Binance has announced that it will automatically convert USDC, Pax Dollar (USDP), and TrueUSD (TUSD) to Binance USD (BUSD). The exchange says that this will boost liquidity and be to the benefit of users.

Binance exchange has announced an auto-convert feature for the USD Coin (USDC) and other stablecoins with Binance USD (BUSD). The exchange published a post on Sept. 5 saying that USDC, Pax Dollar (USDP), and TrueUSD (TUSD) will be automatically converted to BUSD for users’ existing balances and new deposits.

The feature will come into effect from Sept. 29.

The stablecoins will be converted at a 1:1 ratio, and balances will automatically show a consolidated BUSD balance. The exchange says that the automatic conversion helps enhance liquidity and capital efficiency for users. It does note that users will still be able to withdraw funds in USDC, USDP, and TUSD at a 1:1 ratio from their consolidated BUSD balance.

As such, Binance will remove spot trading pairs associated with several of the stablecoins, including their pairs with BUSD. Binance will also remove USDC as margin assets in futures trading. It also makes several changes to other features on the platform, including saving and staking, liquid swap, crypto loans, Binance Pay, and Binance Gift Card.

Binance removing major stablecoins for trading

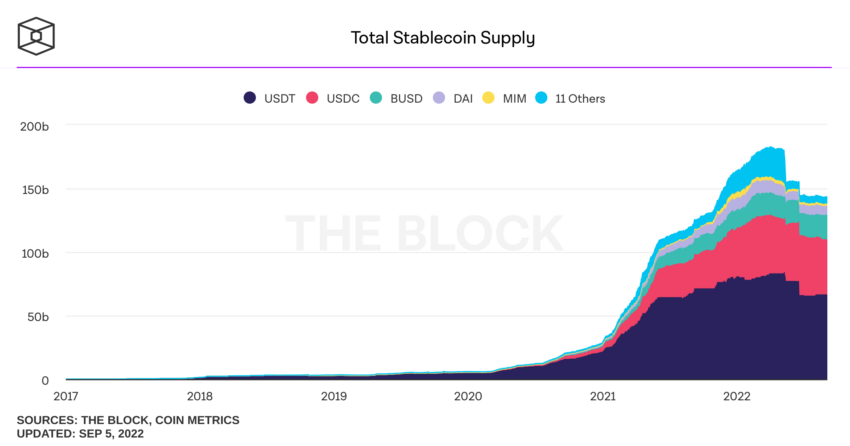

The auto-conversion move will make a huge impact on the stablecoin market, which Tether (USDT) currently dominates. Tether’s supply, an often discussed point in the market, stands at 66.2 billion, while BUSD has 19.1 billion. Tether’s share of the total stablecoin supply has decreased over the past 12 months, currently at 46.7%, while USDC is at 30.36% and BUSD at 13.73%.

USDT currently has a market cap of $67.4 billion, while BUSD has a market cap of $19.4 billion. It’s worth noting that USDC has a market cap of $51.8 billion, considerably higher than BUSD. DAI, another popular stablecoin in DeFi, has $6.4 billion.

Discussions are aplenty as industry insiders chime in

The move by Binance to auto-convert to BUSD has predictably stirred up discussion on social media. There have been several analyses made, though some appear to be not entirely accurate.

Wintermute CEO Evgeny Gaevoy chimed in on Twitter, clearing up what he called misleading headlines. He said that removing stablecoin pairs would be beneficial to liquidity and make market makers more efficient. Furthermore, he said that this was positive for all stablecoins involved and that it benefited the customers because of the absence of converting between stablecoins.

He did point out that USDT was noticeably missing, saying that the stablecoin could lose ground until it improves operational efficiency. His conclusion was that Tether was losing ground to U.S.-native stablecoins.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.