After starting May on a negative note, Arbitrum (ARB) price has surged 13% in the last seven trading days. A closer look at the underlying on-chain data shows bullish action from a cohort of crypto whales. Could this be the main driver behind the recent positive Arbitrum price prediction?

Arbitrum whales were unmoved by the slow start to May. With network traction now on the rise, ARB could be on course for another price rally.

Crypto Whales Bought The Dip in April

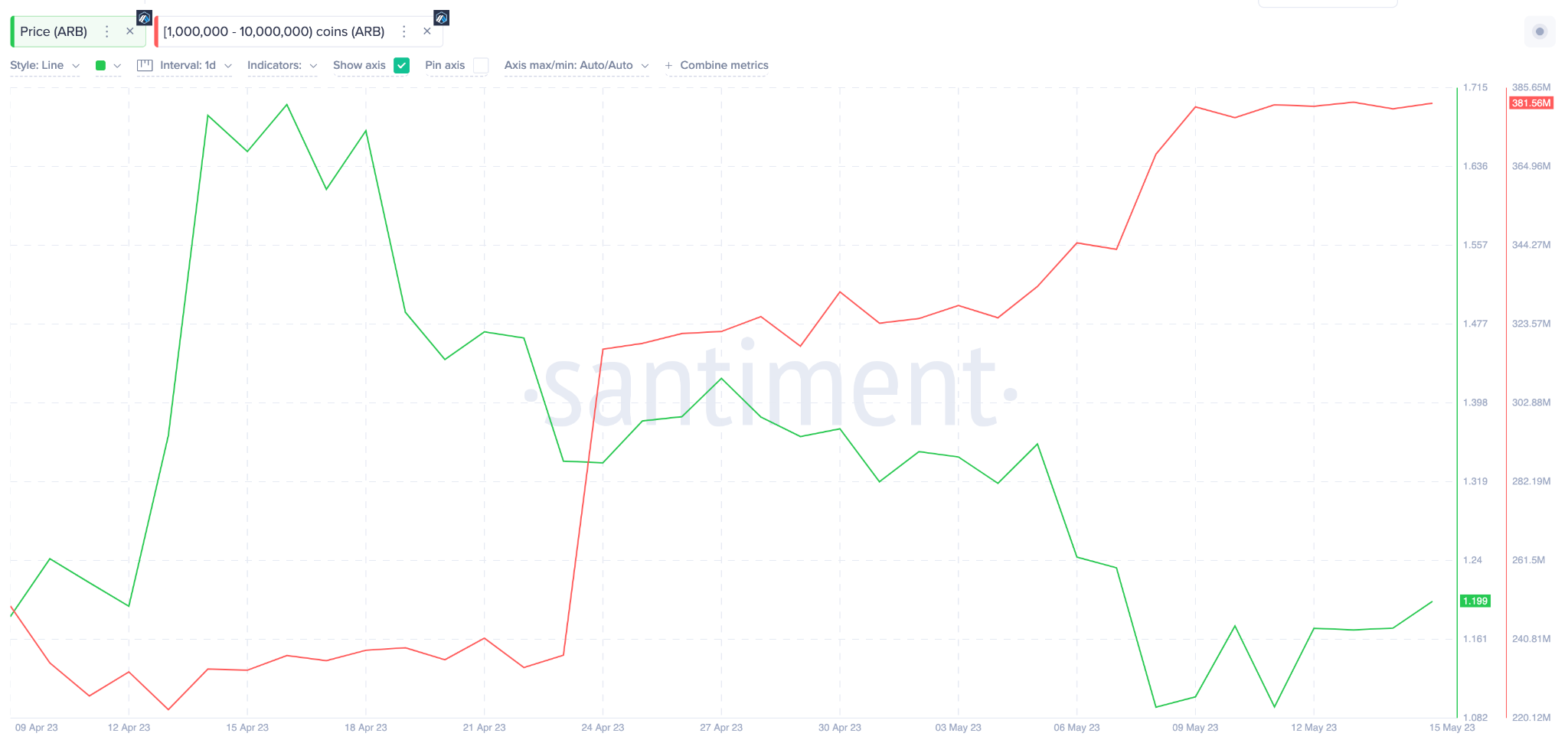

Between April 14 and May 11, Arbitrum (ARB) price dropped by 35%. But interestingly, large investors holding between one million to 10 million ARB tokens continued to buy the dip.

During that period, this cluster of whales has nearly doubled their holdings.

From a total balance of 222 million tokens on April 13, the chart below shows how ARB whales have added another 158 million ARB to their wallets as of May 16.

Whales are large investors holding at least $100,000 of cryptocurrency. Due to their disproportionately huge financial power, their buy/sell patterns can considerably impact an asset’s price.

This accumulation frenzy among the whales could be a major premise for a more bullish Abritrum price prediction.

Arbitrum Network Traction is On The Rise

Beyond the bullish trading activity from the whales, it appears that the Arbitrum network has been gaining all round traction from users.

Notably, the seven-day average of Daily Active Addresses (DAA) on the Arbitrum network has increased since May. Specifically, between May 7 and May 15, the DAA increased by nearly 30% from 101,000 to 131,000 active user addresses.

The Active Addresses (7D) metric takes a seven-day average of the number of unique wallet addresses interacting on a network. And when the number of user transactions on a network increases, as seen above, it signals that the underlying coin is attracting fresh demand.

In summary, if the Arbitrum network participants continue on this trajectory and the whales continue buying, it could trigger the next ARB price rally.

ARB Price Prediction: The $1.25 Resistance Will be Critical

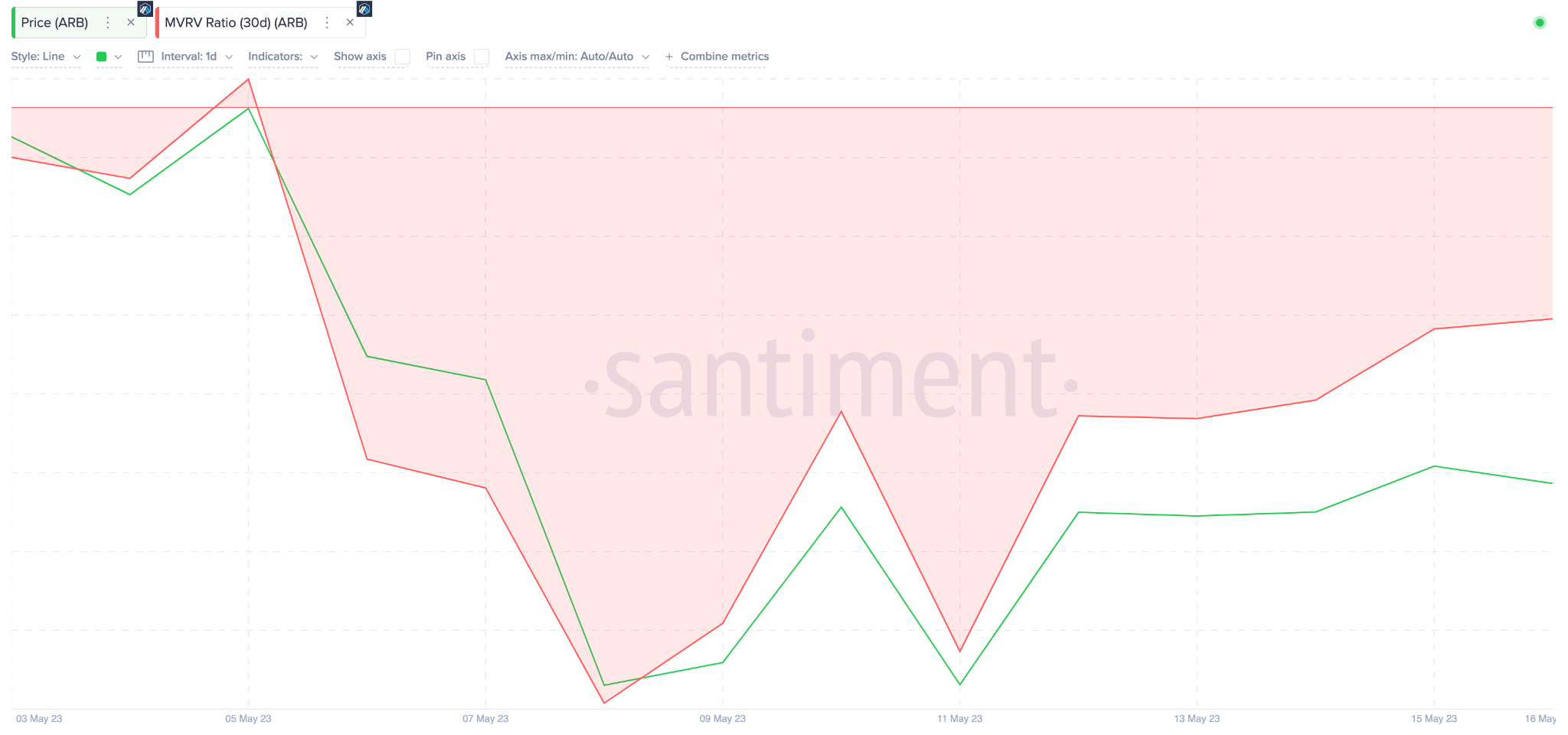

The Market Value to Realized Value (MVRV) ratio, which evaluates the financial position of current Arbitrum holders, suggests a rally to $1.25 is the most likely ARB price prediction.

Currently, the majority of crypto investors that bought ARB in the last 30 days are still sitting on unrealized losses of about 6%. Historical data suggests they are likely to book some profits once they break even, around $1.25

However, if the bullish Arbitrum price prediction plays out, ARB could rally toward $1.35 before the bears regroup.

On the flip side, the bears could negate the bearish Arbitrum price prediction if it drops below the previous local low of around $1.10.

However, holders could stop selling in that zone as they desperately look to keep their losses below 10%.

Nevertheless, if that $1.10 support does not hold as expected, ARB could face further downward pressure toward $1.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.