Cardano (ADA) has had a tough month, dropping over 20% in the past 30 days, yet it remains a top 10 cryptocurrency by market cap. Technical indicators, including the ADX, point to weak trend momentum since December 24, suggesting the downtrend lacks the strength for significant price moves.

ADA is currently trading between key levels of $0.78 support and $0.87 resistance. Its next move hinges on whether these levels hold, with potential outcomes including a sharp correction or a rally toward $1.04.

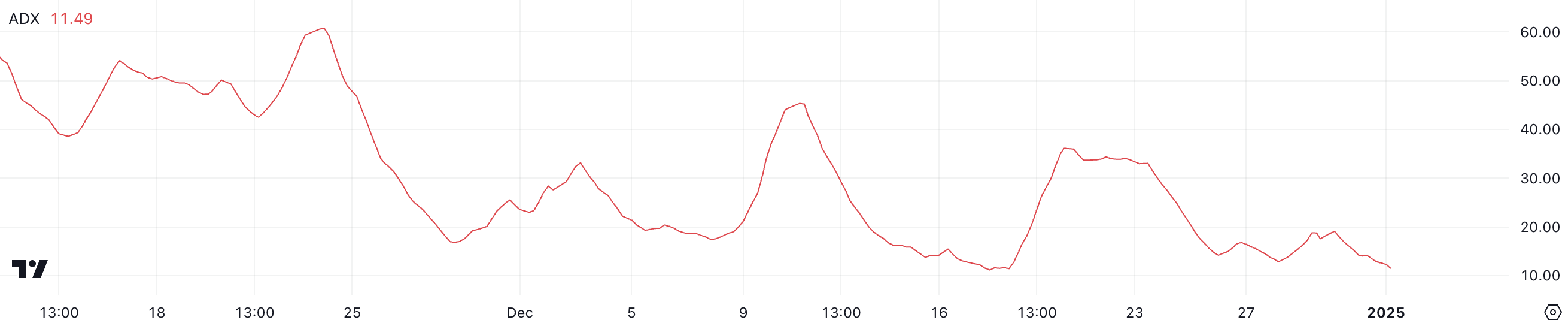

ADA ADX Shows the Downtrend Isn’t Strong Anymore

Cardano ADX is currently at 11.49, reflecting a weak trend strength as it has remained below 20 since December 24. This low ADX reading suggests that the current downtrend lacks strong momentum, indicating that while ADA is still under bearish pressure, the selling force behind the price decline has diminished.

This could signal the potential for a period of consolidation in the short term, as the trend strength remains insufficient to drive significant price movements.

The Average Directional Index (ADX) measures the strength of a trend, whether upward or downward, on a scale from 0 to 100. Values above 25 indicate a strong trend, while readings below 20, like ADA current 11.49, signify a weak or absent trend.

In the context of a downtrend, this low ADX reading means that the bearish momentum is not firmly established to continue, which could limit further price declines unless selling pressure increases. Without a rise in ADX to confirm stronger trend dynamics, ADA’s price may continue to move sideways or experience only modest fluctuations in the near term.

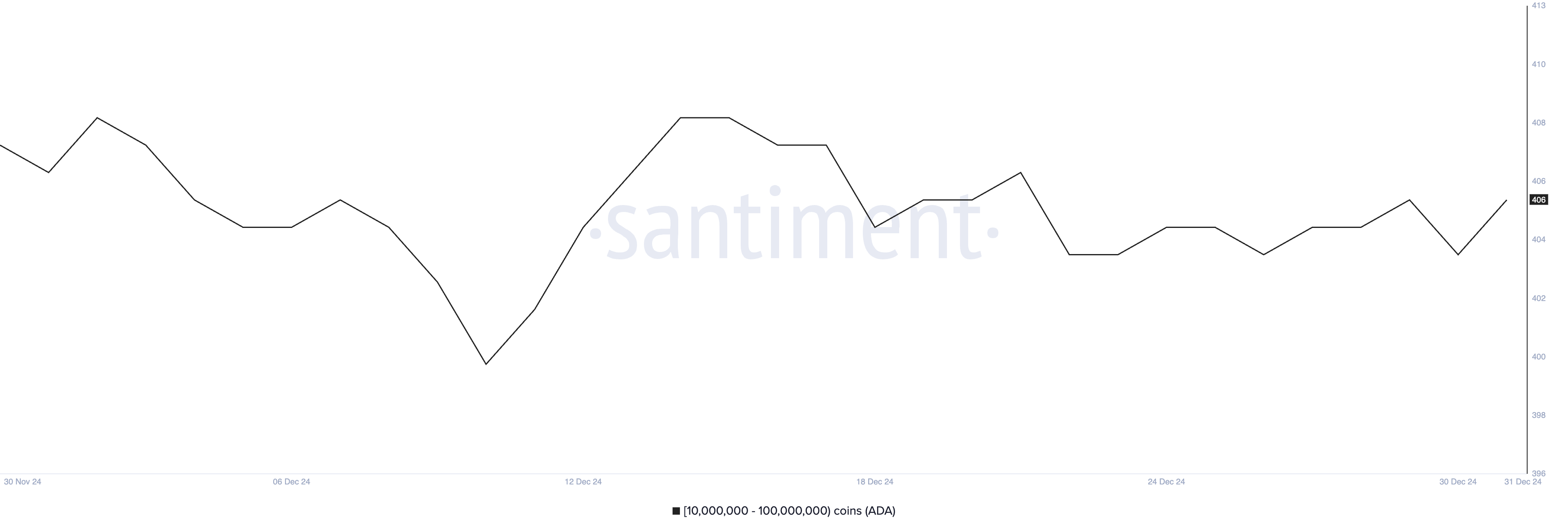

Cardano Whales Are Not Moving That Much

The number of addresses holding between 10 million and 100 million ADA has remained stable since December 18, fluctuating slightly between 407 and 404. This follows a significant surge from December 10 to December 14, when these addresses increased from 400 to 409, signaling whales were buying Cardano in that period.

Since then, the stabilization in whale activity suggests that major investors are neither significantly accumulating nor offloading their positions, reflecting a cautious stance.

Tracking whale activity is crucial as these large holders often have a considerable impact on the market. Their accumulation typically signals confidence in the asset and can drive prices higher, while distribution often introduces selling pressure.

The current stabilization in ADA whale numbers indicates a neutral sentiment among these investors, which could mean limited volatility in the short term. Unless whale activity shifts toward significant accumulation or distribution, ADA’s price may remain range-bound or experience only minor fluctuations in the coming days.

Cardano Price Prediction: Can ADA Go Back $1?

Cardano price is currently trading between a resistance at $0.87 and a support at $0.78. If the $0.78 support fails to hold, ADA price could face a sharp correction, potentially dropping as low as $0.519, representing a 38% downside.

Conversely, if ADA price successfully tests and surpasses the $0.87 resistance, it could signal a shift toward bullish momentum. In this case, the price may climb to test the next resistance at $1.04, offering a potential 23.8% upside.