The Cardano (ADA) price trades above a crucial long-term horizontal support level. But, it has struggled to reclaim a minor horizontal resistance level.

The short-term readings suggest that the ADA price will continue retracing in the short term. Then, it could make a higher low and resume its upward movement.

Cardano Finds Support After Failed Breakout

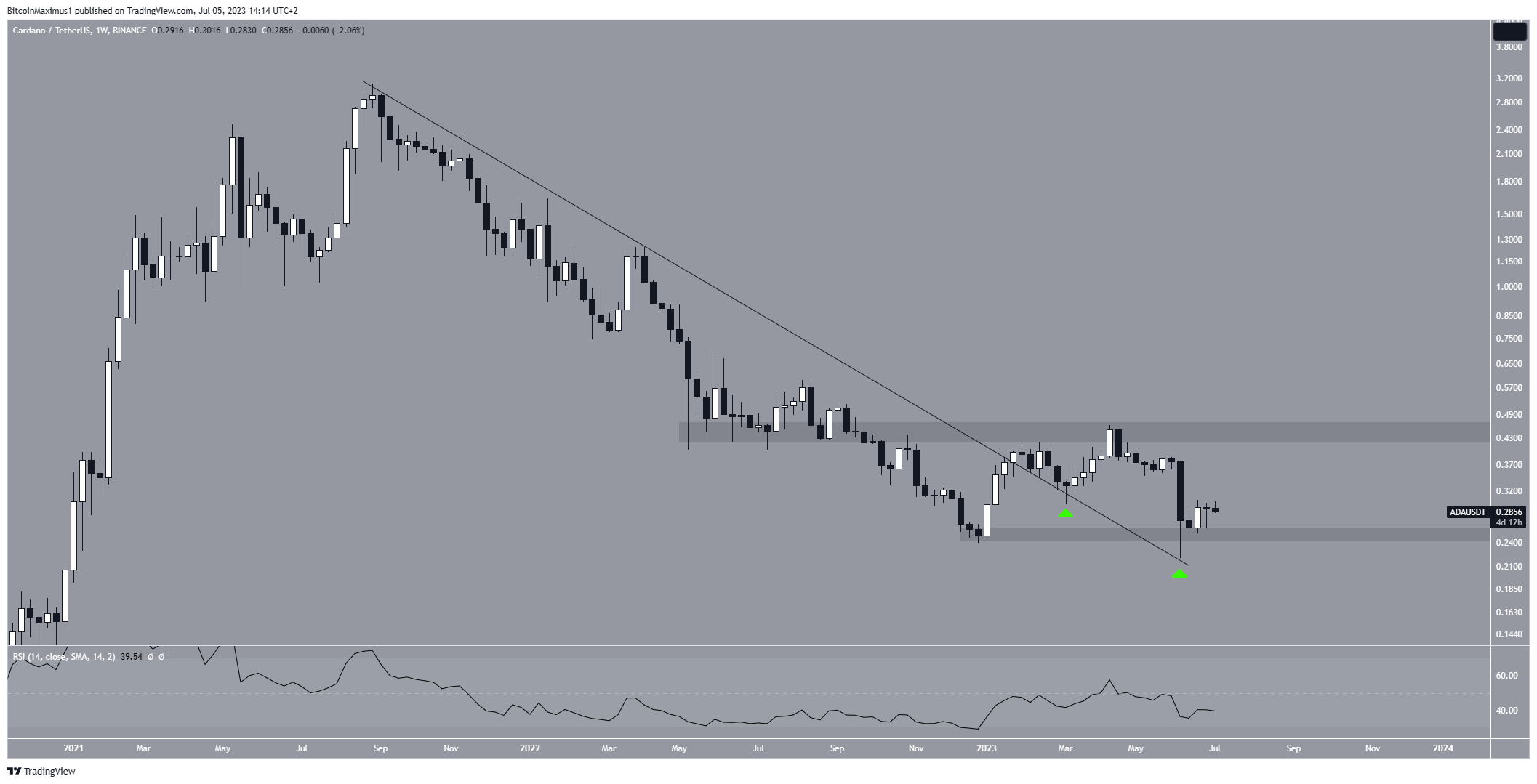

The ADA technical analysis for the weekly time frame shows that the ADA price broke out from a long-term descending resistance line at the beginning of January. Before the breakout, the line had been in place for over a year. So, a breakout from it was expected to lead to a significant upward movement.

However, this was not the case. After the breakout, the ADA Price returned to the descending resistance line twice, validating it as support both times (green icon).

The most recent validation occurred on June 15 and also coincided with a bounce at the $0.25 horizontal support area. The ADA price now trades slightly above this horizontal support area.

The weekly RSI gives an undetermined reading. When evaluating market conditions, traders use the RSI as a momentum indicator to determine if a market is overbought or oversold and to decide whether to accumulate or sell an asset.

If the RSI reading is above 50 and the trend is upward, bulls still have an advantage, but if the reading is below 50, the opposite is true.

Even though the RSI is increasing, it is still below 50. This is a sign of an undetermined trend.

Read More: Best Upcoming Airdrops in 2023

ADA Price Prediction: Wave Count Shows Weakness

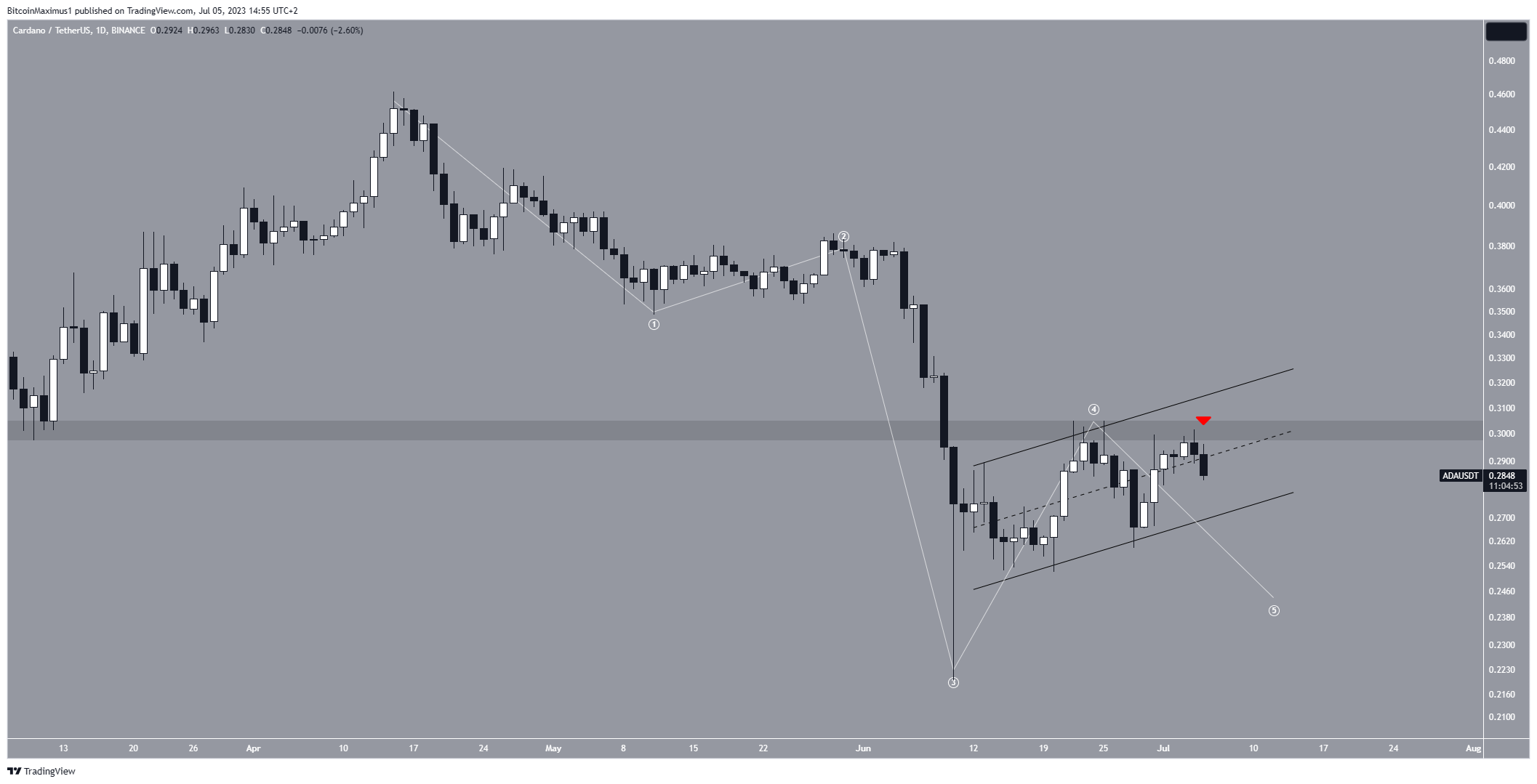

A closer look at the daily timeframe price action and wave count indicates a negative outlook for the ADA price.

Firstly, the price action gives two bearish signs. The first one is that the $0.30 horizontal resistance area rejected the price, while the second one is that ADA is trading inside an ascending parallel channel.

The ascending parallel channel is considered a bearish pattern, meaning that it usually leads to breakdowns.

Next, the Elliott Wave supports a breakdown. The Elliott Wave theory involves studying repetitive long-term price patterns and investor psychology to determine the trend’s direction.

Based on the count, it appears that the ADA price is completing its fifth and final wave of a downward movement (represented in white), indicating a likelihood of new lows.

However, due to the extreme extension of the third wave, the fifth one may end near $0.25, becoming truncated as a result. The low likely coincides with the previously outlined long-term horizontal support at $0.25.

Despite this bearish ADA price prediction, a close above the $0.30 resistance area will mean that the trend is still bullish. The ADA price can quickly increase to the next resistance at $0.40 in that case.

More From BeInCrypto: 9 Best AI Crypto Trading Bots to Maximize Your Profits

For BeInCrypto’s latest crypto market analysis, click here.