Cryptocurrency exchanges like Coinbase could see a fresh round of Bitcoin buying as US officials ponder another distribution of stimulus checks to those affected by the ongoing COVID-19 pandemic.

In the wake of the first payments sent to Americans, some platforms reported a surge in equivalent BTC purchases.

Stacking Sats From Stimulus Payments

Earlier in April, U.S. cryptocurrency exchange Coinbase reported a spike in Bitcoin buying valued at $1,200 — the exact amount sent by the government in its coronavirus stimulus package payments. The trend pointed to a significant number of Americans using the aid funds to ‘stack sats.’ White House officials are still considering another round of stimulus checks to Americans. Senior economic adviser to President Trump, Kevin Hasset, told reporters on April 29, that the administration’s focus at this time is to aid affected Americans in paying bills and buying essential supplies. Given the economic disruptions caused by COVID-19 and the response by the Federal Reserve to enter into a money-printing overdrive, savvy investors might be incentivized to plug the new checks (if they come), into Bitcoin.

The first round of stimulus payments has not been without its problems. While Americans with direct deposits with the Internal Revenue Service (IRS) began receiving their check since mid-April, mail deliveries only kicked off on Friday (April 24, 2020).

Given the economic disruptions caused by COVID-19 and the response by the Federal Reserve to enter into a money-printing overdrive, savvy investors might be incentivized to plug the new checks (if they come), into Bitcoin.

The first round of stimulus payments has not been without its problems. While Americans with direct deposits with the Internal Revenue Service (IRS) began receiving their check since mid-April, mail deliveries only kicked off on Friday (April 24, 2020).

Bitcoin Buying Ramps up as Halving Looms

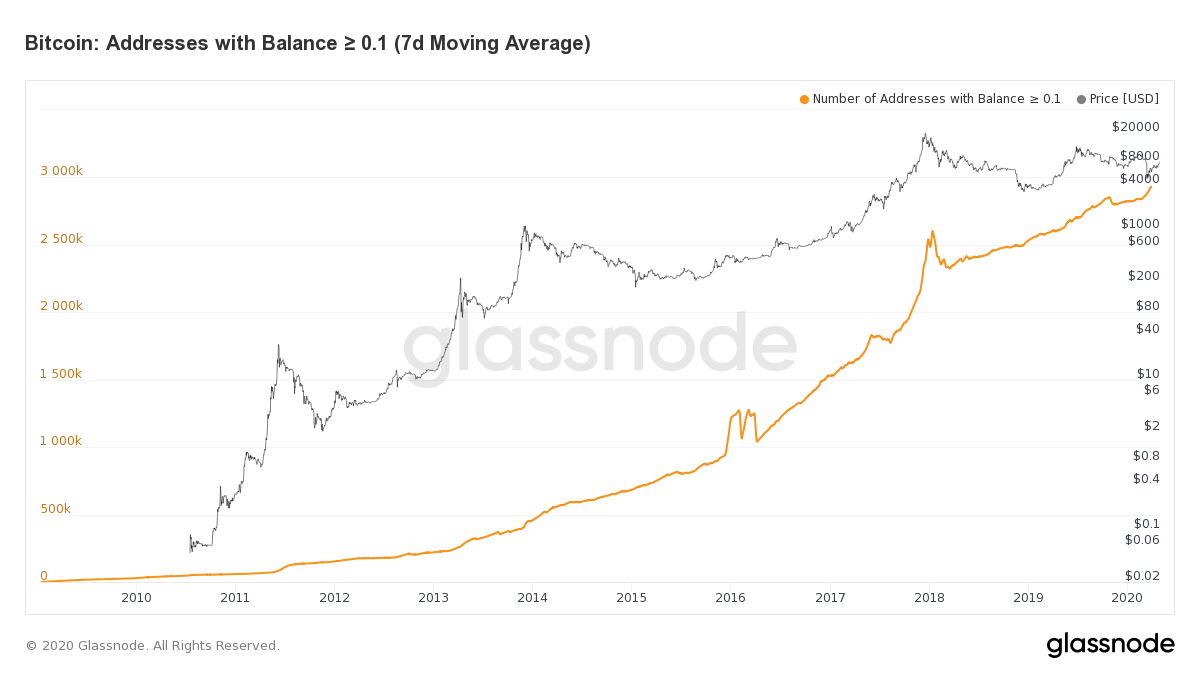

Given the political wrangling that accompanied the previous stimulus package, negotiations on both sides of the aisle might see the new aid package not arriving until after the mid-May Bitcoin halving. However, several trends show that Bitcoin buying is on the rise as BTC hodlers are stacking sats in preparation for the event. According to the crypto analytics platform Glassnode, the number of Bitcoin addresses with at least 0.1 BTC is at an all-time high of more than 3 million. While the number of addresses does not equate to the number of unique owners, anecdotal evidence suggests that retail Bitcoin buying is on the rise as the halving approaches.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Osato Avan-Nomayo

Osato is a reporter at BeInCrypto and Bitcoin believer based in Lagos, Nigeria. When not immersed in the daily happenings in the crypto scene, he can be found watching historical documentaries or trying to beat his Scrabble high score.

Osato is a reporter at BeInCrypto and Bitcoin believer based in Lagos, Nigeria. When not immersed in the daily happenings in the crypto scene, he can be found watching historical documentaries or trying to beat his Scrabble high score.

READ FULL BIO

Sponsored

Sponsored