Amidst the altcoins that charted immense gains was Algorand, which had a good run over the last couple of days.

However, despite the considerable rally, the ALGO holders are still disappointed and facing losses to the point where this increase has become useless.

The Reason Behind Algorand Investors’ Losses

Unlike Algorand, when a cryptocurrency launches, the trajectory follows one of two paths. The asset rises and falls, followed by an eventual increase, or the token corrects first but then finds a way back to the top.

On the other hand, ALGO first charted its all-time high right after launch in June 2019 and has since been struggling to make it back up top. Trading far below the ATH of $3.27, the altcoin is currently at $0.31.

This means Algorand’s price would need to rise by at least 926% to reclaim the highest point and chart fresh highs. The demand for the same is immensely high, but it does not seem like ALGO will be able to achieve it anytime soon.

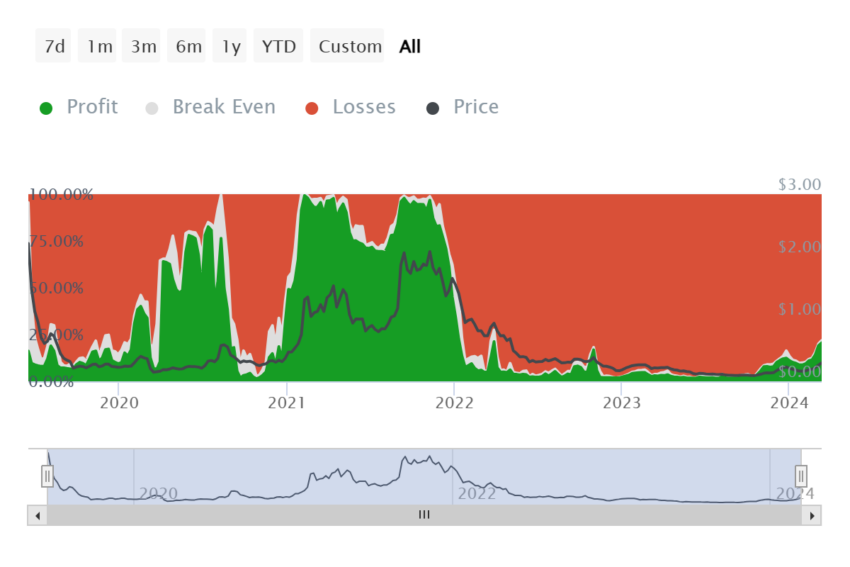

Consequently, the investors that bought their tokens for around 20% of the ATH will have to wait much longer before they can book profits. These addresses are known as all-time higher, and at the moment, they account for 85% of all ALGO investors.

Nearly 16.1 million ALGO holders out of 20 million are underwater and will likely stay this way. In fact, Algorand’s price, despite being at a 16-month high, has made no dent in these statistics.

At the time of writing, the break-even metric showed very minor changes over the past two weeks. This metric calculates whether the addresses holding their ALGO bought it before or after the current price to determine the overall profits and losses.

Presently, 20.6% of all ALGO investors are in profit, which increased from 18.5% in 12 days. This difference represents a 2.1% rise in the overall profits, which is minuscule considering a 71% rally.

Thus, by and large, unless Algorand’s price manages to climb back above $1, the chances of these investors ever witnessing profits are near to none.

ALGO Price Prediction: Why Is Lack of Profits a Good Thing?

Despite Algorand’s price rallying, most of the investors, as mentioned, remained underwater. But this is not the worst thing for the altcoin. Lack of profits means lack of selling, reducing the bearishness that would arise generally due to profit taking.

This allows ALGO to rise further and continue its rally. Algorand’s price is already at the cusp of breaching the $0.32 resistance level and doing so would enable the altcoin to push through and tag $0.35.

Read More: What Is Algorand (ALGO)?

However, the possibility of selling cannot be completely ruled out, which would have some impact on the cryptocurrency. ALGO might potentially fail the breach and fall back to $0.30. Losing this support would invalidate the bullish thesis, sending the altcoin to $0.28.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.