AAVE price recently attempted to breach the $167 resistance level but faced a sharp correction shortly after. However, recent developments, particularly the launch of Grayscale’s AAVE Trust, have created optimism for the token’s future price movement.

This renewed bullish sentiment could potentially spark a significant rally for AAVE, leading investors to question whether a 33% surge is on the horizon.

AAVE Rally Relies on Key Factors

The investors’ activity around AAVE suggests growing confidence in the altcoin’s potential recovery. Over the last three days, addresses holding between 1,000 and 10,000 AAVE have accumulated more than 40,000 AAVE, valued at $6 million. This significant purchase activity from large holders indicates that they are capitalizing on the current low price, positioning themselves for a potential price rise.

Historically, when this cohort accumulates in large quantities, it often precedes upward price movement. This accumulation signals that institutional investors and larger market players expect bullish momentum to continue in the near term.

Read more: How To Use Aave?

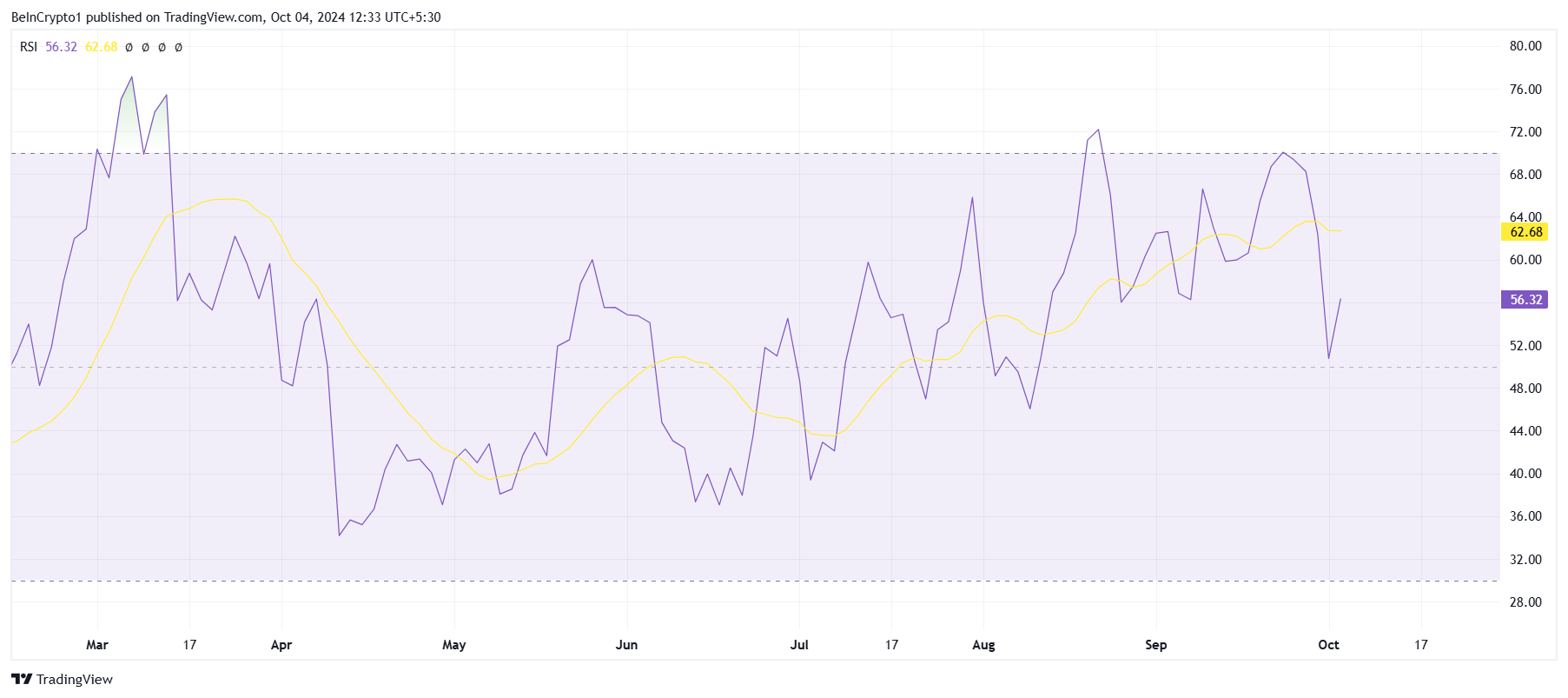

Additionally, the macro momentum for AAVE appears favorable. Technical indicators, such as the Relative Strength Index (RSI), bounced off the neutral line at 50.0, further supporting the possibility of recovery. The launch of Grayscale’s AAVE Trust has also added to this bullish momentum, reinforcing market confidence in the altcoin.

Grayscale’s involvement could play a pivotal role in driving institutional interest, making AAVE more appealing to a broader range of investors. With the RSI reflecting strength and Grayscale providing increased exposure, the current market environment is conducive to a potential rally.

AAVE Price Prediction: Fighting the Resistance

At present, AAVE is trading at $150, having risen 8% today. The altcoin is targeting the immediate resistance at $153, which is a crucial level to breach before making another attempt at $167. This resistance was previously unbroken, but the current market conditions point toward a possible breach in the coming days.

If AAVE successfully flips $167 into support, the next target would be $180. From there, a rise to $200 is plausible, marking a 33% increase and setting an 18-month high for the altcoin. This scenario hinges on sustained bullish momentum and further institutional support.

Read more: Top 11 DeFi Protocols To Keep an Eye on in 2024

However, failure to breach $153 could lead to a downturn, with AAVE potentially falling back to $116, below its local support of $126. This would invalidate the bullish outlook and delay potential profits for investors awaiting a surge.