The Bitcoin dominance rate (BTCD) has broken down from a long-term rising support line. Unless it successfully reclaims the 66.5% resistance area, the trend remains bearish.

Double Bottom

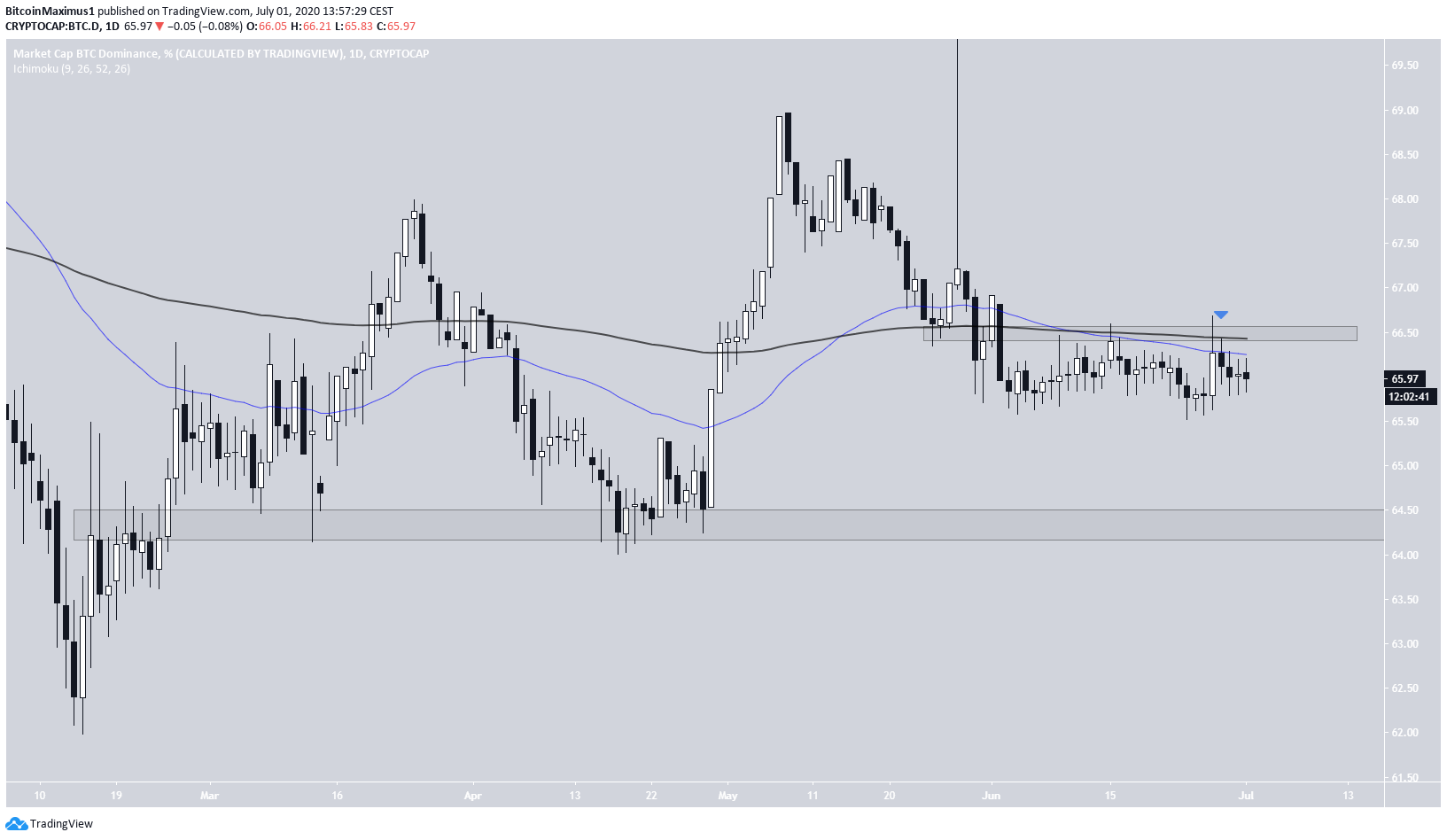

The Bitcoin dominance rate has been gradually increasing since June 24. The rate of increase accelerated on June 27, reaching a high of 66.49%. However, the price has been decreasing since, following a descending resistance line. However, it has created a double bottom pattern at 66%, the 0.619 Fib level of the entire upward move. While this is widely considered to be a bullish reversal pattern, there is no bullish divergence on the RSI to suggest a reversal. A breakdown from this support level could take the rate all the way to the beginning of the upward move at 65.7%. Given that the descending resistance line and support area will soon coincide with each other, the direction of the trend should be revealed shortly.

Long-Term Movement

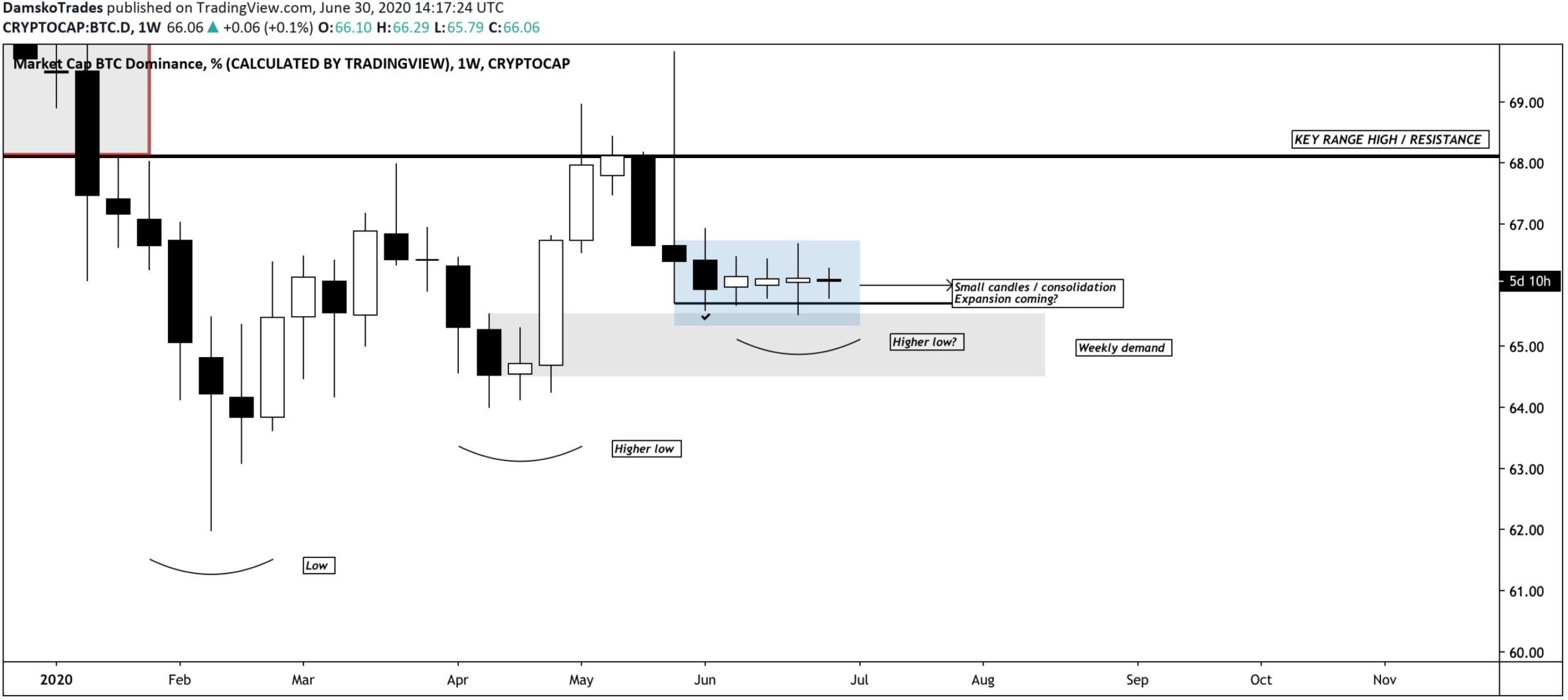

Cryptocurrency trader @Damskotrades tweeted a long-term chart for BTCD, stating that he believes it will increase and that altcoins will bleed.Let’s move on to Bitcoin Dominance. – Weekly demand – Consolidation /side ways – Higher low zone Bitcoin dominance at Weekly support while forming higher lows. Bad spot to step in Altcoin longs.

Relationship to Bitcoin

The relationship between the Bitcoin dominance rate and the price of Bitcoin has been unclear since the beginning of June. Observe the price of BTC (blue) placed side-by-side with the BTCD (candlesticks) in the image below. The white shading represents a positive relationship, meaning a BTC increase causes an increase in BTCD. The opposite is true for the black shading. The relationship between them has mostly been positive. However, there have been two periods of around four days, the second of which is ongoing, in which BTC declines caused an increase in BTCD.

This is particularly evident during sharp BTC price drops, which have caused an equally sharp increase in BTCD.

Therefore, if the BTC price were to drop, we would expect altcoins to drop at an accelerated rate, causing an increase in BTCD.

The relationship between them has mostly been positive. However, there have been two periods of around four days, the second of which is ongoing, in which BTC declines caused an increase in BTCD.

This is particularly evident during sharp BTC price drops, which have caused an equally sharp increase in BTCD.

Therefore, if the BTC price were to drop, we would expect altcoins to drop at an accelerated rate, causing an increase in BTCD.

Top crypto platforms in the US

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored