Aave DAO, Trident Digital, TokenLogic, and on-chain aggregator IntoTheBlock joined hands for the first $100 million fixed yield loan launch.

The fixed-yield loan locks 33,000 Ethereum (ETH) for three months, supported by a non-custodial smart contract from IntoTheBlock’s institutional DeFi solutions. Lenders receive aETH tokens as collateral, guaranteeing a yield that doubles the returns from staking in ETH.

Aave DAO Launches $100M Fixed-Yield Loan

The fixed-yield loan functions as a type of tokenized bond or security with interest payments directly tied to the Aave protocol’s revenue. This setup ensures a fair balance of interests and reduces the chances of “wrong-way risk” associated with traditional structures, where creditors face higher exposure and risk when a debtor’s credit quality declines.

Therefore, it allows investors to participate in a fixed-yield opportunity by supplying capital in the form of ETH and receiving aETH tokens as collateral. aETH is a synthetic derivative asset bridging the currently illiquid Ethereum 2.0 and the regular Ethereum network.

The fixed-yield loan exemplifies how tokenization and blockchain technology can revolutionize the issuance and management of bonds and securities. This tokenization process transforms traditional bonds or securities into digital assets that are tradable securely on blockchain networks.

Read more: How to Use Aave inside Aave V4’s Safer, Faster Lending Solutions

Aave DAO supports this fixed yield, maintaining returns across the loan term using revenues generated by the Aave lending protocol. When the term is over, the smart contract unlocks. This enables lenders to withdraw their initial ETH deposit and the accrued interest, opening up new possibilities for creating and trading tokenized financial instruments in a decentralized and inclusive manner.

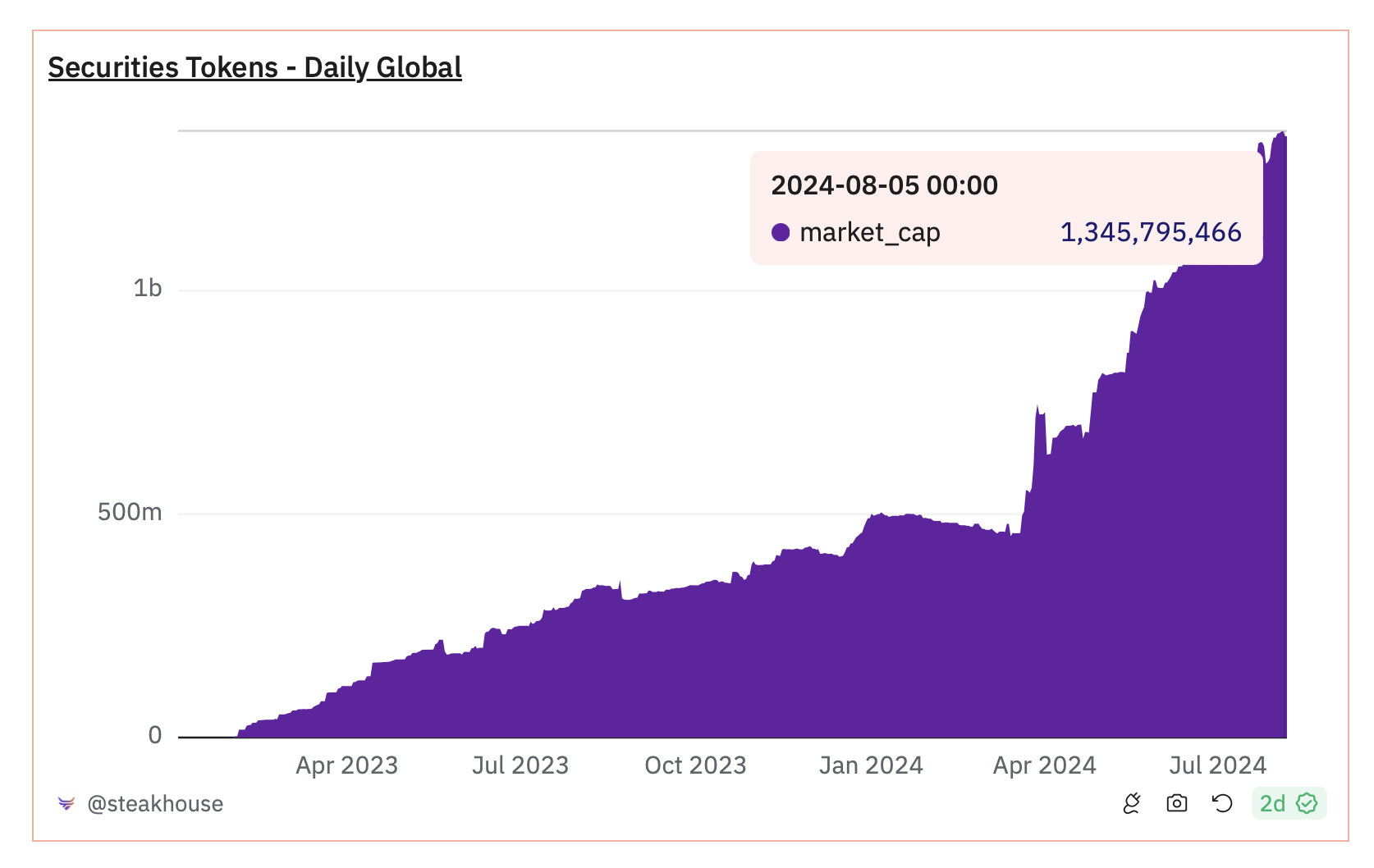

The trend is gaining traction in 2024, attracting industry giants like BlackRock, which paid out $2.1 million in dividends in July. Other notable players in the securities tokenization sector include Ondo Finance and Franklin Templeton. Together, they boast a market capitalization exceeding $1.3 billion.

The launch marks a big step for the Aave DAO, implementing a model of Aave v3 to support ETH-correlated assets. It aligns with the broader initiative to promote Liquid Restaking Tokens (LRTs) on Mellow Finance’s Symbiotic restaking protocol alongside Lido DAO.

Restaking Solution for Traditional Challenges in On-Chain Bonds

Traditional challenges regarding term debt access affect the industry’s progress. Due to their volatility and illiquidity, efforts to use governance tokens as collateral in establishing on-chain “bonds” remain obstructed. The structures disproportionately favored borrowers, exposing lenders to serious risks without commensurate rewards.

Against this backdrop, restaking has become one of the most interesting crypto narratives in 2024. Data on Dune shows that 27.86% of ETH supply is staked. It also shows a steady increase in staked ETH (stETH), reaching over 34 million, and validators going above one million.

A recent report from CoinGecko noted that EigenLayer’s restaking contributed to the Ethereum ecosystem’s achievement in Q1 2024.

Read more: Ethereum Restaking: What Is It And How Does It Work?

BeInCrypto also covered Symbiotic’s debut in mid-June, which aims to offer flexible, permissionless restaking options. The launch followed a $5.8 million funding round from Paradigm and Cyber Fund. The new project poses a significant challenge to EigenLayer, a major player in the Ethereum restaking sector.

These developments signal a new era of possibilities in the digital asset industry, demonstrating continued innovation. It also sets a new standard for secure, balanced, mutually beneficial financial products in decentralized finance.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.