Avalanche’s (AVAX) price has climbed to a 30-day high due to the uptick in the general cryptocurrency market.

Exchanging hands at $41.24 at press time, the 7% rally in the altcoin’s price in the last month mirrors the growth recorded in the general market during that period.

Avalanche Sees Surge in Demand

Apart from the general market rally, the demand for AVAX amongst market participants has skyrocketed in the last week.

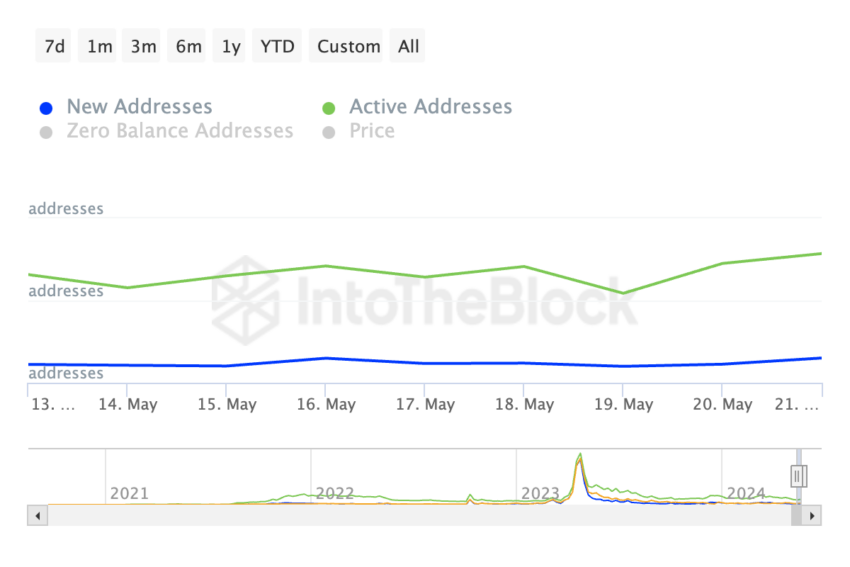

In the past seven days, the count of addresses that have completed at least one AVAX transaction daily has risen by 36%. Likewise, the number of new addresses created to trade AVAX during the period under review has climbed by 41%.

The rise in an asset’s daily active address, alongside a surge in new demand, suggests a strong trend. It means that existing Avalanche users are active, and new users are joining the network. When it coincides with price increases like this, it is a bullish signal and an indicator of further price growth.

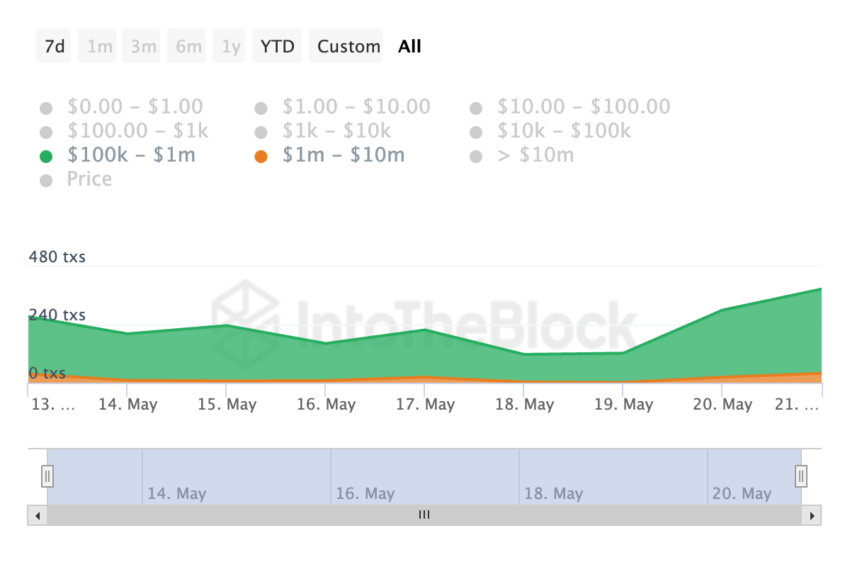

AVAX has also seen a spike in the volume of large transactions completed. This signals an uptick in whale activity during the period under review.

Read More: How To Buy Avalanche (AVAX) and Everything You Need To Know

The number of AVAX transactions worth between $100,000 and $1 million has increased by 60% in the last seven days. For bigger transactions worth between $1 million and $10 million, their count has surged by 129% during the same window period.

AVAX Price Prediction: The Buyers Look to Book More Gains

AVAX’s Chaikin Money Flow (CMF) assessed on a daily chart confirmed the growth in the token’s demand. At a positive value of 0.03 at press time, AVAX’s CMF signaled a steady inflow of liquidity into its market.

AVAX’s CMF tracks the money flow into and out of its market. When it returns a reading above zero, it suggests that the token’s closing price is higher than its average price for the period, and the trading volume is also above average. This signals that buyers are more active in the market.

In addition, AVAX’s Directional Movement Index (DMI) suggested that the bull power might not be easily overcome in the short term. At the time of press, the token’s positive directional index (blue) rested above its negative index (red).

When these lines are positioned in this manner, it signals that the uptrend is stronger than any potential for a downward correction.

If demand continues to increase and the bulls hold on to market control, AVAX’s price might rally past $41 to exchange hands at $49.93.

Read More: Avalanche (AVAX) Price Prediction 2024/2025/2030

However, if profit-taking activity commences and the bears begin to re-emerge, AVAX’s value may fall under $40 to trade at $39.30.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.