Bitcoin’s (BTC) RSI has turned bullish in the daily and weekly time frames, but the price action has yet to catch up with this trend reversal.

Bitcoin created another small bearish candlestick during the week of May 23-30. Since the week of March 28-April 5, this was the ninth consecutive bearish weekly candlestick. This also caused a breakdown from a long-term ascending parallel channel.

Despite this occurrence, the price has not yet dropped below its May 12 low of $26,700.

Currently, the price is trading just above $28,700, which is the 0.618 Fib retracement support level. While this is considered a crucial Fib support level, BTC has fallen below the horizontal support of $30,000. As a result, there is no more horizontal support left until below $20,000.

It’s also worth mentioning that the weekly RSI is currently at 34. This is the exact same value as the March 2020 crash. Since 2017, the only other time the RSI has generated a lower value was during the December 2018 bottom of $3,300.

The weekly chart appears to be mixed overall. On the bullish side, the RSI has reached values that were previously associated with bottoms, and the price is trading above Fib support.

On the bearish side, the price has broken down from an ascending parallel channel and horizontal support area.

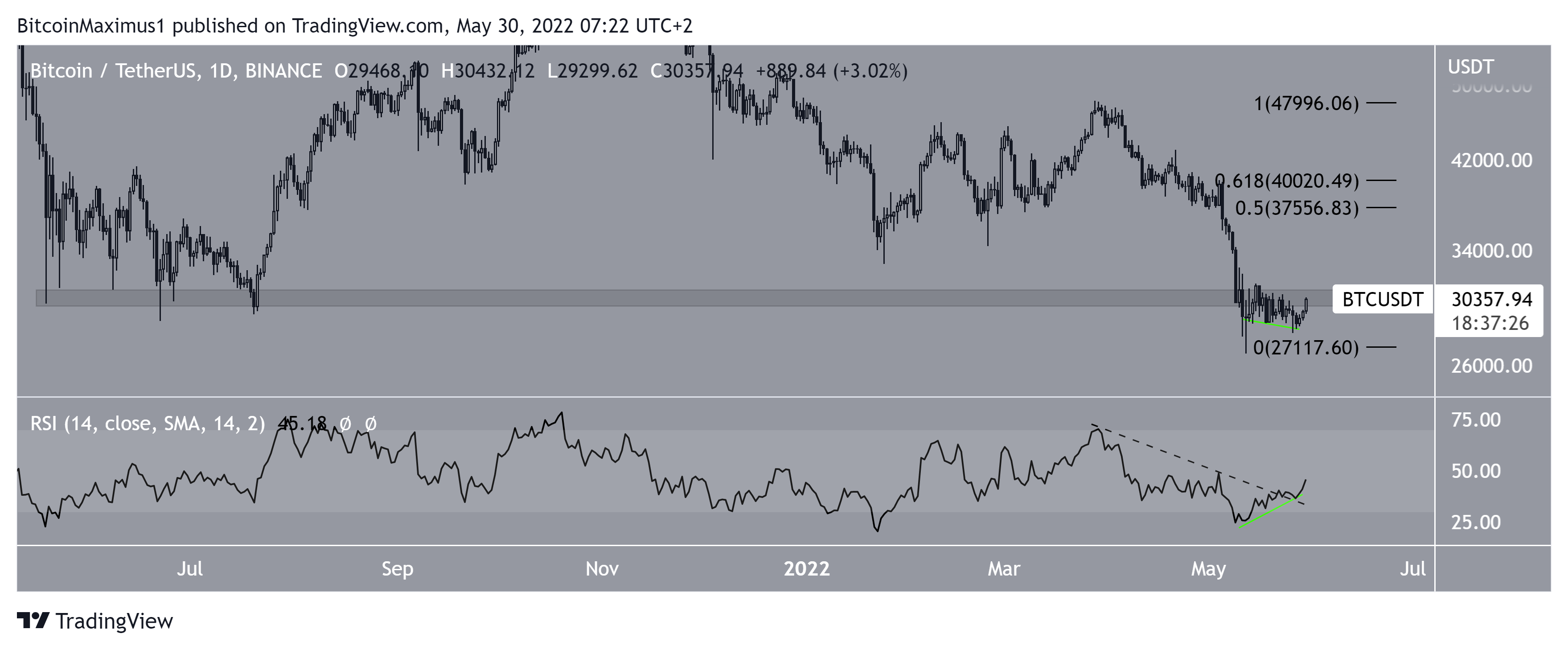

Bearish price action and bullish RSI

The daily chart supports the interpretation of the weekly overview, in which the price has broken down from a horizontal support level. In this time frame, the horizontal level now turned to resistance is found at $30,500.

Despite this occurrence, the daily RSI is decisively bullish.

Firstly, it has generated a considerable bullish divergence (green line), a development that often precedes bullish trend reversals. Additionally, the indicator has broken out from a descending trendline (dashed, black).

If this event initiates a BTC upward movement, the next closest resistance area would be between $37,500-$40,000. This target range is the 0.5-0.618 Fib retracement resistance area.

So, the daily chart is slightly more bullish than the weekly one. Despite the fact that the price is trading below horizontal resistance, the RSI is decisively bullish.

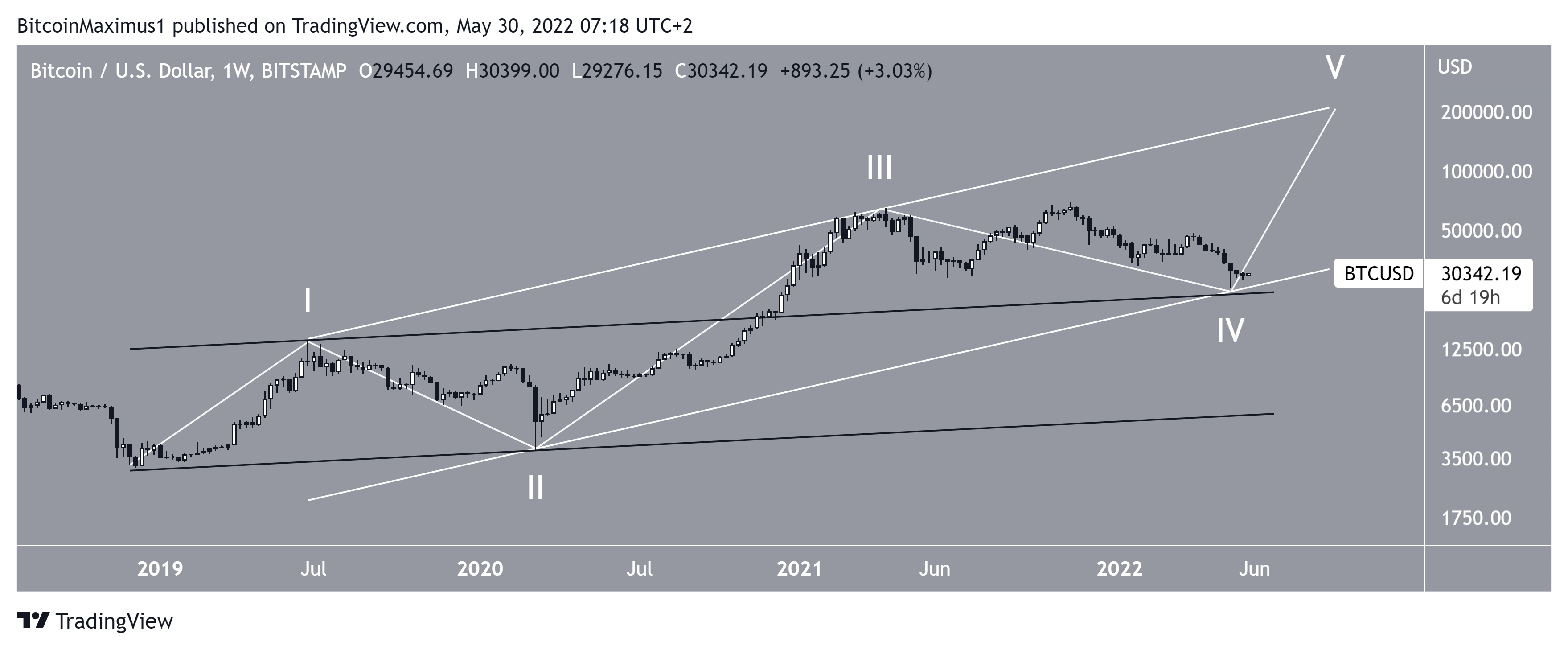

BTC wave count analysis

The long-term count supports the readings from the weekly RSI, which suggest that BTC is close to or has already reached a bottom. It indicates that the price has completed wave four of a five-wave long-term upward movement that began on Dec. 2018.

The May 12 low was reached at a confluence of support levels:

- A parallel channel that’s created by connecting the highs of waves one and three and projecting them to the bottom of wave two (white).

- A parallel channel connecting the highs and lows of waves one and two.

A decisive breakdown below the white channel would indicate that this is not the correct count and the price is still in a bearish trend.

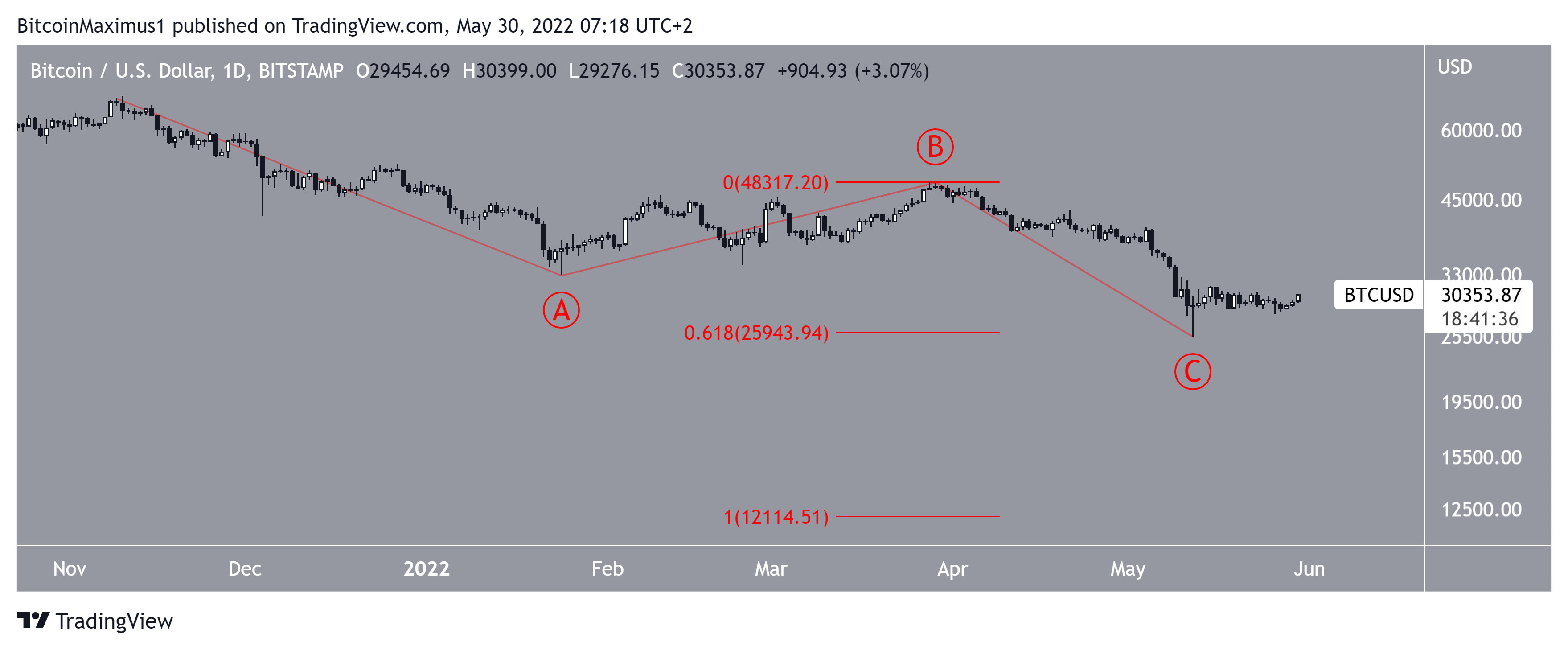

The outlook from the daily chart suggests that BTC might have just finished the C wave of an A-B-C corrective structure (red). In it, waves A and C have had a 1:0.618 ratio, which is common in such structures.

If a bottom is not reached at the current level, the next most common ratio would be 1:1 at $12,100. This would be a drop of more than 60% when measuring from the current price.

So, just like how the weekly time frame count suggests, a decisive breakdown below the current low would likely mean that BTC is in a prolonged bear market.

For Be[in]Crypto’s previous Bitcoin (BTC) analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.