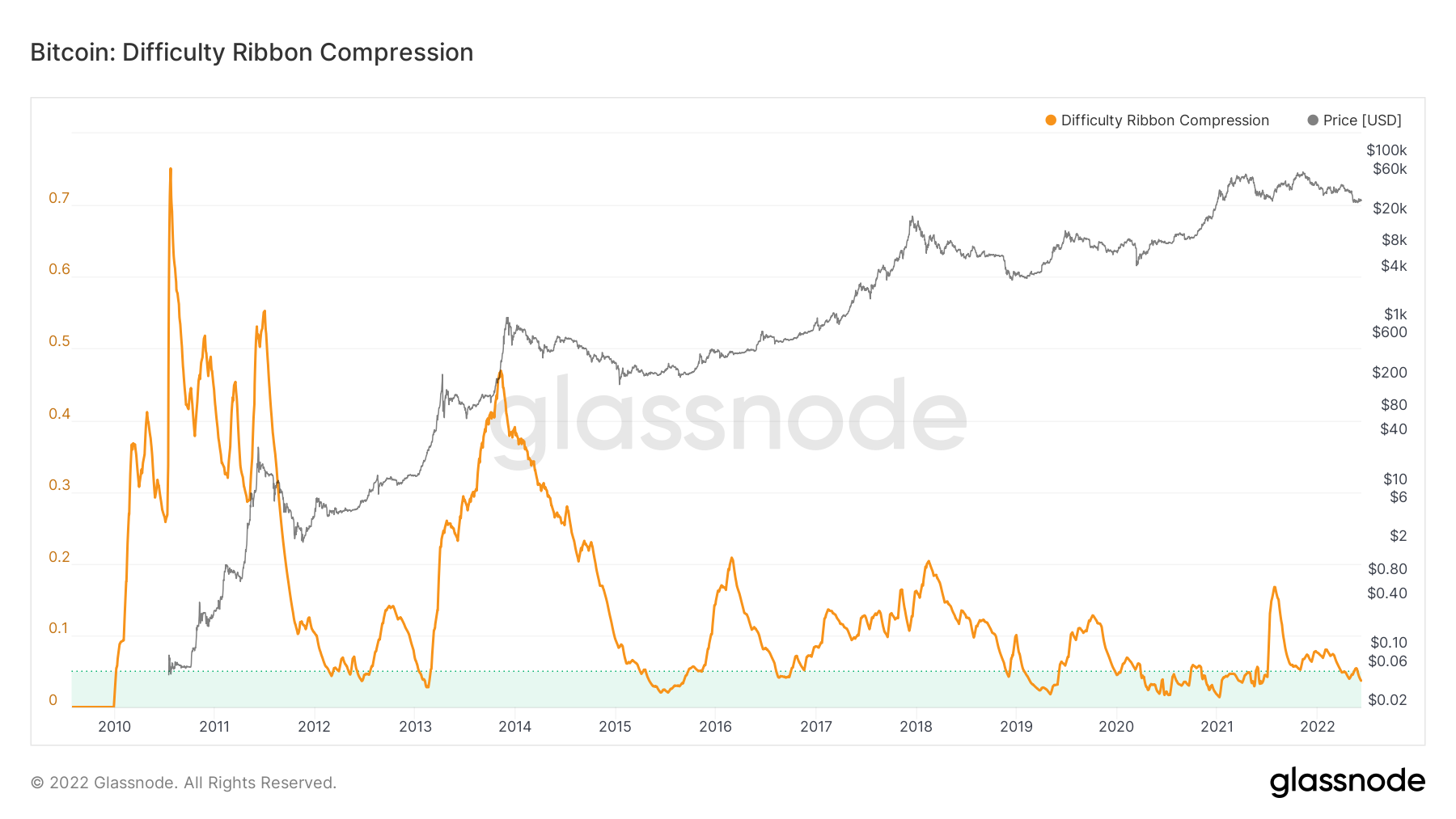

Difficulty ribbon compression

The difficulty ribbon is an on-chain indicator that uses moving averages (MA) of Bitcoin mining difficulty. The difficulty ribbon compression adds a standard deviation to this indicator. Historically, values between 0.01 and 0.05 (highlighted in green) have indicated bottoms.

BTC crossed below the 0.05 threshold in the beginning of May and is currently at 0.045. While the low is inside the bottom area, previous bottoms have usually been reached closer to 0.02.

More specifically, the 2015 bottom was reached at 0.024, the 2018 bottom was reached at 0.019 and the 2020 one at 0.020.

As a result, BTC has more room to fall according to the difficulty ribbon compression.

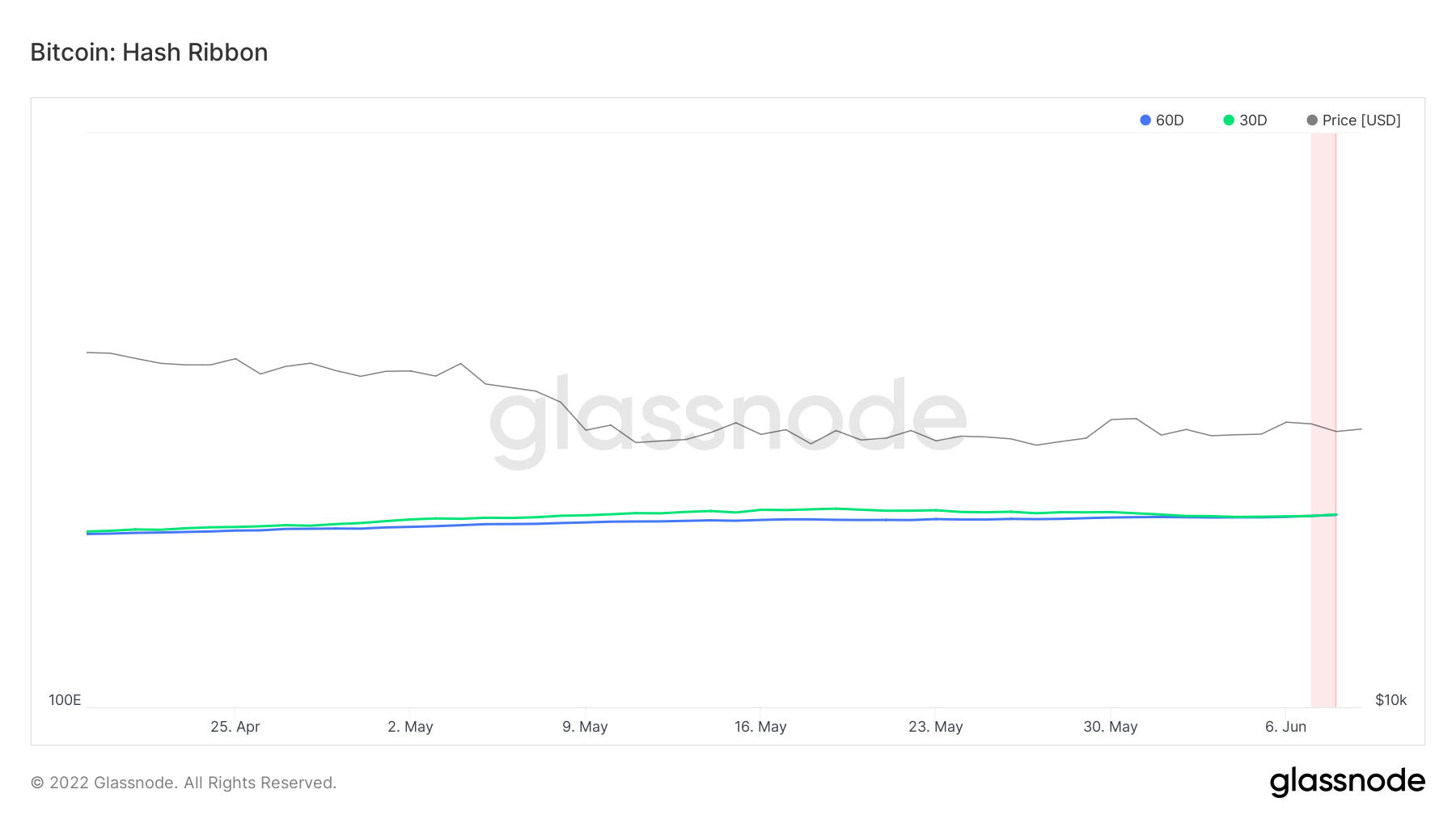

Hash ribbon

Unlike the BTC difficulty, which is calculated every two weeks, the hash rate is calculated every day.

The has ribbon indicator shows if miners have capitulated by using the hash rate. Miners capitulate when their mining costs are higher than the rewards.

In the chart, this is shown visually when the 30-day moving average (MA) crosses below the 60-day (blue). Afterwards, this created a light red area, which turns to dark red when there is a bullish cross.

Historically, such crosses have preceded significant upward movements.

A closer look at the movement shows that a bearish cross occurred on June 7.

So, if previous history is followed, miner capitulation is already starting to occur and a BTC bottom will follow soon.

For Be[in]Crypto’s latest bitcoin (BTC) analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.