The debut of the Apple savings account has sparked a discussion concerning the rate of digital innovation in the US. Apple has encountered major operational difficulties with its savings accounts due to AML complexities.

According to the Washington Journal, withdrawal delays are occurring following the recent launch of the Apple savings account. Apple launched the accounts in collaboration with Goldman Sachs, and now they face a stringent regulatory framework.

Apple Savings Account Customers Face Delays

The report mentions that customers have encountered delays and challenges while transferring money from their Apple savings accounts, a product that it introduced in April.

If you want to learn about buying Bitcoin with Apple Pay, you can read our guide here!

Goldman Sachs attributed the delays to security issues and anti-money laundering (AML) procedures. Delays were especially noticeable for accounts or transactions involving a sizable chunk of the total balance. Another scenario would be if individuals transferred funds from a newly created savings account to another. This needed additional review time, causing more delays.

Some irate clients have responded by making unforeseen financial decisions. The report underlines that they have started selling stocks or transferring their cash back to their original accounts. The circumstance illustrates the difficulties in providing retail clients with a digitally seamless and effective banking experience. Even if it involves two of the biggest banking and tech giants. The news comes after the recent banking crisis in the U.S. following the failure of the Silicon Valley Bank.

The WSJ notes that some customers even reported that their money did not appear in the intended accounts. According to anti-money laundering specialists who spoke with the newspaper, the average length of these delays is five days. This has eclipsed Apple’s original savings account strategy, which included a greater interest rate than what was offered by conventional banks.

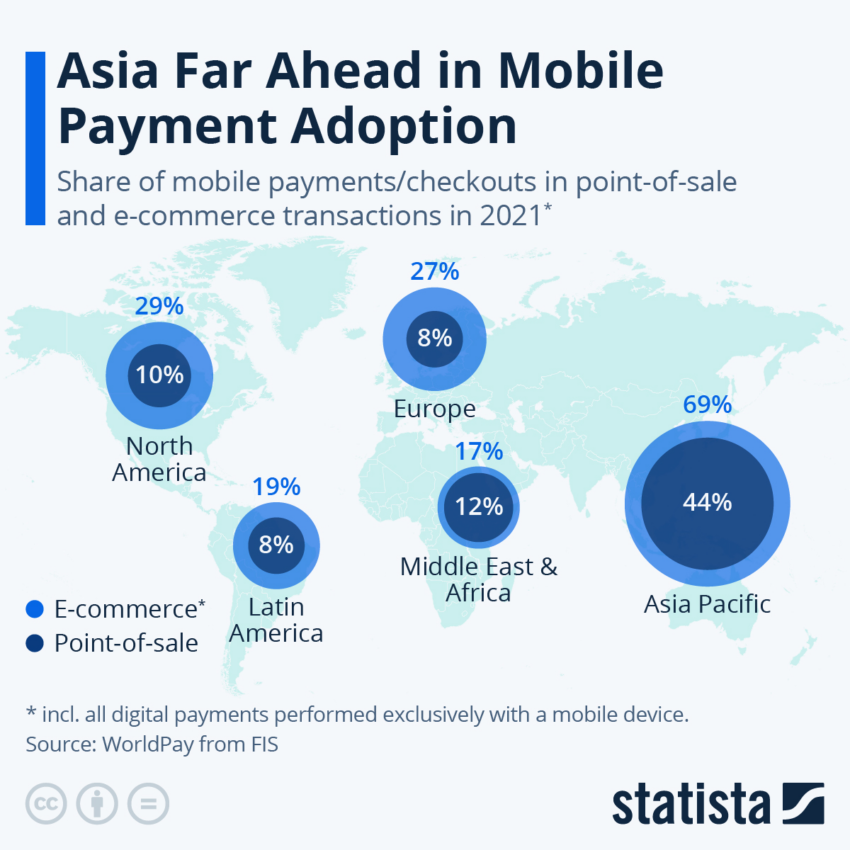

Has Asia done a better job of fostering digital innovation while containing security concerns despite the persistence of these issues?

Asia Beating the US Market

The Asia-Pacific digital payments sector is expanding significantly, according to previous BlueWeave research. The market is anticipated to develop at a strong CAGR of 21.1% between 2022 and 2028. It could reach $67.42 billion by 2028 from an estimated market value of $17.85 billion in 2021.

This is based on elements including the ease of transactions, the widespread use of smartphones, and the prospects for financial inclusion offered by digital technologies. According to another study, the ASEAN-6 nations of Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam are expected to have 6% yearly growth in their digital economies despite the hurdles posed by the digital divide.

Countries like India have rapidly grown in digital transactions that it has eclipsed other significant developed economies like the U.S., the UK, and Europe.

India is a global leader in UPI-driven retail digital payments, which are predicted to account for 90% of all retail payments by 2026–2027 and have reportedly risen at a CAGR of 50%.

AML Complexities in the US

The Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) rules in the U.S. are in place to check money laundering and terrorism financing. It establishes guidelines to encourage financial system openness and identify people or organizations trying to abuse it illegally. As a result, banks and other financial institutions must set up a BSA/AML compliance program and adhere to recordkeeping regulations.

In April, AML compliance for centralized and decentralized financial services became a critical proposal. While discussing AML safeguards, the U.S. Treasury Department published a paper evaluating the dangers of decentralized financing (DeFi).

This followed the securities regulator’s emphasis from the previous year that broker-dealers are responsible for adhering to all AML laws.

Although consumer and national security remain paramount, so is regulatory clarity. But while the U.S. struggles with digital innovation due to legal complexity, Asian nations have demonstrated considerable development and leadership in digital payments and the digital economy.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.