Axie Infinity (AXS) closed April in a 5% negative position after a recent token unlocks event triggered a bearish price action. On-chain data shows that the Axie Infinity GameFi network may struggle to break out of the downward trend.

Axie Infinity is one of the biggest names in the GameFi industry. AXS price has wavered recently as investors react to the April 23 token unlock, which saw nearly 19 million tokens worth over $144 million introduced into circulation. With traders increasingly looking for selling opportunities, here is a data-driven outlook for AXS price prediction in the coming weeks.

Axie Infinity Traders Are Looking for Selling Opportunities

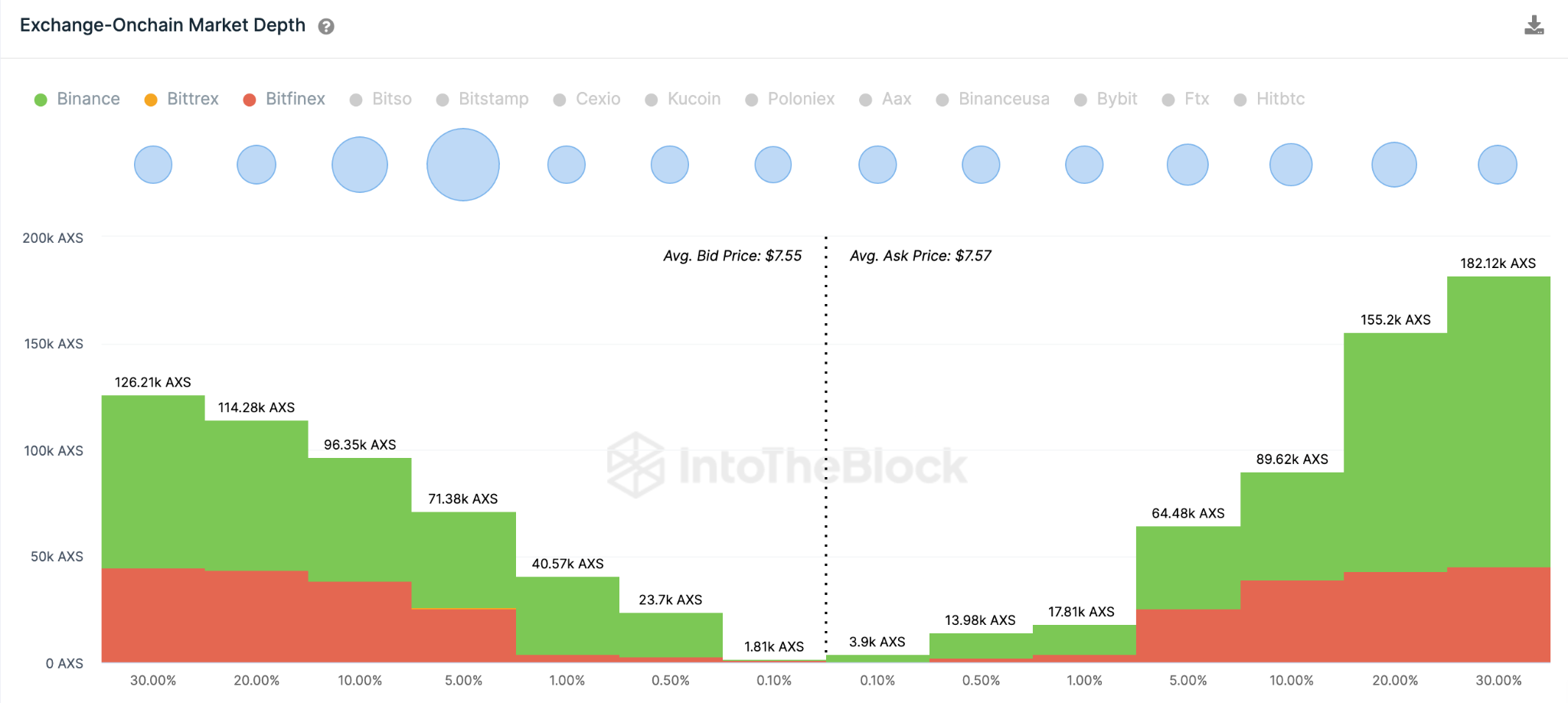

Axie Infinity traders have been piling on sell orders across various crypto exchanges following its most recent token unlock. The Exchange Market Depth provides an aggregate of all limit orders placed on recognized exchanges by holders of a specific token.

Currently, holders have placed 527,000 AXS up for sale. But in reference to the bearish outlook, buyers have requested less than 475,000 AXS tokens.

With an excess market supply of 52,000 AXS, prices will likely drop as sellers compete to fill orders. Unless the Axie Infinity network can attract new demand in the coming days, AXS price is likely to decline.

The Struggle to Attract New Demand Continues

According to the data presented by Santiment, AXS has been struggling to attract new demand over the past month. The chart below illustrates how Axie Infinity Network Growth has reduced persistently since the start of April.

Specifically, between April 7 and May 3, Network Growth dwindled from 113 to 55, representing a 51% decline.

Network Growth measures the number of new wallet addresses created daily on a blockchain. It roughly estimates the rate at which the ecosystem attracts new participants.

When it starts to decline steeply, as observed above, it suggests a dearth of new potential investors.

In conclusion, a downward trend in Network Growth means that the heightened sell pressure from Axie Infinity traders will likely result in a further AXS price decline.

AXS Price Prediction: The $7.21 Support Level is Critical

IntoTheBlock’s Global In/Out of the Money (GIOM) price data suggests that AXS will decline toward $6.50. But first, the bears must battle the initial support line around $7.21.

Around that critical price level, 1,160 investors that bought 123 million tokens for an average price of $7.21 will attempt to shore up the price.

If the market stays bearish as predicted, AXS price could slump further to a 4-month low of $6.50. At that level, the 786 investors that paid an average of $6.50 for 202,000 tokens could end the slump.

Yet, the bulls could invalidate the bearish narrative if Axie Infinity’s price can break above $7.70. But fierce resistance from 290 wallet addresses holding 386,000 tokens could pose a challenge.

If the bulls manage to scale that sell wall at $7.70, AXS holders can be optimistic about an early recovery toward the $8.63 zone.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.