Despite a fall in the total sales volume of several NFTs which has been detrimental to the transaction counts of several blockchains, Binance Smart Chain continues to see a spike in NFT sales volume since Jan. 1, 2022.

Binance Smart Chain has been an integral part of decentralized finance (DeFi) and the non-fungible token (NFT) space since it was launched in September 2020. According to Be[In]Crypto Research, the chain has gained approximately 1,180% in NFT sales volume since the close of January 2022.

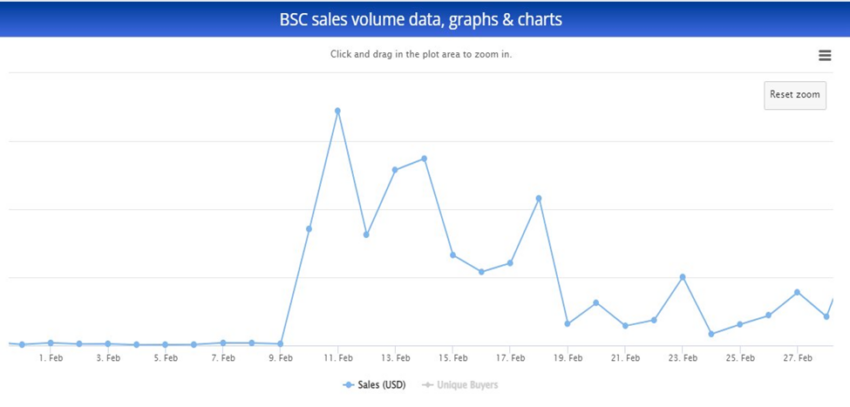

In January, the total sales volume generated was approximately $94,325. This number spiked by 1,109% to close February 2022 at approximately $1.14M

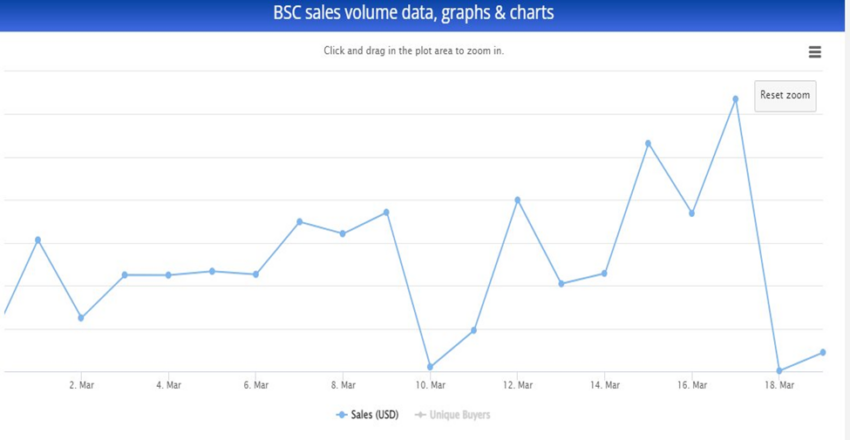

Between March 18 and March 20, the sales volume on BSC climbed to approximately $1.21M

Binance Smart Chain (BSC) is a blockchain protocol that was launched in September 2020 to rival Ethereum in terms of dominance in the emerging decentralized finance space.

Binance Smart Chain has a huge ecosystem that comprises decentralized lending platforms, decentralized exchanges, stablecoins, crypto wallets, and non-fungible tokens.

What contributed to the increase in Binance Smart Chain sales volume?

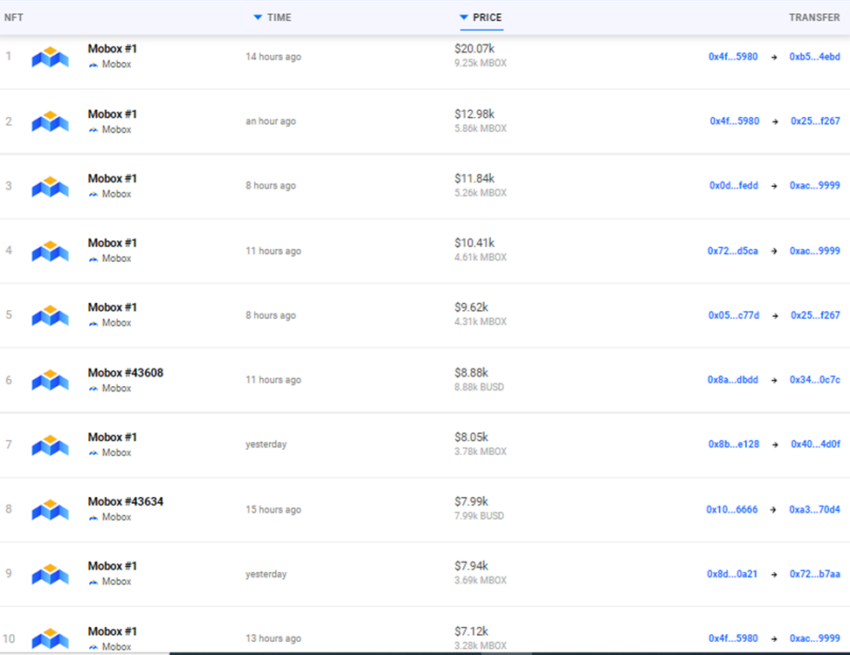

Several NFT Marketplaces have made massive contributions to the improved NFT sales volume of the Binance Smart Chain. Some of these marketplaces include but are not limited to Mobox, NFTrade, AirNFTs, and Treasureland.

The aforementioned are the four NFTs with the most volume in sales on BSC. Among them, the top-10 NFTs by sales are from Mobox collectibles. Mobox which is a part of MOMOverse is a gaming platform that uses the combination of farming NFTs through yield farming to create a play-to-earn ecosystem that is entirely free.

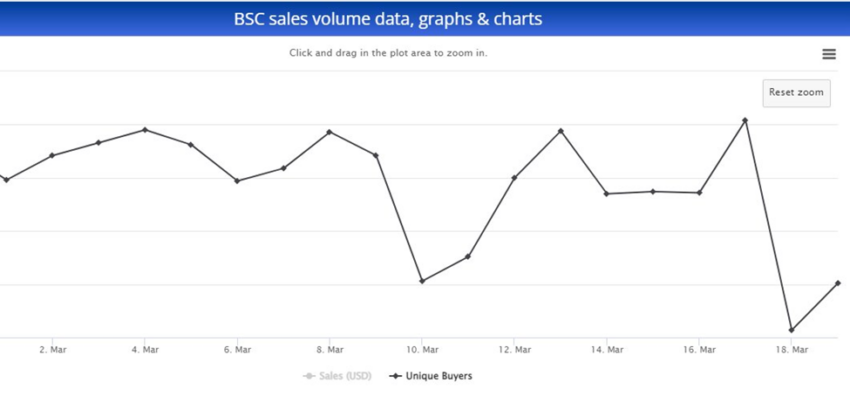

Mobox has increased in unique buyers, which has had a positive effect on the total transaction count on BSC.

Unique buyers on BSC at the time of press were approximately 1,785.

This was a 53% spike in the total unique buyers recorded in February 2022 which recorded 1,163.

BSC NFTs gained ground in February 2021, which was the first-month non-fungible token activity was tracked by CryptoSlam. In February 2021, the total number of unique buyers was a paltry 142.

This means that March’s total unique buyers are 1,150% higher than the number of unique buyers recorded in the first month of BSC NFT data tracking.

Although March is still ongoing, the daily sales volume of NFTs on the Binance Smart Chain continues to surpass $50,000.

Effects of NFT milestone on BNB

Unfortunately, the success of BSC NFTs sales volume in 2022 has not been enough to push up the price action of the native asset of the entire Binance ecosystem, Binance Coin (BNB). BNB opened on Jan. 1, 2022, at $512 and reached a 2022 high of $533 on Jan. 2.

At the time of press, BNB is trading in the region of $400, a 25% fall from its yearly high, and has been trading between $325 and $419 in the last 30 days.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.