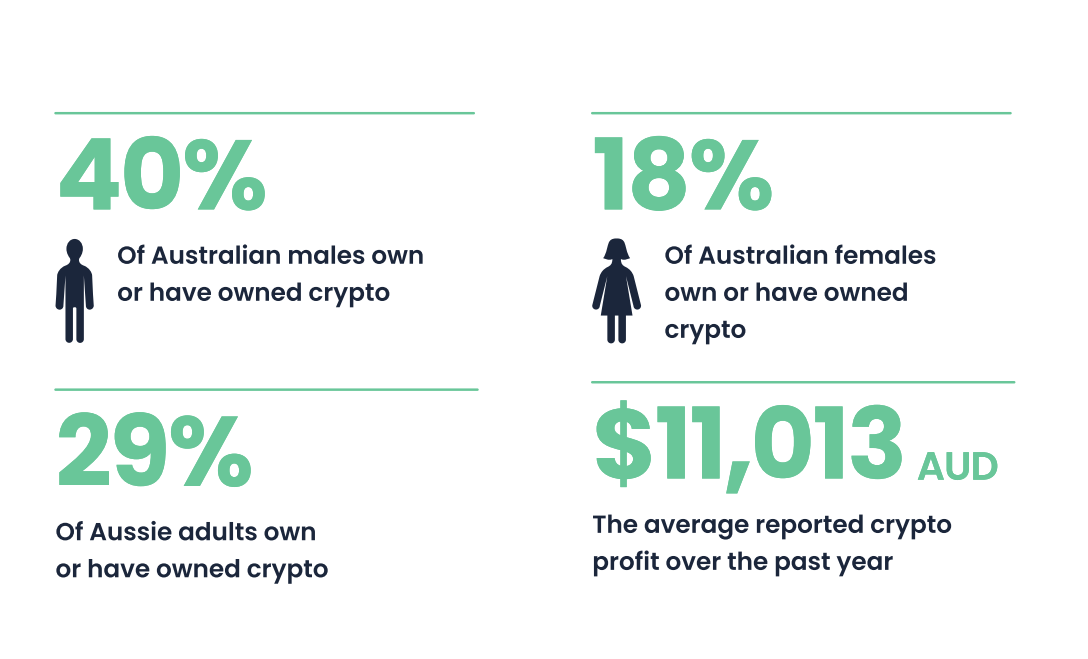

Australian women reported profits of $7314, compared to $7089 for Australian men. This is according to a new survey by crypto exchange Swyftx.

Despite the crypto winter biting hard, 72% of Australians who own crypto reported an average profit of $7152.

This finding may be surprising, but there are some other interesting nuggets of information that have come from the survey.

This year, Australians are more into the idea of buying crypto. According to Swyftx, “Crypto-spending has increased by 10pp over this past 12 months with 53% of crypto-owning Aussies reporting they have used their crypto to make purchases. The most popular website to purchase goods with crypto is Amazon (via Purse.io) 27%, followed by restaurants/hotels (23%) and petrol stations (21%).”

Australian crypto spending rises

Tommy Honan is the Head of Strategic Partnerships at Swyftx. “Technically, Australians can spend their crypto almost anywhere if they have a Mastercard or Visa payments card from a digital assets provider. We think the adoption of crypto payment cards is the reason why we’ve seen such a big jump in the number of Aussies saying they’ve used crypto for purchases. Long term, the increased use of crypto for spending does throw into question the assumption that cryptocurrencies are purely speculative assets. We’re edging closer to the long-term thesis of Bitcoin as a currency.

“Less important, but still relevant to the growth in crypto spending in Australia, is a spike in the number of online and physical stores accepting digital assets as a form of payment. These are places like Zumi, Travala and a host of smaller retailers across areas like cafes and petrol stations. Our expectation is that the introduction of regulation might be a tipping point for a lot of retailers to start offering crypto payment options.

“If you’re a retailer, there are some attractions to offering crypto payment options. Transaction fees are generally lower than credit card counterparts and, because Bitcoin offers irreversible payments, it basically eradicates the risk of people reversing their payments after they’ve taken receipt of a good or service, which is an issue for merchants.”

Australian newbies are more friendly to crypto

About one million citizens of Down Under are projected to enter crypto markets for the first time in 2022-2023. Millennials and Gen Zedders are the most likely to buy digital assets.

Crypto adoption rates in Australia increased by four percentage points over the past year. 29% of Australians say they own (21%) or have owned crypto (8%).

Says Honan, “We know Australians buy crypto for a number of reasons but there’s no doubt that the majority of Aussies principally view it as a long-term investment. Your average local investor, in so far as there is one, is a metropolitan, millennial dad with kids at home reporting a high level of financial knowledge.

“The really interesting question is will investment be the main use case for crypto in five years’ time? Everyone is expecting prices to stabilize as the market matures and that brings you closer to having a more predictable day-to-day price. Long term, our expectation is that Bitcoin and Ethereum will behave more like currencies than securities.”

Australian regulation

The key barrier to market entry for non-crypto users is the lack of effective regulation.

The second annual Swyftx Cryptocurrency Survey was released amid volatility across all markets. While $2tn has been wiped off global crypto markets, traditional markets have also hit a snowstorm. The ASX has fallen around 8% since this time last year. And, Australian home prices are falling, although it is thought this won’t be prolonged.

Honan says, “This is the first real sign that Australians are looking to a future beyond the crypto winter. Even in the midst of a bear market, there’s belief in the fundamentals of cryptocurrency and blockchain technology, and this is manifesting itself in a high intention to buy digital assets among under 50s. But the crypto winter has taken a toll, with trust in digital assets in the country falling as a result of the failure of some big crypto projects.”

Bear market and confidence

The bear market has shaken the confidence of Australians who have never bought crypto. 61% said that they have not bought crypto because of trust issues. This is 3% higher than last year.

Despite this, more Australians than ever are trusting a switch to crypto. 53% of those surveyed said they used digital assets to buy goods and services in Australia last year. This is a 10% point increase from last year’s survey.

Says Honan, “It’s interesting to see such a significant uptick in the number of Aussies using crypto to shop online because it speaks to where the future of digital assets almost certainly belongs. Over the next five to ten years, we expect to see far fewer cryptocurrencies and far less market volatility. Digital assets and traditional finance likely will become indistinguishable from one another.”

Australia’s future in crypto

Says Honan, “Australia is fast becoming one of the crypto capitals of the world. You have a young and wealthy population that’s generally receptive to new technologies and that translates into huge enthusiasm for all things crypto and blockchain. People were being turned away from the Australian Crypto Convention during peak bear market, it’s astonishing really. But it speaks to the fact that Aussies see digital assets as a transformative technology.

“Australia doesn’t have the sophisticated wholesale financial services you find in centers like the US and UK, but it does punch well above its weight in blockchain and crypto, with some genuinely exciting and disruptive projects being driven from centers including Brisbane, Sydney and Melbourne.”

Got something to say about the Australian crypto landscape or anything else? Write to us or join the discussion in our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.