Binance Coin (BNB) recently broke above a major resistance formed at its 20-day exponential moving average (EMA). However, its weakening buying pressure suggests that an attempt to retest the breakout level will fail.

This analysis discusses how the altcoin is poised to shed some of the gains it recorded over the past week.

Binance Coin Rallied Above Resistance, But Here Is a Catch

Over the past seven days, BNB’s price has jumped 8%, surpassing the 20-day EMA on Wednesday. This moving average, which reflects the coin’s average price over the past 20 trading days, had established a resistance level at $524.50 since August 26.

In a downtrend, the 20-day EMA often acts as a key resistance point. BNB’s price decline since August 26 illustrates this, as it repeatedly attempted to break above the $524.50 level before finally succeeding.

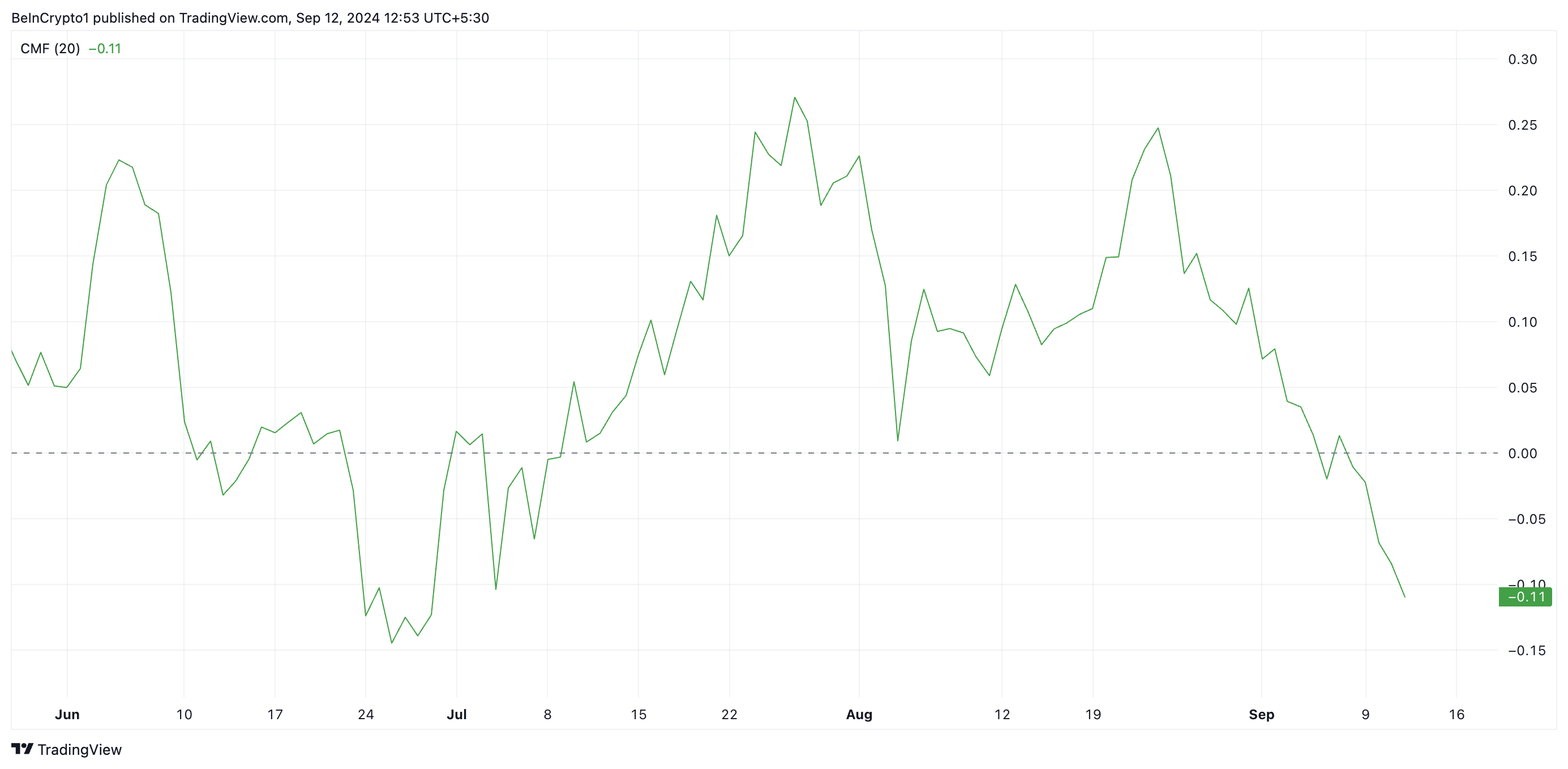

BNB successfully broke above the $524.50 resistance on Wednesday, but this gain may be temporary. Despite the price rally over the past week, BNB’s Chaikin Money Flow (CMF) has been trending downward, signaling weakening buying pressure that could limit further upside momentum.

Read more: How To Trade Crypto on Binance Futures

CMF, a momentum indicator that measures the flow of money into and out of the market, has dropped below the zero line, signaling a bearish divergence. This divergence indicates that BNB’s price hike is not backed by significant buying volume. Despite the recent price increase, the lack of substantial capital inflow suggests the rally may not hold.

BNB Price Prediction: Bearish Bias Is Significant

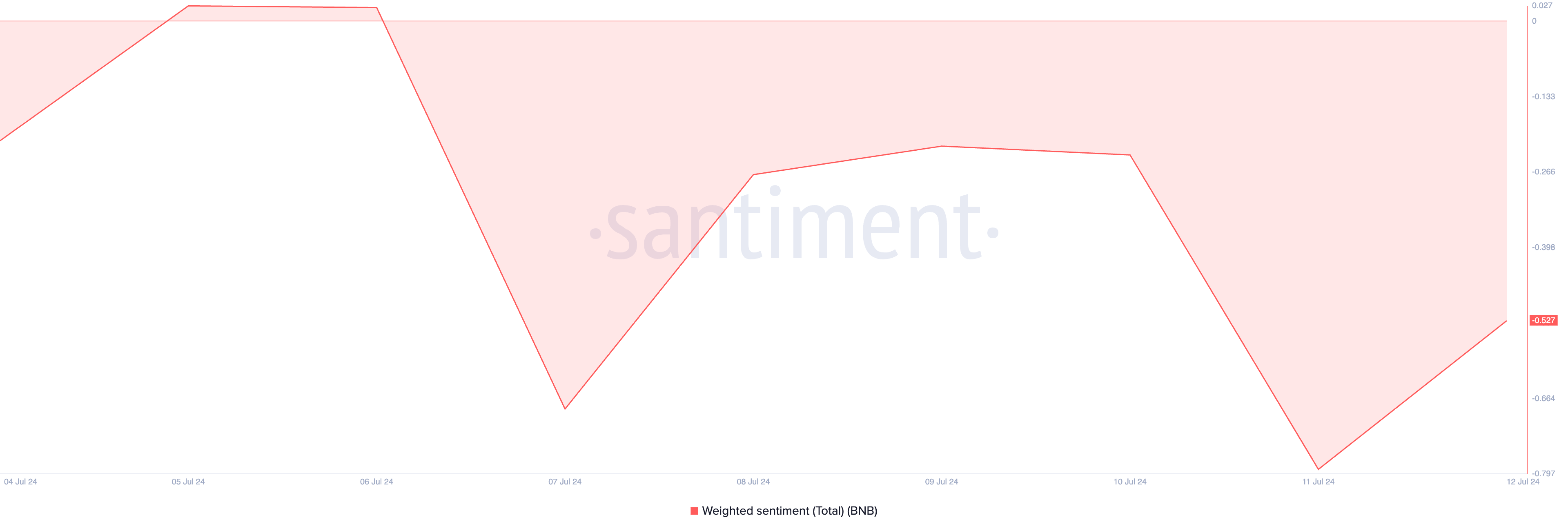

Despite the recent price hike, bearish sentiment continues to weigh on BNB, dampening market confidence. The coin’s weighted sentiment, which gauges overall market mood, stands at -0.52 at press time, indicating a prevailing negative outlook.

When an asset’s weighted sentiment drops below zero, it indicates that social media discussions are dominated by negative emotions such as fear, uncertainty, and doubt. As buying pressure weakens, BNB is likely to reverse its uptrend and retest the 20-day EMA.

If it fails to hold this level, the price could drop toward $400. BNB last traded at this level on August 5, when the crypto market saw over $1 billion in liquidations.

Read more: Binance Coin (BNB) Price Prediction 2024/2025/2030

Binance Coin Price Analysis. Source: TradingView

However, if new demand re-emerges, it may push BNB’s price toward $589.90, invalidating the bearish projections above.