The recently launched Coinbase layer-2 network Base is getting a lot of attention as transactions and activity surge. However, it is predominantly being generated by the controversial web3 crypto social media dApp Friend.Tech.

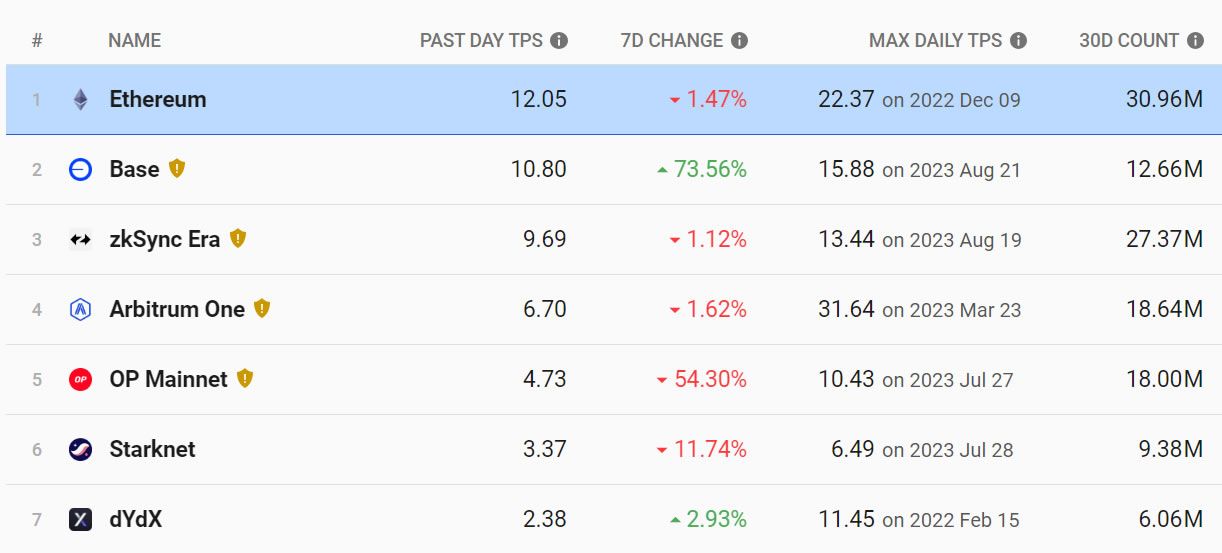

Base has briefly eclipsed the leading layer-2 networks in terms of network activity as transactions spike on the newly launched platform.

Base Boosted by SocialFi

On August 23, Coinbase CEO Brian Armstrong commented on Base hitting 16 transactions per second. “Lots due to Friend.tech but still – incredible growth,” he added, admitting that one platform was driving activity.

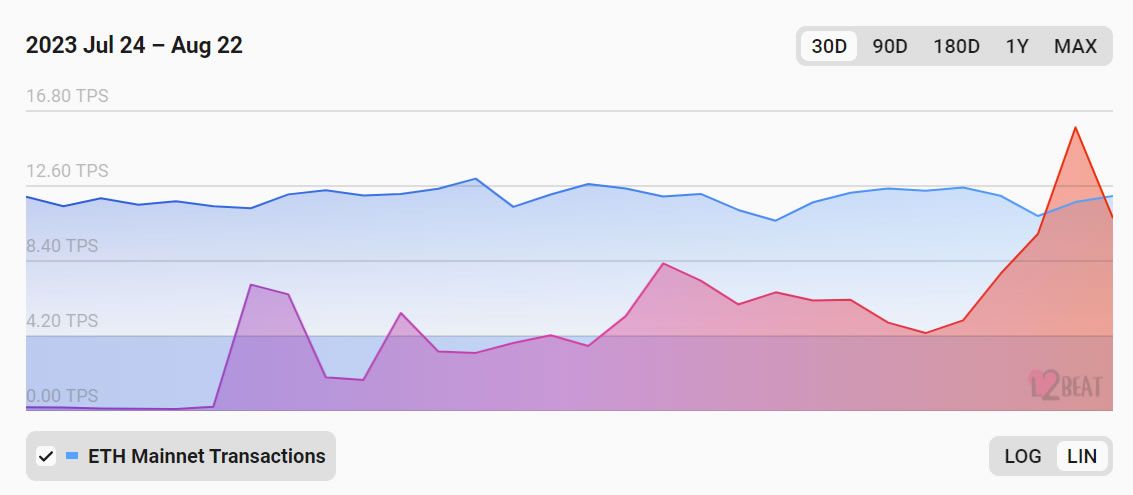

Moreover, Base activity actually spiked above Ethereum’s briefly on August 21, according to L2beat.

The total activity on all layer-2 networks is around five times that on Ethereum in terms of transactions per second.

Furthermore, Base TPS activity has surged over the past week enabling it to surpass layer-2 market leaders Arbitrum and Optimism.

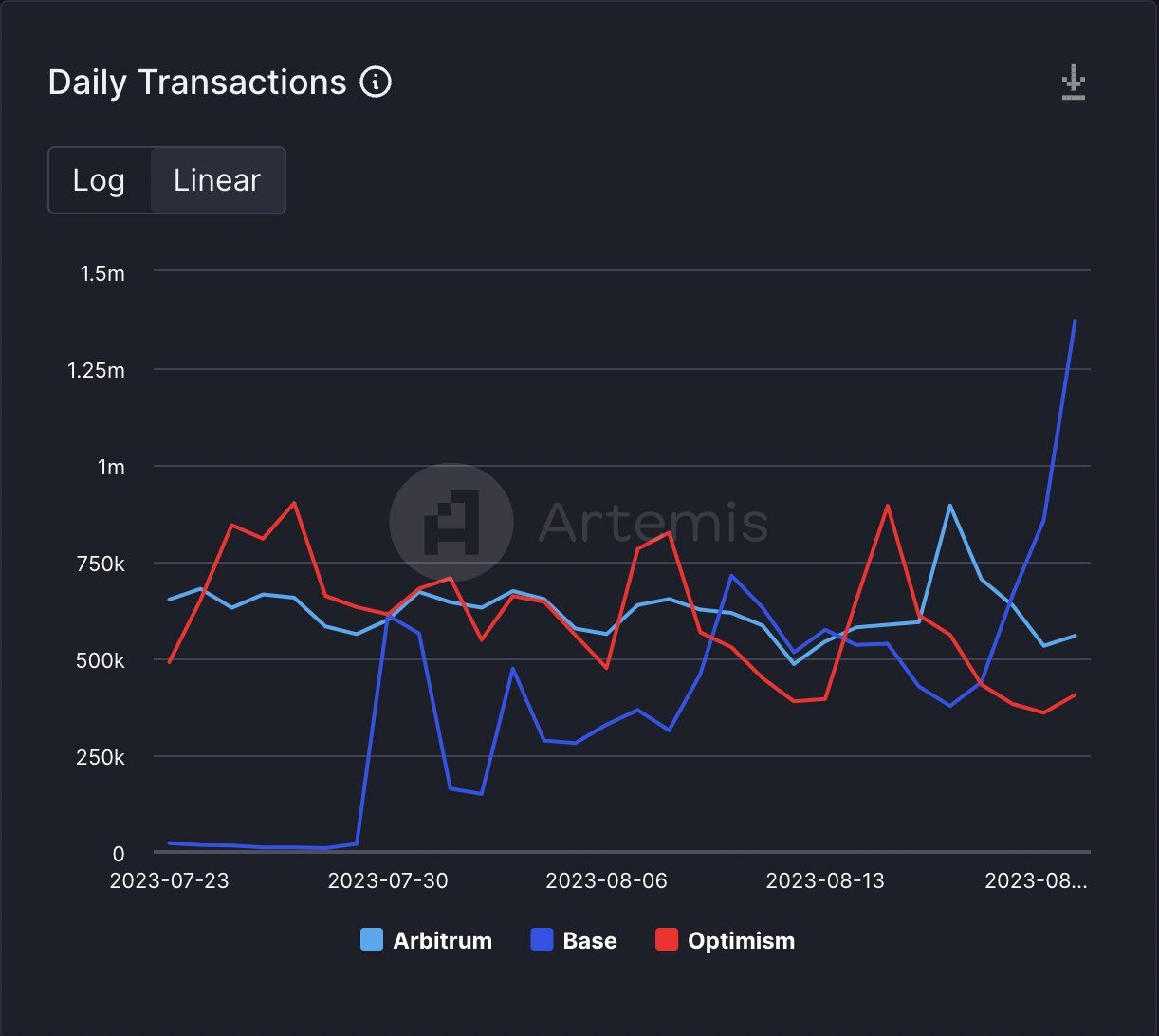

DeFi researcher Thor Hartvigsen went to Artemis to get his data confirming the findings. Base had more daily transactions than both Arbitrum and Optimism combined on Monday.

However, some are skeptical of the figures. “What percentage of those were successful transactions? I saw a lot of numbers about bots trying to front-run new accounts opening,” said developer A.J. Warner.

Nearly all of the activity on Base is being driven by the Friend.Tech frenzy at the moment. The platform is a “SocialFi” or “DeSo” platform that allows users to buy and sell shares of certain Twitter accounts.

According to DeFiLlama, it has generated $5.3 million in network fees in just seven days. Moreover, degens are piling into the platform in the hope of an airdrop from its reward points allocation.

Layer-2 Ecosystem Outlook

The platform has already attracted a lot of criticism. Earlier this week, it was reported that several users found their Twitter IDs linked to their Ethereum wallets in an alleged data leak.

Arbitrum One remains the layer-2 market leader in terms of total value locked with $5.4 billion. This gives it a commanding market share of 55.5%.

Optimism is the second most popular L2, with a TVL of $2.6 billion and a 27% share of the market.

Base is still a minnow using these metrics as it has just $240 million locked and a 2.4% share of the L2 ecosystem.

It is likely that when the Friend.Tech hype fades, Base activity will decline. That is, until the next degen-driven crypto-fad launches on it.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.