Axie Infinity (AXS) price is leaning more towards a bearish outcome wherein the existing losses will likely intensify.

Investors could catalyze this with early selling as they move to offset their losses.

Axie Infinity Investors’ Skepticism Spikes

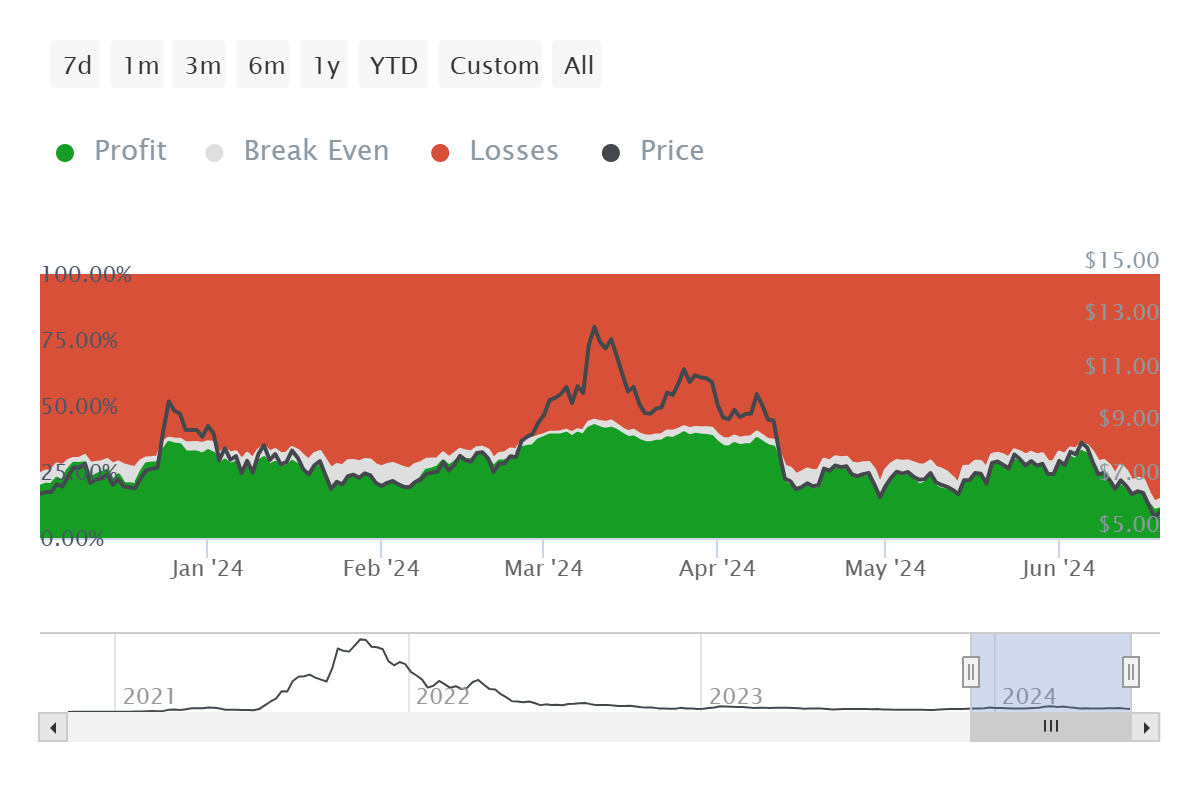

Owing to the drawdown in the AXS price, less than 11% of all AXS holders are currently in profit. This is because the broader market bearish conditions weigh heavily on the altcoin. This is the lowest figure clocked by gaming token investors in eight months since October 2023.

The unfavorable market conditions could trigger a wave of selling as investors look to offset their losses. This potential sell-off may exacerbate the downward pressure on AXS, leading to further price declines.

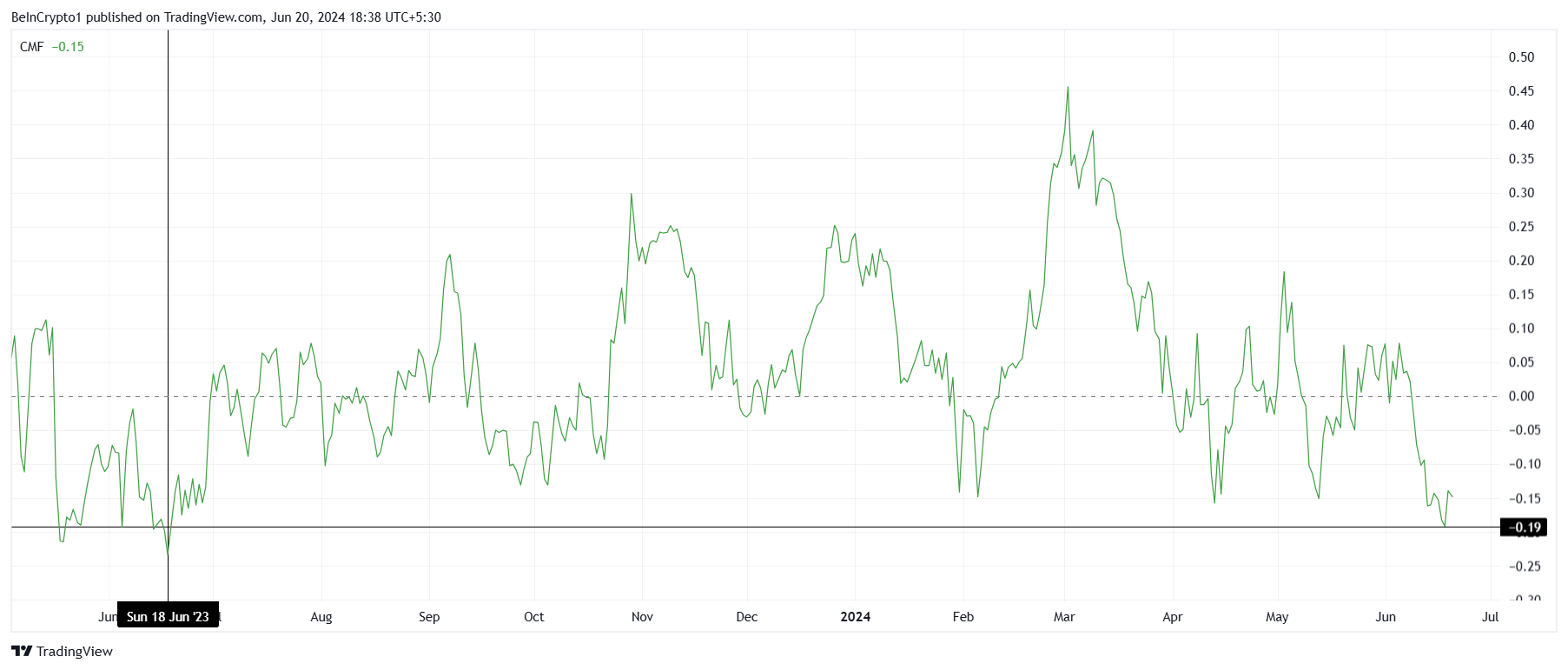

Furthermore, the Chaikin Money Flow (CMF) indicator is at a yearly low. CMF is a technical analysis indicator that measures the strength of buying and selling pressure in a market by combining price and volume data.

A positive CMF indicates buying pressure, while a negative CMF suggests selling pressure. The CMF’s current reading suggests that the market is experiencing significant outflows of capital. This is owing to rising selling pressure, which could hinder any attempts at recovery for AXS price.

Read More: Axie Infinity (AXS) Explained for Beginners

AXS Price Prediction: Watching a Breakdown

AXS price is forming a head and shoulders pattern at the moment. This is a classic bearish indicator, as the formation often precedes significant price corrections. Changing hands at $6.1 at the time of writing, it appears that AXS could be poised for further declines.

The head-and-shoulders pattern suggests a potential 96% correction for AXS. If this pattern plays out as expected, AXS price could plummet, resulting in substantial losses for holders.

However, the more practical outlook for the altcoin is a drawdown to $4.0. This price point has been tested as a support floor in the past, and the altcoin will likely land here.

Read More: Axie Infinity (AXS) Price Prediction 2024/2025/2030

But if the gaming token bounces back from support at $5.3, it could initiate recovery. Reclaiming $7 as support would trigger the recovery rally and invalidate the bearish thesis.