Earnings are estimated to be down 30%, yet stocks are hitting ATHs.

— Dan Morehead (@dan_pantera) September 16, 2020

Prices – as quoted in fiat money – are not rising because stock fundamentals have improved. They are rising because a huge wave of money is being printed.

https://t.co/MAjZpnQLgM

Morehead: “Buy Bitcoin

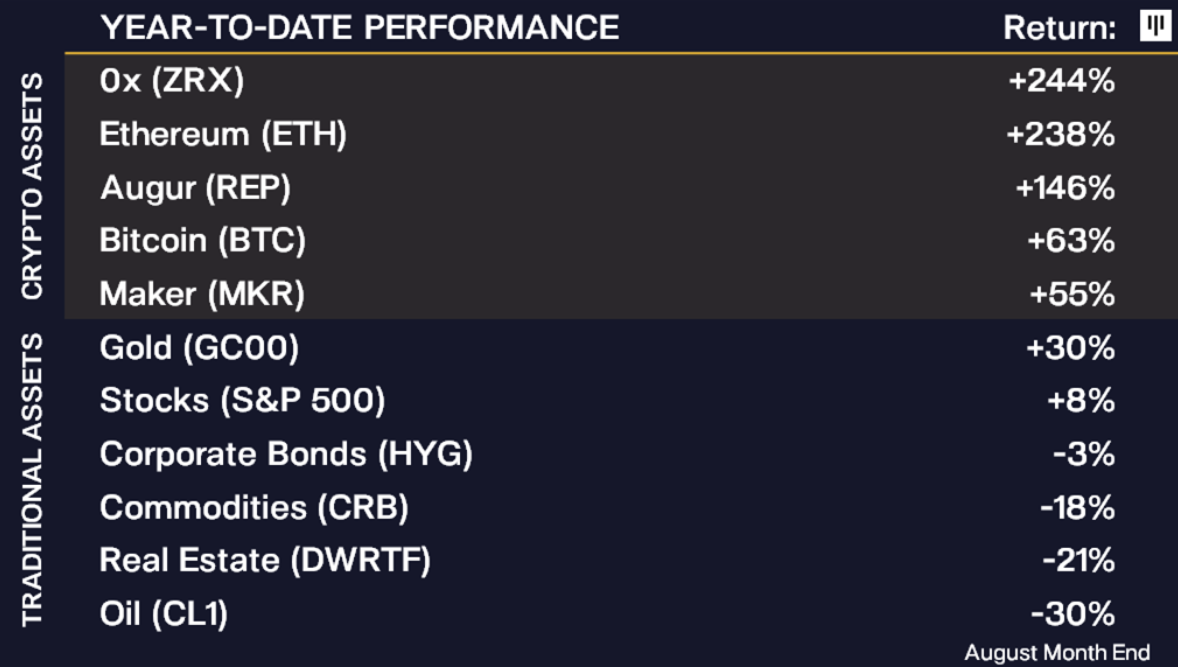

Pantera’s Morehead offered a piece of advice in response to Chairman Powell’s monetary policy, saying,“#buybitcoin”He went on to illustrate how hard assets like gold have been on a tear this year, unscathed by the fallout from the pandemic and taking an accelerated path higher. But it has been cryptocurrencies that have outperformed most other assets year-to-date, as features like scarcity shine in a post-pandemic world.

‘Early Stages of a Large Bull Market’

Not only does Pantera Capital think that bitcoin is in a bull market, but they believe it is going to be one for the ages and that it is only getting started. Morehead said,“We strongly believe we are in the early stages of a large bull market fueled by both a powerful global macro tide and growing fundamentals in the underlying technology.”

Morehead is a Tiger Management alum who has been in the markets for more than three decades. He has witnessed a trio of major price cycles in the eight years that he’s been in crypto and is relying on that experience plus his own instinct to predict where bitcoin is now, saying:

Morehead is a Tiger Management alum who has been in the markets for more than three decades. He has witnessed a trio of major price cycles in the eight years that he’s been in crypto and is relying on that experience plus his own instinct to predict where bitcoin is now, saying:

“Even with that, it’s still a massive hype cycle roller coaster. My intuition from trading waves for 35 years is we’re in for another one.”Pantera is doing something right. The firm’s bitcoin fund is up 61% year-to-date, while its ICO fund has ballooned by more than 300%.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.