Since the beginning of 2019, practically all major markets have witnessed a significant upswing — but which is the true winner, so far?

In 2018, global stocks and bonds saw their worst losses since 2008. Cryptocurrencies were dealt a hefty blow, with many digital assets seeing upwards of 80 percent of their value cleaved. Most commodities were in a gut-wrenching decline.

With that in mind, is 2019 shaping up to be any different? Let’s take a look at how 2019 is shaping up for several major markets.

[bctt tweet=”How has the year shaped up for financial markets so far? Check out our recent article to find out! (Spoiler: Cryptocurrency > everything).” username=”beincrypto”]

Cryptocurrencies

All major cryptocurrencies are up more than 100 percent since January:

- Bitcoin (BTC): 132 percent

- Ethereum (ETH): 100 percent

- EOS (EOS): 188 percent

The total market capitalization of all cryptocurrencies added more than 120 percent to reach more $270 billion — throughout which Bitcoin dominance hovered around 60 percent.

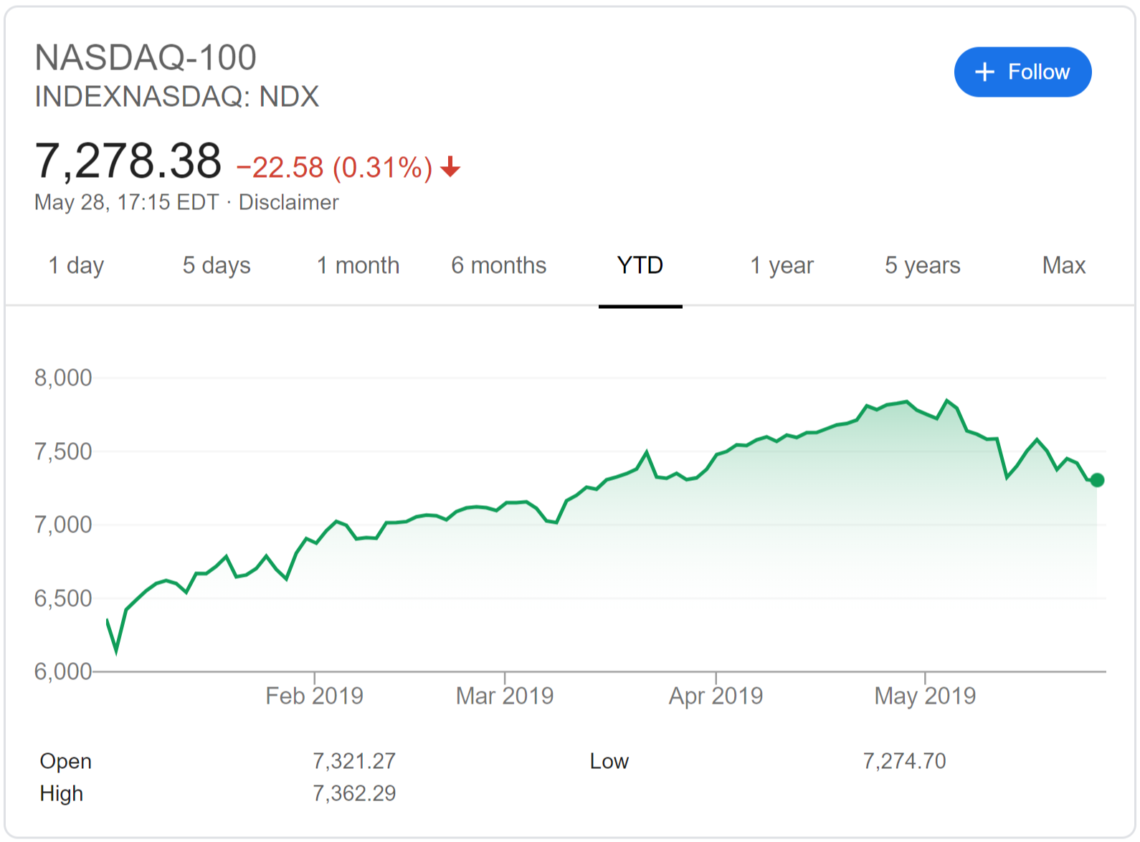

NASDAQ 100

The market index of the 100 biggest non-financial companies — the NASDAQ 100 — has seen a growth of nearly 15 percent since the start of 2019.

This year, some of the best-performing companies in the NASDAQ 100 include Align Technology, AMD, MercadoLibre, and Celgene.

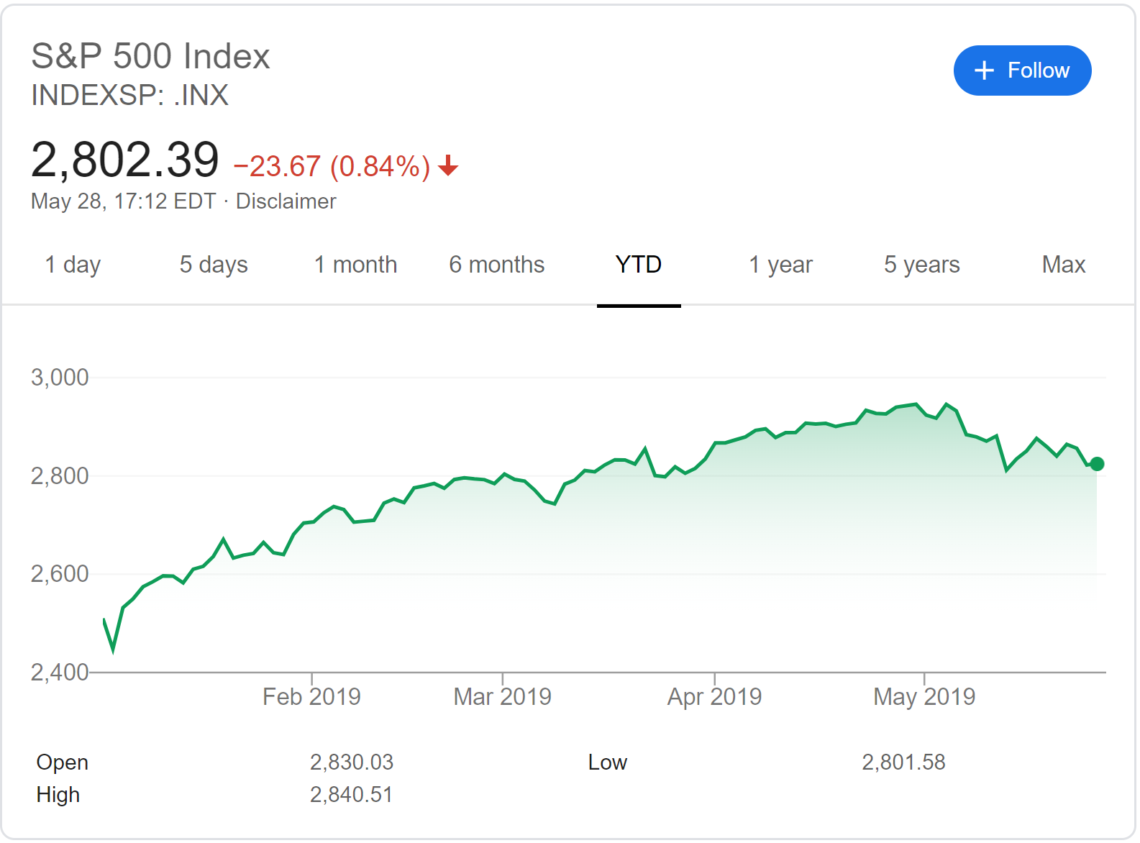

S&P 500

2019 has proven to be a good year so far for S&P 500 equities, with the index growing 13 percent — mostly thanks to the technology and real-estate sectors.

This is reported to be the strongest first quarter for equities since 1998.

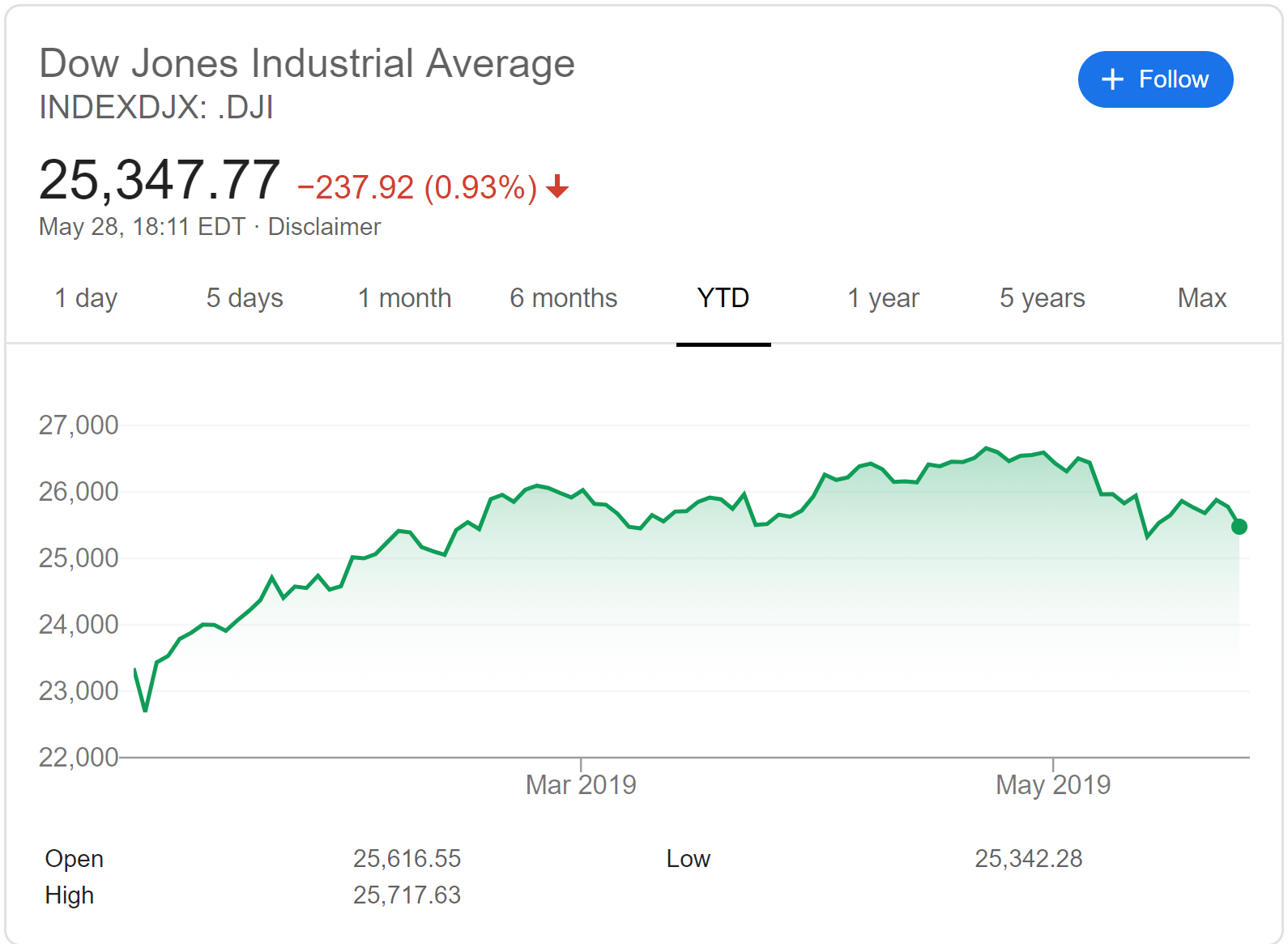

Dow Jones Industrial Average

In the first quarter of 2019, the Dow Jones Industrial Average recovered 2,420 points — achieving around 10 percent growth during this time. This was possible because of two key factors:

- A steady Federal Reserve Interest rate of 2.5 percent

- An increase in job growth in most major markets.

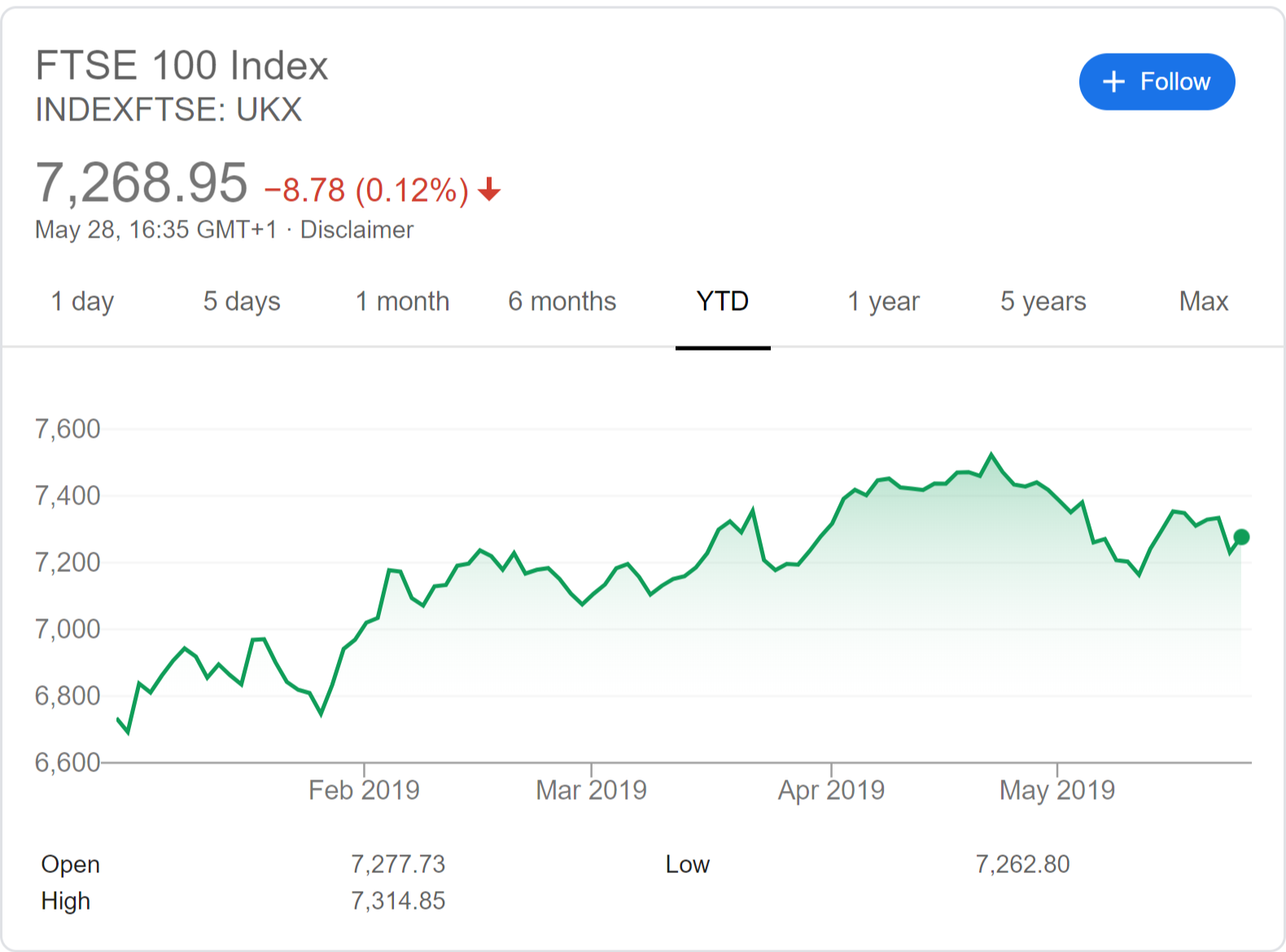

FTSE 100

The FTSE has seen a growth of more than eight percent in 2019, so far.

The current US-China trade war is one of the primary driving factors for investors this year. This has enabled companies like WPP China to gain momentum — while other companies, including Rightmove, have had a tumultuous year.

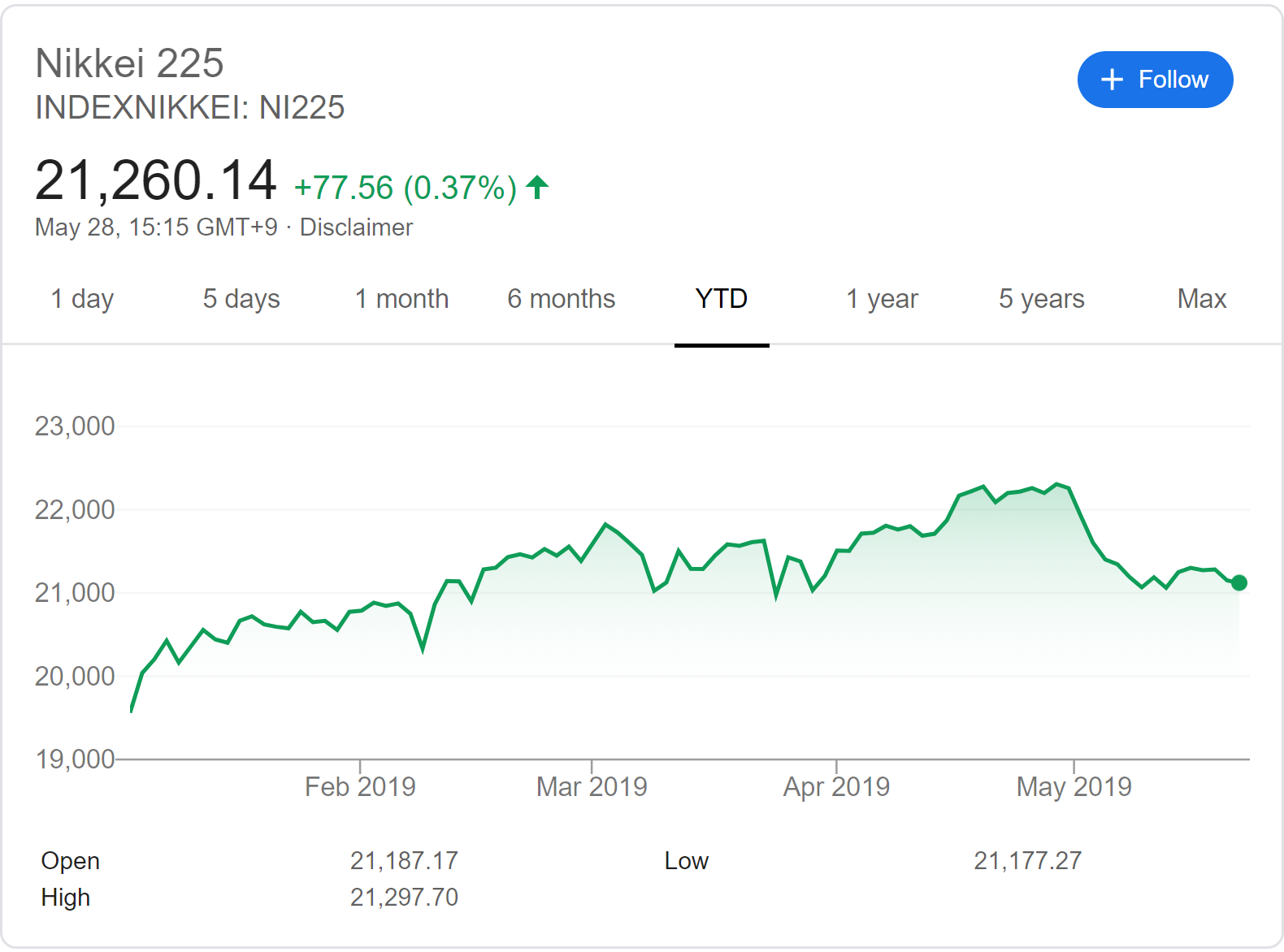

Nikkei 225

Synonymous with Japan’s economy, the Nikkei 225 index has clocked in an increase of over eight percent since the start of the year.

Companies like NEC, Fuji Electric, Softbank, and Hitachi are some of the top performers, so far — with each registering double-digit growth.

Gold

The gold spot price has fallen only marginally since Jan 1 — dropping from $1,281/oz to $1,279/oz as of writing. However, since its 2019 peak, gold has fallen by almost 4.5 percent.

Experts hope that improved geopolitical relations between the US, Iran, and China may soon result in a boon for the precious-metal markets.

Oil

This year has been one of the best on record for oil, with the WTI crude oil spot recording an impressive 36 percent growth — increasing from 46.31 to 63.1 USD/bbl in the past five months.

Big oil stocks have also gained considerably in this time — with Exon Mobil Corporation (XOM) shares up four percent after recovering from its Dec 2018 slump.

Cryptocurrency Markets Winning The Race (So Far)

Overall, the cryptocurrency markets are up more than any other financial market since the year began.

(However, they also experienced easily the sharpest decline of any market in 2018.)

How do you think the financial markets will shape up throughout the remainder of 2019? Can cryptocurrencies continue to recover? Let us know your thoughts in the comments!