The Altcoin Market Cap (ALTCAP) possibly initiated a bullish trend reversal on June 18. It has broken out from both a short- and a long-term resistance level since.

ALTCAP has been falling since creating a double top pattern (red icons) in Nov 2021. The double top is considered a bearish pattern, meaning that it usually leads to bearish trend reversals.

SponsoredIn April 2021, it broke down from the $2,950 horizontal area, which had previously been acting as support (green icons) since the beginning of 2021. Breakdowns from such long-term structures usually indicate a change in trend.

So far, a low of $1,367 has been reached in June. The low was combined with an all-time low of 29 (green circle) in the weekly RSI. Since then, the indicator has been increasing and has moved outside of its oversold territory. While this is a bullish sign, the RSI is still below 50.

So, while a re-test of the $2,900 area by the price and the 50 line by the RSI could occur, the trend cannot be considered bullish until both of these are reclaimed.

ALTCAP breakout

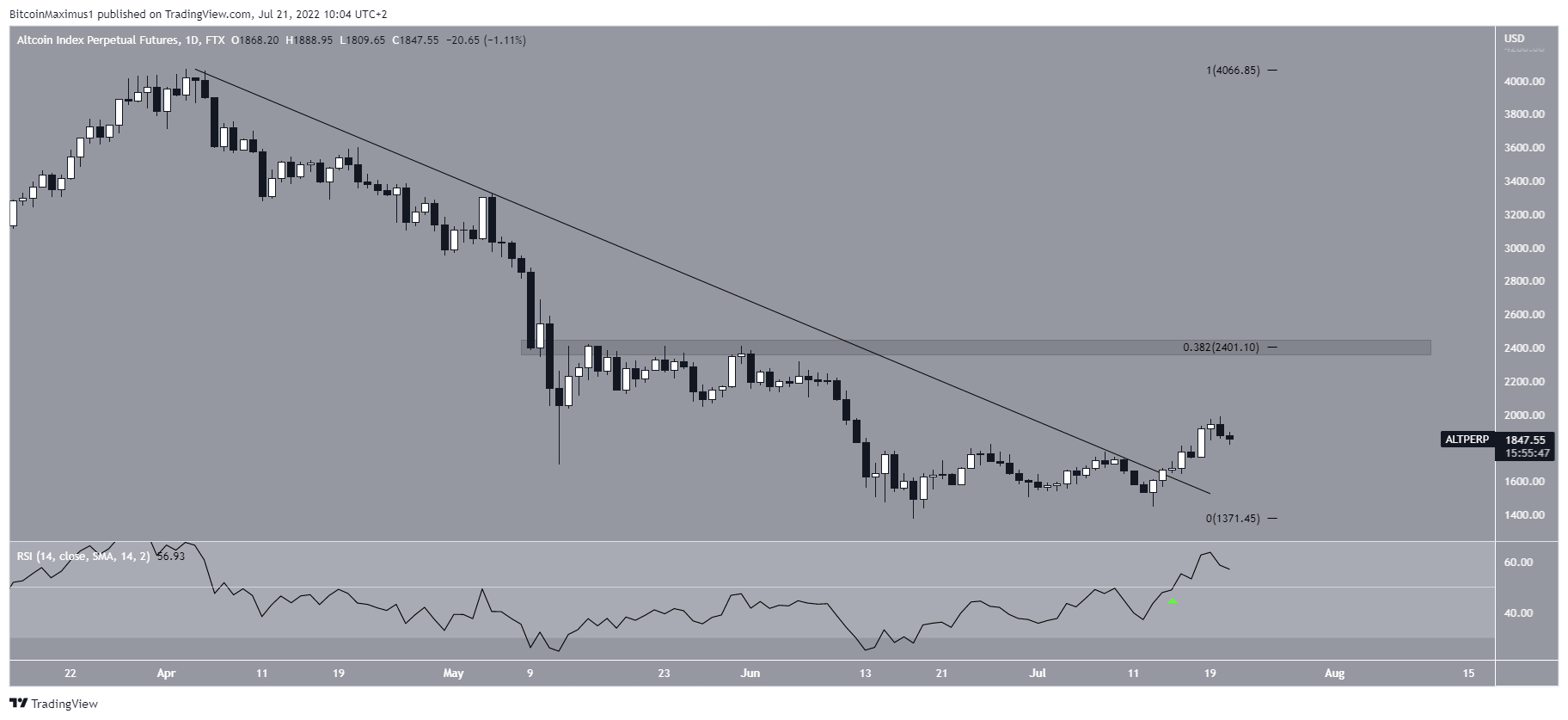

The daily chart provides a more bullish outlook, which could lead to a re-test of the aforementioned resistance.

Firstly, ALTCAP has broken out from a descending resistance line that had previously been in place since April. Secondly, the daily RSI has moved above 50 (green icon). As stated previously, this is a sign associated with bullish trends.

SponsoredIf the upward movement continues, the closest resistance area would be at $2,400, created by the 0.382 Fib retracement resistance level.

Future movement

Technical analyst @Altstreetbet tweeted a chart of ALTCAP, stating that alts are expected to continue increasing.

Since the tweet, ALTCAP has broken out from an ascending parallel channel, and could be in the process of validating it as support. The current level is crucial since it coincides with both the resistance line of the channel and the $1,800 support area. So, if the upward movement is to continue, it is crucial that this level gets validated as support.

As for the wave count, it is not yet certain if the current increase is part of an A-B-C structure or a new upward movement. In any case, an increase towards at least $2,155 area would be expected even in the bearish scenario, since that would give waves A:C a 1:1.61 ratio.

For Be[in]Crypto’s latest Bitcoin (BTC) analysis, click here