Whenever someone makes a deposit or withdraws from a yEarn Vault, the smart contracts reallocates capital held in the Vault into the highest yielding opportunity. Ryan Sean Adams expands on this process here, in his latest Bankless newsletter.

At the time of press, the curve.fi/y liquidity provider vault which farms the CurveDAO CRV tokens was the best-earning strategy. The returns when the guide was written were a whopping 91% APY on that particular vault. The second-best earning vault was Dai with 58%, followed by TUSD at 40%, though these rates are dynamic.

YFI prices spiked to $12,000 on the FTX exchange during late trading hours on Tuesday. For a brief moment, one YFI was worth more than one BTC.

Whenever someone makes a deposit or withdraws from a yEarn Vault, the smart contracts reallocates capital held in the Vault into the highest yielding opportunity. Ryan Sean Adams expands on this process here, in his latest Bankless newsletter.

At the time of press, the curve.fi/y liquidity provider vault which farms the CurveDAO CRV tokens was the best-earning strategy. The returns when the guide was written were a whopping 91% APY on that particular vault. The second-best earning vault was Dai with 58%, followed by TUSD at 40%, though these rates are dynamic.

YFI prices spiked to $12,000 on the FTX exchange during late trading hours on Tuesday. For a brief moment, one YFI was worth more than one BTC.

As has often been the case with DeFi, the whales with the most liquidity will have benefitted the most. As former dev advocate at OpenZeppelin, Dennison Bertram [@DennisonBertram], pointed out:YFI now over $10k – I would like to thank my mum for giving birth to me so that I could experience this euphoric moment pic.twitter.com/8XDNlhJP4o

— sassal.eth/acc 🦇🔊 (@sassal0x) August 18, 2020

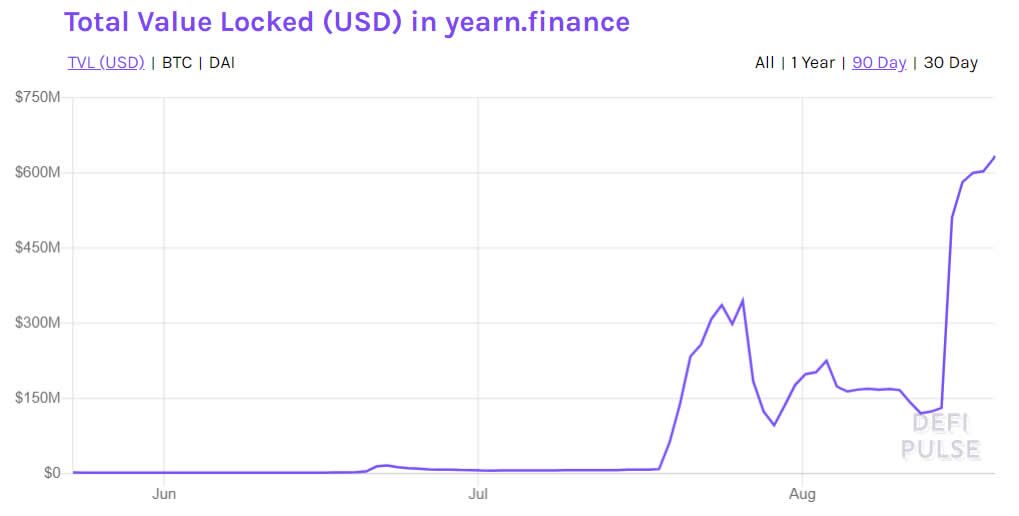

I don’t think it turned too many people into millionaires if any to be honest. There was almost never enough supply available, and the folks who were able to “yearn” enough of them, did so via providing millions in liquidity…In terms of liquidity, TVL on the platform has also reached an all-time high of $635 million according to DeFi Pulse.

As reported by BeInCrypto on Tuesday, the platform has released the details of three new tokenized insurance pools for liquidity providers. The Yinsure.Finance system will be comprised of three core components; Insurer Vaults, Insured Vaults, and Claim Governance.https://t.co/Tm4Su0BzFk stats

— yearn (@yearnfi) August 19, 2020

-Yearn-

DAI 7.06%

USDC 10.96%

USDT 5.51%

TUSD 3.25%

sUSD 48.84%

BUSD 2.18%https://t.co/15ymmpD1Xy 9.8%https://t.co/jQtziUlEsg 18.07%

-Vaults-

yTUSD 10.72%

yDAI 56.56%

yUSDT 36.92%

yUSDC 36.43%

yCRV 157.15%

-TVL-

$738,564,213

-Treasury-

$329,981 pic.twitter.com/1rxZK9IJgx

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.