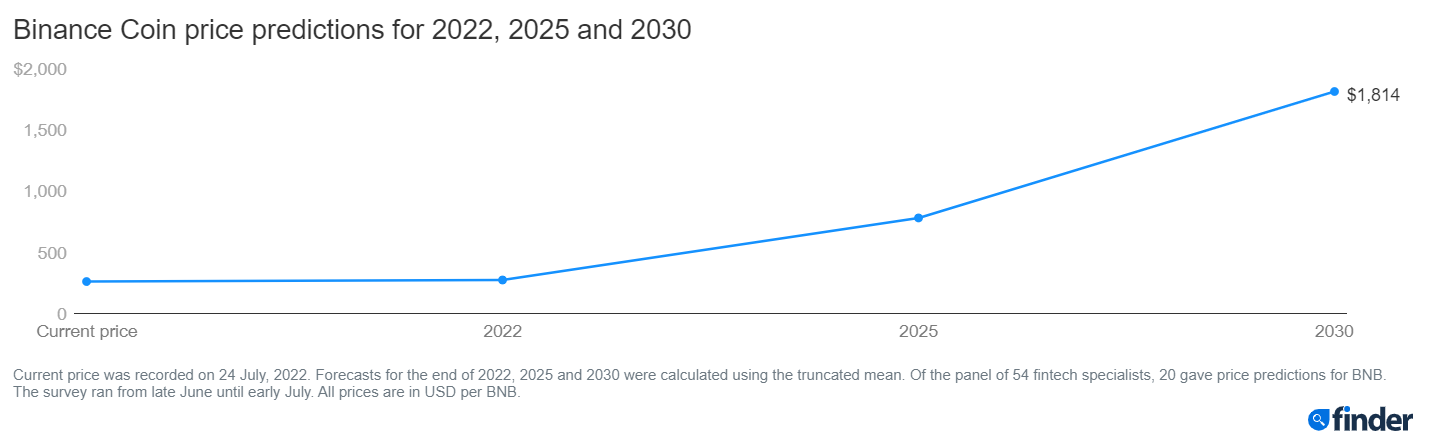

Binance Coin (BNB) is expected to end the year at $274. This is according to a panel of crypto and fintech specialists.

Finder.com polled 54 people and has discovered that the panel predicts the longer-term prospects of the coin are strong. The 2023 prediction is that the price will hit $781.

Binance Coin Opinions

Kevin He is the COO of CloudTech Group. He predicts BNB will be priced at $250 by the end of 2022. And it will hit $1,000 by 2030. BNB, he thinks, will be coming in strong due to the support and ecosystem of Binance.

“If the centralized exchange is still the mainstream platform chosen by investors before the next bull market starts…BNB will definitely get a value boost in the next bull market. However, if the centralized exchange is no longer mainstream or loses heat in the market before the next bull market starts, and the collapse of the centralized exchange [is] plagued by liquidity runs and cash flow problems…then BNB’s price will drop.”

Joseph Raczynski is a technologist and futurist at Thomson Reuters. He is more bullish than the panel average. He is of the opinion that Binance is the best global exchange.

“While BNB is not decentralized, it still can serve a purpose for fast and cheap transactions. That has a cost though. Binance could change parameters on the token without general consensus and they are far more likely to be a single point of failure.”

Ben Ritchie is the managing director at Digital Capital Management. “BNB introduced a burn mechanism in every transaction fee and conducted quarterly burns, making it a deflationary asset. Since the BNB chain ecosystem continues to grow, the price may reach as high as $3,000 in 2030. BNB Chain also plans to support a layer 2 chain within the network, which can be helpful in the future as they may suffer the same gas fees issues as Ethereum.”

SEC Issues

The majority of the panel predict the SEC will accuse Binance of issuing Binance Coin as an unregistered security.

Jeremy Britton is the CFO of Boston Trading Group. “The SEC struggles to apply old legislation to an entirely new industry. Until adequate crypto regulations are in place, we will see battles such as XRP, BNB and others, which the SEC cannot honestly win. We support new rules for a new paradigm.”

Desmond Marshall is the MD of Rouge International. “…SEC needs money due to the bad markets, so at max could slap [Binance] with a hefty fine (which Binance could easily pay off) and everyone will get on with their lives. Then [the] SEC will turn to other more popular coins and repeat.”

Martin Froehler is CEO of Morpher. “The SEC thinks everything is a security and BNB was sold to US customers.”

Walker Holmes is the cofounder of MetaTope. He says Changpeng Zhao “has the ability to present a very compelling case.”

Says Rithie, “Binance issues with the SEC may likely be a long investigation as the BNB token is a utility token and is different from traditional securities. We are unsure if they can find evidence of BNB as security. If they found evidence, there may be penalties and restrictions on the Binance Exchange and the BNB chain ecosystem.”

Half of panelists say hold BNB. 30% say sell. 20% say buy.

Got something to say about Binance Coin or anything else? Write to us or join the discussion in our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.