This article will predict the long-term price of the ALGO coin using the right mix of fundamental and technical analysis. Algorand has the edge over Ethereum and Bitcoin as a pure proof-of-stake (PPoS) blockchain. It promises environmental efficiency over anything else whilst boasting scalability, faster transactions, and smart contract coverage. Let us learn more about its price potential in this comprehensive algorand price prediction.

- ALGO price prediction and fundamental analysis

- Algorand and its DeFi presence

- Algorand blockchain and the associated tokenomics

- Key metrics and ALGO price prediction

- ALGO price prediction and technical analysis

- Algorand (ALGO) price prediction 2023

- Algorand (ALGO) price prediction 2024

- Algorand (ALGO) price prediction 2025

- Algorand (ALGO) price prediction 2030

- Algorand (ALGO’s) long-term price prediction until the year 2035

- Is the ALGO price prediction model accurate?

- Frequently asked questions

Want to get ALGO price prediction weekly? Join BeInCrypto Trading Community on Telegram: read ALGO price prediction and technical analysis on the coin, ask and get answers to all your questions from PRO traders! Join now

ALGO price prediction and fundamental analysis

The democratized consensus mechanism PPoS or pure proof-of-stake makes Algorand so desirable. Unlike Ethereum’s staking threshold of 32 ETH, Algorand follows a more inclusive approach, as anyone holding 1 ALGO coin can participate.

Did you know? Algorand went through a significant network upgrade in 2023, which optimized the block time and even improved transaction speeds and overall network efficiency.

No token-locking mechanisms exist, making Algorand a welcoming ecosystem involving staking and on-chain governance. Here are some more use cases that make Algorand popular and forward-thinking.

- It helps develop DApps.

- It helps build and host leading stablecoins or digital assets. USDC and USDT have exposure to the Algorand ecosystem.

- The blockchain network even works as a facilitator of cross-border payments.

- Algorand even works as a hosting platform for intellectual property on the blockchain, becoming home to several tokenizing instances. SIAE, one of the largest copyright collection agencies based out of Italy, used Algorand to tokenize author rights in the form of 4.5 million NFTs.

“Algorand as designed to be environmentally friendly.”

Silvio Micali, Founder of Algorand: X

The Algorand network is the brainchild of MIT professor Silvio Micali. Having received the Turing Award in 2012, Silvio Micali is one of the more trusted names in the crypto space.

Here is his profile:

Algorand and its DeFi presence

To some, Algorand comes across as a major DeFi facilitator. In February, it boasted a TVL of $184.05 in dollar terms, with AlgoFi being the most dominant protocol.

Coming to the global DeFi rank, Algorand ranked 16 in chain-specific TVL, in February 2023. At press time, it is ranked 27.

If it ever manages to enter the top 10, we can see the future price of the coins respond well to the same. Further, watching out for the DeFi advancements made at Algorand’s counter is advisable.

Algorand blockchain and the associated tokenomics

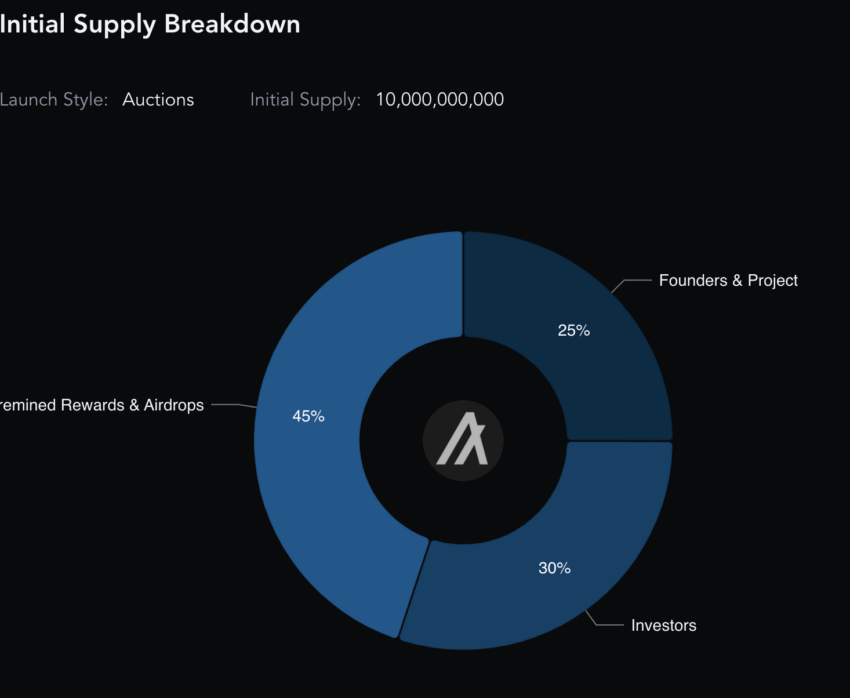

The ALGO coin works as the network incentivization tool. Plus, ALGO can also power transactions. The network supports staking, which in turn generates rewards. Further, the ALGO coin has a fixed supply of 10 billion. Currently, almost 80.8% of the fixed supply makes the circulating supply. Further, the 10-billion threshold is expected to be reached by 2024, after which we can expect ALGO to turn deflationary.

Hence, despite the initial 25% allotment to founders and the project, the tokenomics model looks transparent.

Post 2024, we can expect this to impact the price of ALGO coins.

Key metrics and ALGO price prediction

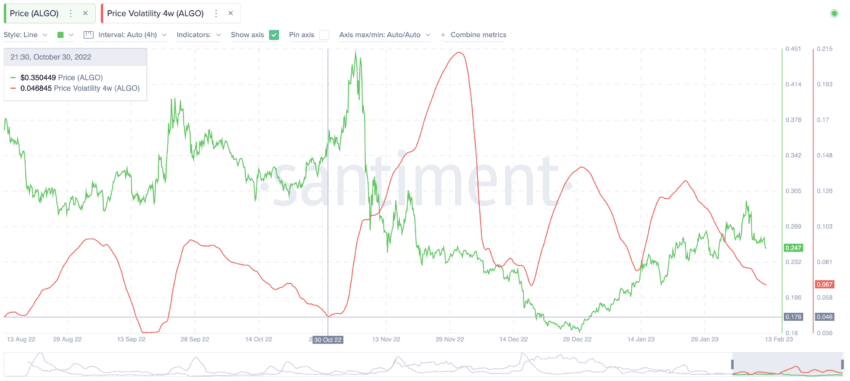

The 4-week price volatility metric reveals an interesting trend. Notice the December 2022 peak in volatility pushed the prices down rather significantly. Also, the trough made in early November did push the prices higher. Hence, we can assume that if the volatility hits bottom, the prices of ALGO might go up.

Currently, the volatility line seems to be heading down, which might be a good sign for the price of the ALGO coin. Also, notice that a bottom in December 2023, pushed the price of ALGO higher.

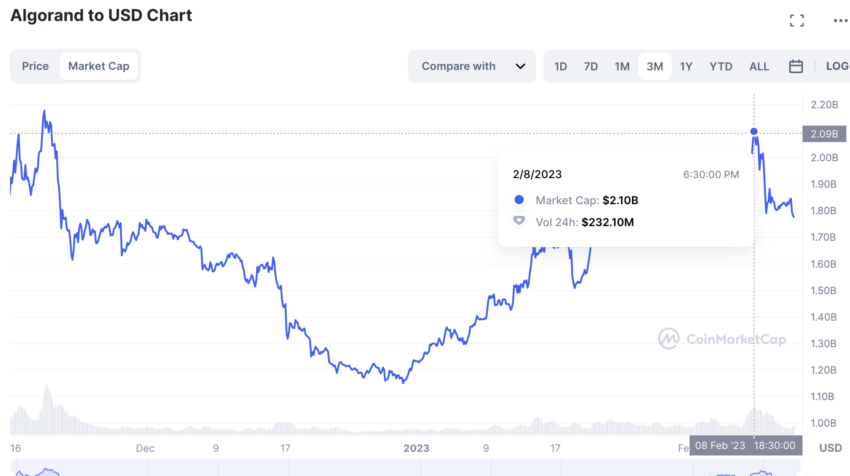

Notice the rising market cap and trading volume levels at Algorand’s counter in February 2023. Increasing trading volume shows that the prices are becoming more stable with time. It also shows that interest in ALGO’s counter is slowly building.

Marketcap cap and other metrics

The same theory holds even for the December 2023 market cap evaluation as the rise in value is certainly leading to a surge in prices.

As mentioned, Algorand also supports smart contracts and DApp development. As such, development activity is a crucial metric for analyzing price forecasts. Moreover, the chart below shows that development activity follows the price action in most cases. The most obvious one is the peak in October 2023, when both development activity and ALGO prices started rising.

Therefore, with more developers coming into the Algorand ecosystem — to develop newer digital assets or use the network, we can expect the prices to increase in the future.

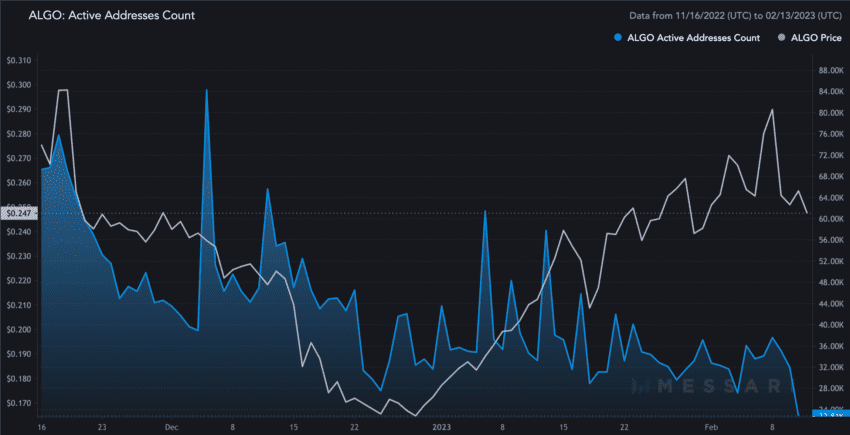

And finally, the 90-day active address count In February 2023 was low yet steady. And this steady count propelled the short-term price surge at Algorand’s counter.

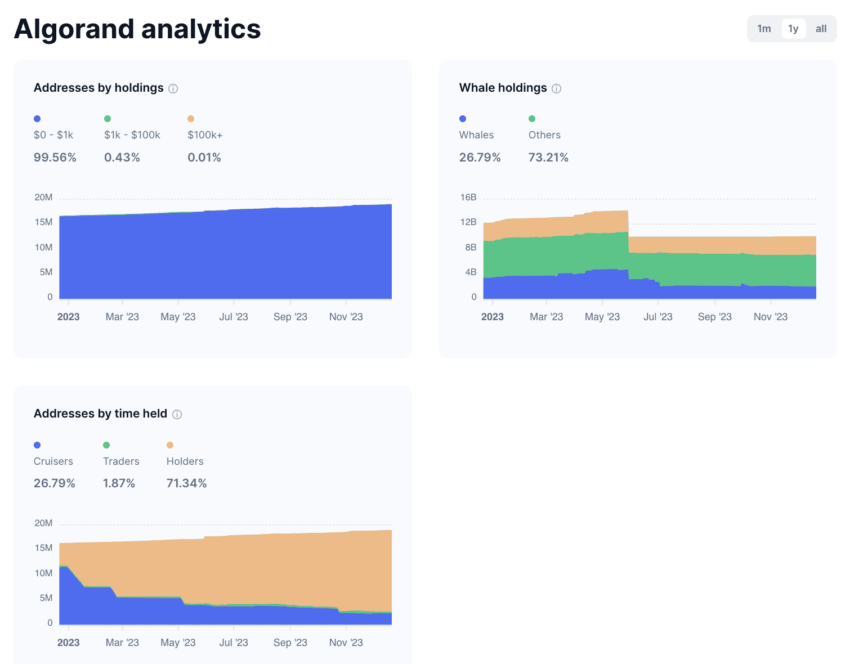

One advantage for Algorand is that Whales only control 26.79% of the total supply, a metric that makes ALGO less prone to massive selling pressure.

ALGO price prediction and technical analysis

It’s now time to focus on ALGO’s price chart, helping us project prices in the short and long term. Let us first check the short-term potential of ALGO, which might determine the price action in 2024:

Our December 2023 analysis

It seems that on the daily chart, ALGO has broken past a cup-and-handle pattern followed by an upper trendline breach of an ascending wedge. And the volume levels are also slowly picking up, hinting at short-term optimism.

Yet, it is important to keep a close eye on the RSI as a lower high can kickstart a consolidation, courtesy of the bearish divergence.

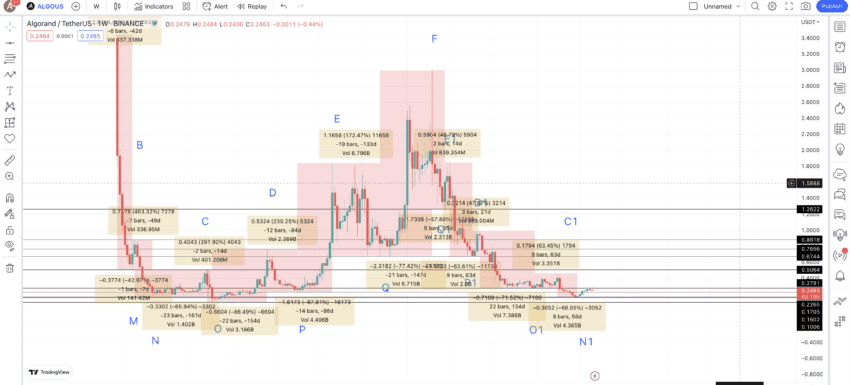

Now, we check the weekly ALGO-USDT chart to see if we can locate a pattern. (based on our February 2023 analysis using historical data)

Here is what happens with the chart. ALGO peaks and then dips within a few trading sessions. From there, it starts making higher highs, only to peak at close to $3. Post the $3 peak, the prices started to drop, as predicted by the bearish divergence made by the RSI.

Notice that there might be a bullish divergence forming, which might push the prices of ALGO higher than the previous highs. Once that happens, we can expect it to repeat a formation similar to the left side of the chart. That would even help complete a standard foldback pattern.

Here is what we are expecting ALGO’s price chart to look like.

We can now mark all the crucial points on the chart to help us calculate the short-term and long-term price moves.

Notice that each point also corresponds to an important support/resistance level, which ALGO can adhere to as per the state of the broader crypto market.

Price changes

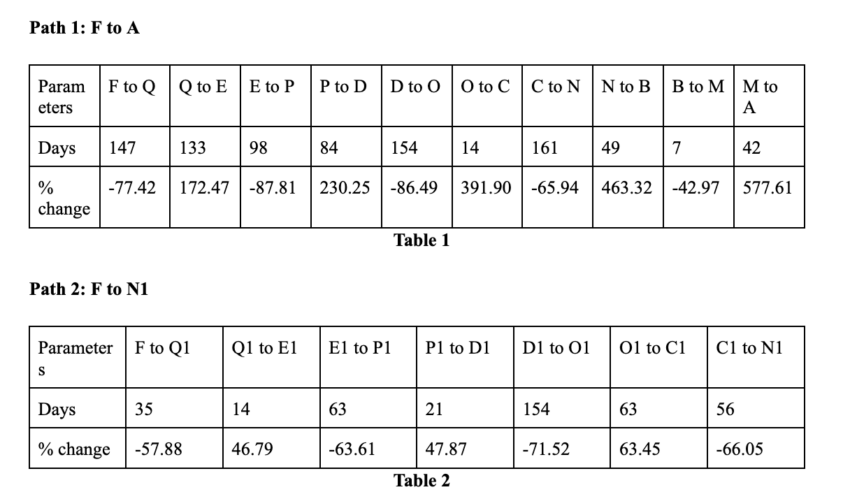

We now have a few tasks in hand. First, we need to locate the price percentage changes and distance between the points corresponding to two paths: F to A and F to N1. This will help us locate the average values of every other low-to-high and high-to-low movement.

Once we have the average levels, our task will be to locate the first higher high in a while — a level that we might term B1. That will help us locate the right-sided peak of the pattern.

Columns with negative values are meant to calculate the high-to-low averages, whereas columns with non-negative values are meant to calculate the low-to-high averages.

Calculations

By integrating data from both tables, we can determine the average points for market trends.

The high-to-low average is calculated at -68.85%, indicating a significant downward trend.

Conversely, the low-to-high average shows a more optimistic trend at 249.21%. It’s important to note that the duration for the high-to-low trend can vary greatly, ranging from as long as 161 days to as short as seven days, influenced by prevailing market conditions. In making ALGO price predictions, we consistently consider the maximum number of days for these fluctuations.

Similarly, the duration for the low-to-high average price change can fluctuate between 133 days and 14 days, again depending on the broader crypto market’s behavior.

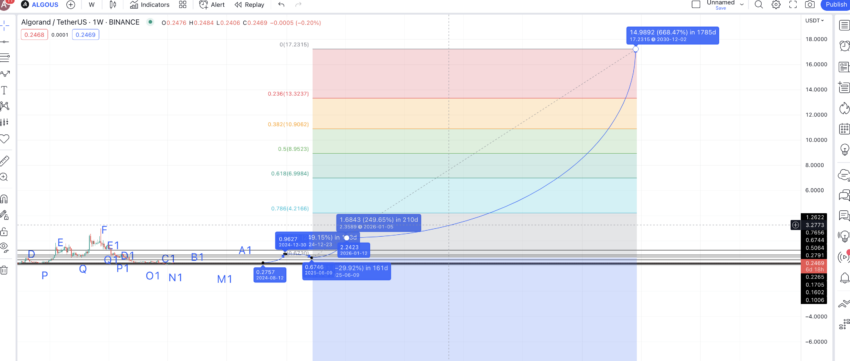

With these averages in hand, we are now equipped to use these values for projecting the Algorand price levels up until 2030.

Algorand (ALGO) price prediction 2023

Outlook: Bullish

We have the last low N1 in our sight. So, we can use the low-to-high average of 249.21% to plot the next high or B1. It can take ALGO 133 days (per table 1) to reach this level. This projection puts the Algorand price forecast level for 2023 at $0.5583.

The low from this level can drop to $0.1760, as per the high-to-low average price drop of -68.85% (approximate). Note that the projected 2023 low might not wait for the high to appear. The low can surface anytime in 2023, with or without the high.

Projected ROI from the current level: 126%

Algorand (ALGO) price prediction 2024

Despite not being able to reach our projected high in 2023, the short-term technical analysis hints at a change of fate for ALGO in 2024. Therefore, our 2024 Algorand price prediction holds.

Outlook: Bullish

From M1, we can use the low-to-high average of 249.21% to plot the next high or A1. That level surfaces at $0.6137 and in 2024. Once the price of ALGO reaches $0.6137 or A1, we can expect a new pattern to start forming. So, we can expect ALGO to follow the same path as A to F — illustrated by the left side of the previous pattern.

With A1 being the new A, we can now use the high-to-low average to locate the next M or M2. And while the average drop percentage is 68.85%, there seems to be strong support at $0.2791. This can be the new 2024 low projection for ALGO.

The worst-case scenario, based on the 2023 low of $0.088, could be a 2024 high of $0.315.

Projected ROI from the current level: 143% max

Algorand (ALGO) price prediction 2025

Outlook: Bullish

We can now see a strong higher-high and higher-low formation at ALGO’s counter. This means that the new B or B2 could follow the average low-to-high value of 249.21% and go higher than 2025. This projection puts 2025 high for ALGO at $0.9827.

The next low, or 2025 low for ALGO, can take support at $0.6746 — a level that coincides with two previous lows, Q and P1.

Projected ROI from the current level: 290%

Algorand (ALGO) price prediction 2030

Outlook: Very bullish

The next high might show up by early 2026. And this could be at a high of 249.21% from the previous low or from $0.6746. Hence, the 2026 high could show up at $2.358. Notice that this high can even surface in 2025, but we have pushed the same to 2026, keeping the improving crypto market stability in mind.

We now have the 2026 high and 2025 low at our disposal. Using the Fib levels, we can extrapolate the path till 2030. This projection puts the ALGO price prediction for 2030 at a high of $17.23. This is assuming that the previous high of $3.28 is breached by the end of 2027 or early 2028.

Projected ROI from the current level: 6737%

Algorand (ALGO’s) long-term price prediction until the year 2035

Outlook: Very bullish

Now that we have all the ALGO price prediction levels till 2030, we can extrapolate the logic further to locate the price potential of the Algorand blockchain network till 2035. Assuming the trading volume increases steadily over the years, the table below maps out a long-term Algorand price forecast.

You can easily convert your ALGO to USD here

| Year | | Maximum price of ALGO | | Minimum price of ALGO |

| 2023 | $0.2899 | $0.0887 |

| 2024 | $0.6137 | $0.2791 |

| 2025 | $0.9827 | $0.6746 |

| 2026 | $2.358 | $1.833 |

| 2027 | $3.28 | $2.56 |

| 2028 | $4.92 | $3.83 |

| 2029 | $11.07 | $6.86 |

| 2030 | $17.23 | $13.44 |

| 2031 | $25.85 | $20.16 |

| 2032 | $38.76 | $24.03 |

| 2033 | $50.39 | $39.30 |

| 2034 | $62.99 | $49.13 |

| 2035 | $85.04 | $66.33 |

Is the ALGO price prediction model accurate?

The Algorand blockchain network is one of the more technologically empowered ecosystems around. This ALGO price prediction blends fundamental and technical analysis to form a reliable, data-informed forecast model. Take note of average annual prices and highs and lows to ensure you gain the most realistic expectations of future prices. The crypto market is volatile and will not always adhere exactly to predictions.

Frequently asked questions

How much will Algorand be worth in 2030?

Is Algo coin a good investment?

Does Algorand have a future?

What will ALGO’s price be in 2040?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.