Binance has launched a non-fungible token (NFT) loan feature, which allows users to borrow Ethereum by keeping their blue-chip NFTs as collateral.

In traditional finance, assets such as gold and real estate are kept as collateral to secure loans. But, NFTs can also serve a similar use case.

Blue-Chip NFT as Collateral for Binance Loan

Binance announced the launch of the “NFT loan” facility, allowing users to borrow Ethereum (ETH) by keeping their NFTs as collateral.

Changpeng Zhao’s company will facilitate the service through a peer-to-pool approach, wherein it will serve as a pool for loans.

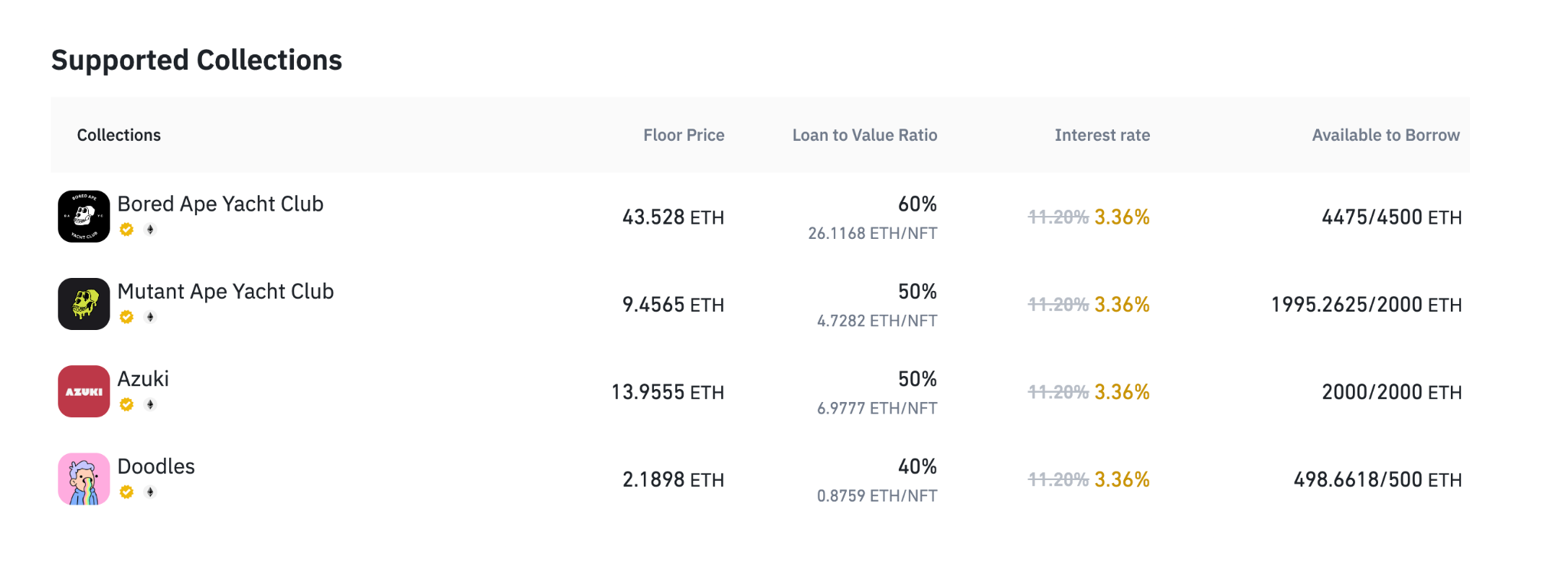

Owners of only four collections, namely Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC), Azuki, and Doodles, can be used as collateral. However, Binance wants to expand to more collections and blockchains in the future.

Initially, the platform is keeping the annual interest rate at 3.36% and will later increase it to 11.20%. The loan-to-value ratio is 40% for Doodles, 50% for Azuki and MAYC, and 60% for BAYC collections.

With the launch, the Binance NFT marketplace will directly compete with Blur’s “Blend.” Earlier this month, Blur launched Blend, a peer-to-peer perpetual non-fungible token lending protocol that allows lenders to keep flexible rates.

Got something to say about the Binance NFT loan or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.