Breaking It Down

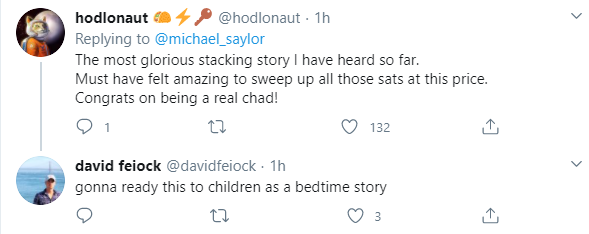

Saylor has outlined the blueprint for the transactions in a tweet, tipping his hand to the corporate strategy and cementing his new reputation as a bitcoin bull — if there was any doubt. The way the company acquired its latest round of an eye-popping 16,796 BTC that it announced on Sept. 14 was to trade nonstop for more than three days straight. They were buying approximately 0.19 BTC every three seconds, which amounts to nearly $40,000 in bitcoin per minute. Being the opportunistic traders that they are, the MicroStrategy team was prepared to buy $30 million-$50 million in BTC within a few seconds if the price went on sale.Crypto Twitter cheered as MicroStrategy was stacking sats. Based on his recent interview on Anthony Pompliano’s podcast, Saylor appears to be a bitcoin maximalist whose intentions are to keep the bitcoin community accountable for “[defending] the network to the death against someone who is going to break it or compromise it in any shape or form.” He may be watching what’s going on in the DeFi space and smart contracts, but he is putting his money where his mouth is in bitcoin.To acquire 16,796 BTC (disclosed 9/14/20), we traded continuously 74 hours, executing 88,617 trades ~0.19 BTC each 3 seconds. ~$39,414 in BTC per minute, but at all times we were ready to purchase $30-50 million in a few seconds if we got lucky with a 1-2% downward spike.

— Michael Saylor⚡️ (@saylor) September 18, 2020

Year of the Bitcoin

MicroStrategy has chosen a good time to be a crypto investor. Bitcoin has been a top-performing asset this year so far, having left both gold and the S&P 500 index in the dust with its 57% gains. If some bitcoin price predictions are right, there is still a great deal of runway left for gains in the short-term.#Bitcoin Performance in 2020

— ecoinometrics (@ecoinometrics) September 18, 2020

Sep. 17, 2020

Year to date

BTC +57.7% 🔥🔥🔥🚀

Gold +27.7%

SP500 +2.77% pic.twitter.com/NFNwC7ghbh

If Woo is right, 2021 could be an interesting year as companies get the wheels turning to capture their share of the bitcoin market.This may sound delusional at this point but I still think we hit a new 🔥All Time High🔥 (ATH) for #Bitcoin on or before October 31st, 2020.#BTC currently at $10,453.31 USD.

— Jason A. Williams (@GoingParabolic) September 14, 2020

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.