Being able to transfer money privately from one party to another is essential for the proper functioning of cryptocurrency.

Bitcoin (BTC), Litecoin (LTC), and many other cryptocurrencies are not entirely private. Transparent addresses and public transaction data can be used to determine the identity of many users while inherent vulnerabilities permit various forms of malfeasance.

Fortunately, privacy coins exist to increase the anonymity of users and their data by integrating blockchain technology with privacy-based innovations.

Two dominant privacy coins are Monero (XMR) and Zcash (ZEC). Both are designed with similar intentions, but they are otherwise unique. Both integrate different privacy-based features into the blockchain space and, while both use a Proof-of-Work (PoW) consensus algorithm, the implementation of each is distinct. Furthermore, both have responded to ASIC mining and threats of centralization differently.

Privacy Features of ZEC

Zcash (ZEC) was initially released on Oct 28, 2016. It integrates the Zerocash protocol developed by Dr. Matthew D. Green, Associate Professor of Computer Science at the John Hopkins Information Security Institute. This protocol includes non-interactive zero-knowledge proofs (zk-SNARKs) which allow transactions between shielded address. ZEC is not private by default, however, because transactions between transparent addresses are also permitted.- Transparent addresses are like BTC public addresses. When used, they broadcast all transaction data without encryption. This means that transaction amounts are publicly viewable.

- Shielded addresses encrypt transaction data. This creates shielded transactions which allow senders and recipients to more easily conceal their activities. Transaction data is hidden from public view. Thus, discovering user identity becomes theoretically more difficult.

Privacy Features of XMR

XMR was initially released on Apr 18, 2014. Monero’s private transactions are facilitated by four different privacy-based features:- Ring Signatures are used to encrypt the origins of a transaction. This means that the sender’s identity remains anonymous.

- Ring Confidential Transactions (RingCTs) encrypt the value of a transaction. The application is similar to zk-SNARKs but the protocols for each are distinct.

- Kovri hides the IP addresses of both senders and recipients. This creates greater privacy for both senders and recipients. With both Ring Signatures and Kovri, the identity of the sender of XMR is secured with two blockchain-based privacy technologies.

- Stealth addresses encrypt the recipient’s location during an XMR transaction. In conjunction with Ring Signatures, the identity of the recipient is secured with two blockchain-based privacy technologies.

Different Proof-of-Work (PoW) Algorithms

A consensus algorithm is a mechanism by which transactions are confirmed within the blockchain space. This involves two processes:- An algorithm must be solved by a specific type of user, or node, on the network.

- Other nodes on the network must reach a consensus that the algorithm was solved correctly.

Cryptonight

XMR’s PoW protocol is called “Cryptonight.” It was first introduced by Bytecoin (BCN) with the help from a CryptoNote development team. Theoretically, Cryptonight is supposed to be ASIC resistant. ASIC stands for “Application-Specific Integrated Circuit.” It’s a computer chip developed specifically for cryptocurrency mining. The machines are expensive and centralize control of a cryptocurrency’s production into the hands of a minimal number of ultra-rich mining pools. ASIC resistant PoW protocols are designed to outsmart the machines. It is supposed to make mining egalitarian by allowing CPUs or GPUs to participate. The integration of Cryptonight in XMR has not created ASIC Resistance, however. On Feb 7, 2019, MoneroCrusher posted an article on Medium in which he methodologically analyzed the hash rate of XMR to determine that over 85 percent of Monero mining is done by ASIC machines. A hard fork for XMR has been announced on Mar 9. This Monero development will allegedly stifle XMR mining by ASICs. Hard forks are known for their contentiousness and divisiveness. It is not yet known whether or not the issue of ASIC resistance and the proposed hard fork will divide the community. It is possible that the hard fork will be uncontentious but only if a sufficient majority supports it. This means that the users of XMR must collectively oppose ASIC mining.Equihash

ZEC’s PoW protocol is called “Equihash.” It was developed by researchers at the Interdisciplinary Centre for Security, Reliability, and Trust at the University of Luxembourg. On Feb 22, 2016, the team showcased Equihash for the first time at the Network Distributed System Security Symposium 2016. The first major implementation of the protocol was ZEC. Since then other cryptocurrencies including Bitcoin Gold (BTG) and Bitcoin Private (BTP) have implemented Equihash. Similarly to Cryptonight, Equihash was designed with ASIC resistance. However, an ASIC machine built for mining ZEC was introduced by Bitmain in May 2018. BTG and other Equihash currencies have also been mined by ASICs. The Zcash Foundation has taken a different approach to the problem of ASIC resistance. During the Community Governance Panel Election for the second quarter of 2018, it was asked whether or not ASIC resistance should be prioritized by the Foundation. 45 of the 64 voting members voted in the negative. This effectively meant that ZEC would not take efforts to reestablish ASIC resistance.

Coin Allocation

The total number and way in which ZEC and XMR coins are allocated differ in several noteworthy ways. ZEC has a fixed supply and a taxation system in the form of the Founder’s Reward. On the other hand, XMR does not have a fixed supply of coins to be created. The total could be indeterminately large. Furthermore, XMR lacks anything that could be construed as a system for taxation.ZEC Allocation

ZEC was originally funded with a $1 million investment from a number of partners — including Roger Ver, Erik Voorhees, Barry Silbert, Naval Ravikant, and others. To receive a return on their investment, ZEC developed the Founder’s Reward. Until the first halving of ZEC, projected for Apr 18, 2020, 20 percent of all mined ZEC will be distributed to investors, founders, advisers, and employees of ZEC. This will amount to 2.1 million ZEC or 10 percent of the total fixed supply of 21 million. Mining will continue after the first halving until at least 2032. After Apr 18, 2020, all mining rewards will be distributed to miners. Some, including Edward Snowden, have classified the Founder’s Reward as a cryptocurrency tax. Snowden supports this tax because he believes it helps the ZEC Foundation prevent attacks before they happen. However, this may not necessarily be true.XMR Allocation

XMR’s token allocation differs from ZEC in several ways. First, there is no fixed supply of XMR. An initial supply of 18.4 million XMR will be mined; however, mining is only projected to continue until May 31, 2022. At that point, there will be an announced 0.3 XMR created every minute for an indefinite period of time. This means that, unlike ZEC’s fixed supply of 21 million, XMR’s supply could be indeterminately large. Furthermore, XMR does not include inherent systems of taxation. There is no Founder’s Reward.

Price Analysis at Time of Writing

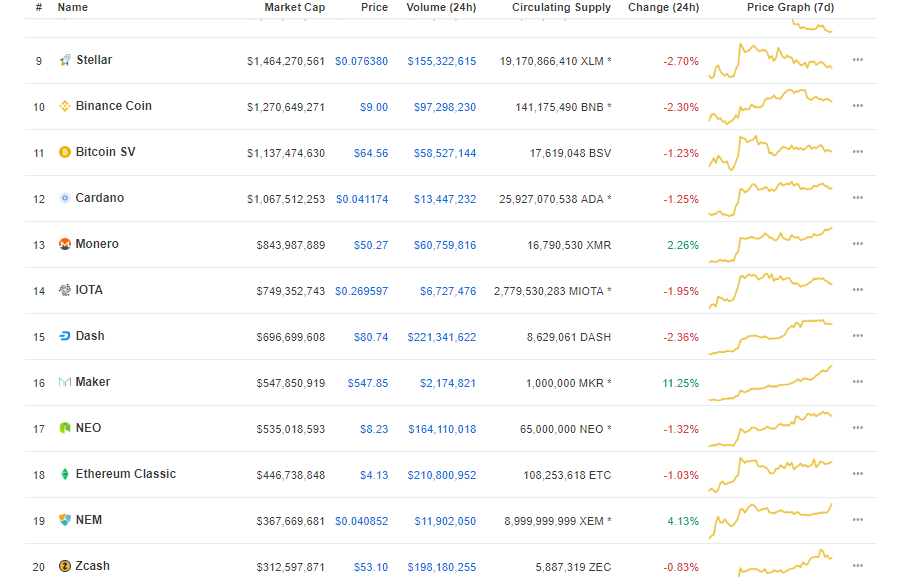

At 3:36 P.M. EST on Feb 13, 2019, XMR was ranked with the thirteenth highest market capitalization of $843,987,889. The price for one Monero coin was $50.27. On the contrary, ZEC had a market cap of only $312,597,871. It was ranked in twentieth place. The price of one Zcash coin, however, was more than one XMR coin: $53.10 versus $50.27. The performance of each over their lifetime also differs drastically.

When XMR was first listed on CoinMarketCap.com on May 25, 2014, it was worth around $3. It dropped significantly over the next few months. By Oct 5, it was trading at under $1. The price continued falling until mid-Jan 2015. At one point, it was trading for around a$0.25. By Jun 5, 2016 XMR had again reached parity with the dollar. Steady growth followed until a high of over $470 was reached in early Jan 2018. The price has continued on a downward trend since then.

ZEC, when first listed on CoinMarketCap.com on Oct 29, 2016, reached nearly $4,300. Similar to XMR, a downward trend followed. By late Feb 2017, ZEC was traded in the upper $20 range. An upper trend brought prices to over $100 on May 19. A high of over $400 was reached on June 20. Value fell to below $200 in mid-July. Slight fluctuations were seen as part of an overall upper trend which brought the value of ZEC to over $800 in early Jan 2018. Like XMR and many other cryptocurrencies, ZEC has faced a significant downward trend until the present day.

In the battle of Monero vs. Zcash, which privacy coin do you prefer? Which will succeed in the long term? Let us know your thoughts in the comments below!

Disclaimer: This article is not intended as investment advice and should not be taken as such. Always do your own research before making any investment into the crypto market, which is notoriously volatile.

The performance of each over their lifetime also differs drastically.

When XMR was first listed on CoinMarketCap.com on May 25, 2014, it was worth around $3. It dropped significantly over the next few months. By Oct 5, it was trading at under $1. The price continued falling until mid-Jan 2015. At one point, it was trading for around a$0.25. By Jun 5, 2016 XMR had again reached parity with the dollar. Steady growth followed until a high of over $470 was reached in early Jan 2018. The price has continued on a downward trend since then.

ZEC, when first listed on CoinMarketCap.com on Oct 29, 2016, reached nearly $4,300. Similar to XMR, a downward trend followed. By late Feb 2017, ZEC was traded in the upper $20 range. An upper trend brought prices to over $100 on May 19. A high of over $400 was reached on June 20. Value fell to below $200 in mid-July. Slight fluctuations were seen as part of an overall upper trend which brought the value of ZEC to over $800 in early Jan 2018. Like XMR and many other cryptocurrencies, ZEC has faced a significant downward trend until the present day.

In the battle of Monero vs. Zcash, which privacy coin do you prefer? Which will succeed in the long term? Let us know your thoughts in the comments below!

Disclaimer: This article is not intended as investment advice and should not be taken as such. Always do your own research before making any investment into the crypto market, which is notoriously volatile.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Alexander Fred

Global AI, Data Science, and Blockchain expert. Alexander writes for BeInCrypto where he completes technical analyses of various alt-coins and qualitative commentary and analysis about various cryptoassets and their potential for social integration.

Global AI, Data Science, and Blockchain expert. Alexander writes for BeInCrypto where he completes technical analyses of various alt-coins and qualitative commentary and analysis about various cryptoassets and their potential for social integration.

READ FULL BIO

Sponsored

Sponsored