Binance Research has identified some key trends in a 2022 report and themes to watch for the year ahead.

Binance Research is the research arm of Binance, the world’s most popular cryptocurrency exchange.

The paper, called ‘Full-Year Review 2022 & Themes for 2023,’ pointed to a steep decline in total value locked (TVL) as a result of what it called ‘exogenous market events.’ TVL is defined as the total value of cryptocurrency locked in a smart contract and is used to measure the health of a DeFi protocol.

Currently, TVL is valued at around US$40B, or roughly 25% of what it was at the start of the year. The report also points out that DeFi entered 2022 already in a bear market. A picture that the wider Web3 environment would follow only months later.

Late Spring’s collapse of the UST stablecoin triggered a flight from the DeFi ecosystem that still hasn’t reversed.

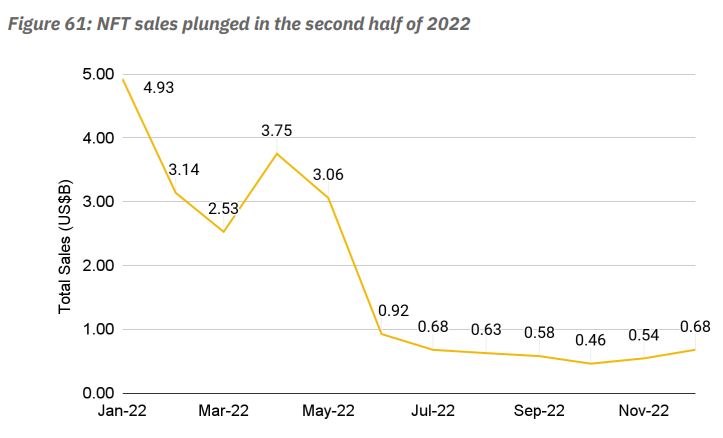

Q3 and Q4 Were Rough For NFTs, Says 2022 Report

The 2022 report is devastating for the NFT market, with 83% of all sales taking place in the first half of the year, representing $18.3 billion dollars. However, the market saw a 10.6% increase year-on-year. The market reached its nadir in October before very modest gains in November and December. By the end of the year, sales were a tiny fraction of January’s figures.

The implosion of UST stablecoin and contagion from Three Arrrows Capital are cited as causes.

According to Google Trends, interest in NFTs peaked in January before declining throughout the year. A relatively small number of enthusiasts also sustained the market. The number of unique buyers and sellers has approximately halved compared to the start of the year.

In addition, blockchain-based games continue to grow, but momentum has slowed. There were criticisms about the quality of gameplay and the robustness of tokenomics in many play-to-earn games. After a bumper 2021, interest in the Metaverse has also declined.

Things To Watch In 2023

As growth opportunities from within the crypto ecosystem become harder to come by, Binance Research predicts the tokenization of assets will become a greater focus. The industry has also lost a significant amount of trust with regulators.

Governments look less kindly on Web3 than they did the year before. As such, regulations will be tighter than they otherwise would’ve been, but the industry will gain greater clarity on a number of fronts. A positive development for long-term growth.

According to the paper, NFTs will increasingly become about utility and move beyond profile-picture NFTs. Real-world use cases will be the next driver of adoption.

You can read the full report on Binance Research’s website.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.