Avalanche (AVAX) price has soared by another 16% in April, edging it closer to the 100% year-to-date growth milestone. A deeper analysis of the on-chain data reveals that intense developer activity and growing demand are critical drivers behind the rally. Will the AVAX price reach $28 for the first time in 8 months?

Bitcoin dominance declined by 2 percent in the past week. It appears that crypto investors are turning to altcoins to diversify their portfolios and supercharge profits from the current bull rally. Along with other Layer-1 cryptocurrencies like Ethereum, Cardano, and Solana, on-chain data suggests Avalanche could continue to attract investor attention.

Avalanche Developers are BUIDLing up the Price Rally

Avalanche is a unique blockchain protocol with three individual blockchains, the X-Chain, C-Chain, and P-Chain. With each chain performing a distinct purpose, the network optimizes for improved scalability and higher transaction throughput.

In early February, Avalanche’s price jumped 16% as markets reacted to the completion of a scheduled network upgrade. Since then, development activity on the network has increased considerably. On-chain data suggests that the intense development activity on the Avalanche network is a major driver behind the current price rally.

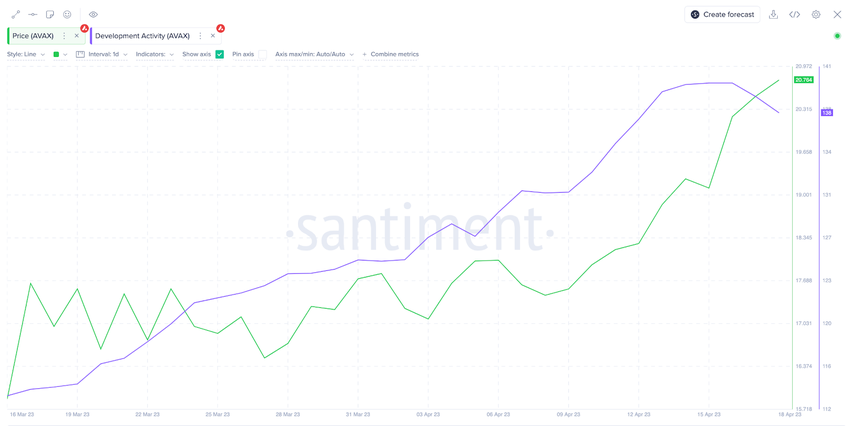

According to Santiment, the Avalanche Developer Activity score has increased 38% from 105.86 to 145.80 between April 1 and April 17. AVAX’s price surged 16% within the same period, as the chart below depicts.

Investors often see increased development activity as a bullish signal because it shows the team is actively working on improving the underlying technology. New product updates and partnerships also attract new users, which helps the underlying coin to find new demand. Notably, a closer look at the historical trends shows that an upturn in development activity has often preceded Avalanche price rallies.

Hence, if investors remain confident in the Avalanche development team, it could lead to increased demand and higher prices for the underlying AVAX altcoin.

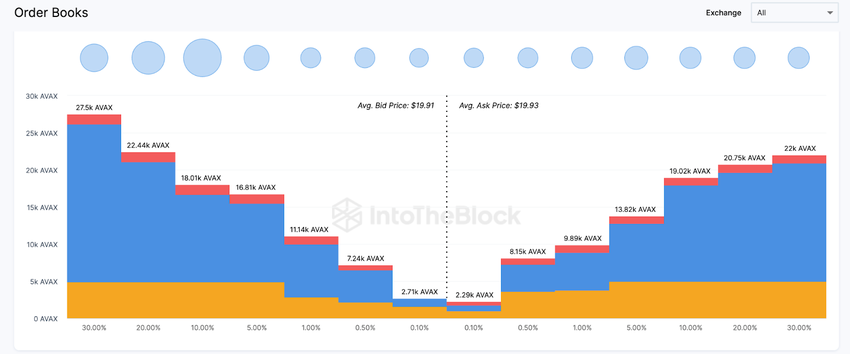

Similarly, the surplus demand for AVAX, as depicted by aggregate Exchange order books, further confirms the bullish outlook.

According to IntoTheBlock, the bulls have placed orders to buy 106,000 AVAX around the +/-30% price boundaries. But, sellers have only put 96,000 coins up for sale.

When exchange order books have more buy orders, it implies that demand for an asset outweighs the market supply. Ultimately, a demand surplus, as observed, could trigger a price upside as sellers can demand higher prices from the yearning buyers.

In summary, the spike in developer activity and surplus market demand suggests AVAX could experience more price gains

AVAX Price Prediction: $28 is the Next Target

IntoTheBlock’s GIOM depicts that the AVAX price could ride the current rally to a new year-to-date price peak of $28.

The chart below shows that AVAX could face minimal resistance until it breaks out of the $21 zone. Here, the 180,000 addresses that had paid and an average of $21 for 2 million AVAX could pose a challenge. If that resistance is breached, the rally could gain enough momentum to reach $28.

However, at that point, the 345,000 addresses that paid an average of $28 to acquire nearly 6.38 million coins could pose a significant obstacle

Still, the bears could gain the upper hand if AVAX loses its current support at $21. However, the 180,000 addresses that bought 2.09 million tokens here could look to prevent that.

Failure to hold that support could see the Avalanche price drop further down until it reaches $18. Here, a more significant support of 386,000 addresses holding 24 million coins will likely stop the drop.