Bitcoin’s hashrate has fallen significantly amid the global pandemic. Some mining pools seem to be capitulating at current prices.

Bitcoin’s hashrate is usually seen as a way to assess the health of the network. Although it is not the perfect indicator, it does tell us a lot about how ‘secure’ the network is. This metric has fallen in the past few days.

Bitcoin’s Hashrate Sees a Rare Decline

BeInCrypto often reports on Bitcoin’s hashrate, which has, historically, consistently ticked upward. However, the recent global crisis has caused Bitcoin’s price to decline drastically – and that’s bad news for Bitcoin’s network health, it seems. Skew (@skewdotcom) is reporting that Bitcoin’s hashrate has fallen some 40% this month. Usually, the months leading up to a halving event should produce the opposite effect. However, given the exceptional macroeconomic factors at play, this has not happened.The trillions of hashes per second (Ehash/s) is now under 100 for the first time since January 2020. Although the 40% drop is drastic, it still puts us at the same hashrate seen just a month or two ago. So, this is no reason to panic or believe that Bitcoin’s network is faltering. However, the hashrate is not the only way to gauge the health of the network. China still owns the vast majority of mining power for Bitcoin, which is a liability in and of itself. Other miners have stepped in to try to compete, but not much has changed.Worth monitoring Bitcoin's hash rate as we approach halving and spot has retraced 40% this month. Back < 100 Ehash/s

— skew (@skewdotcom) March 17, 2020

source: @bitinfocharts pic.twitter.com/8HUkddozyG

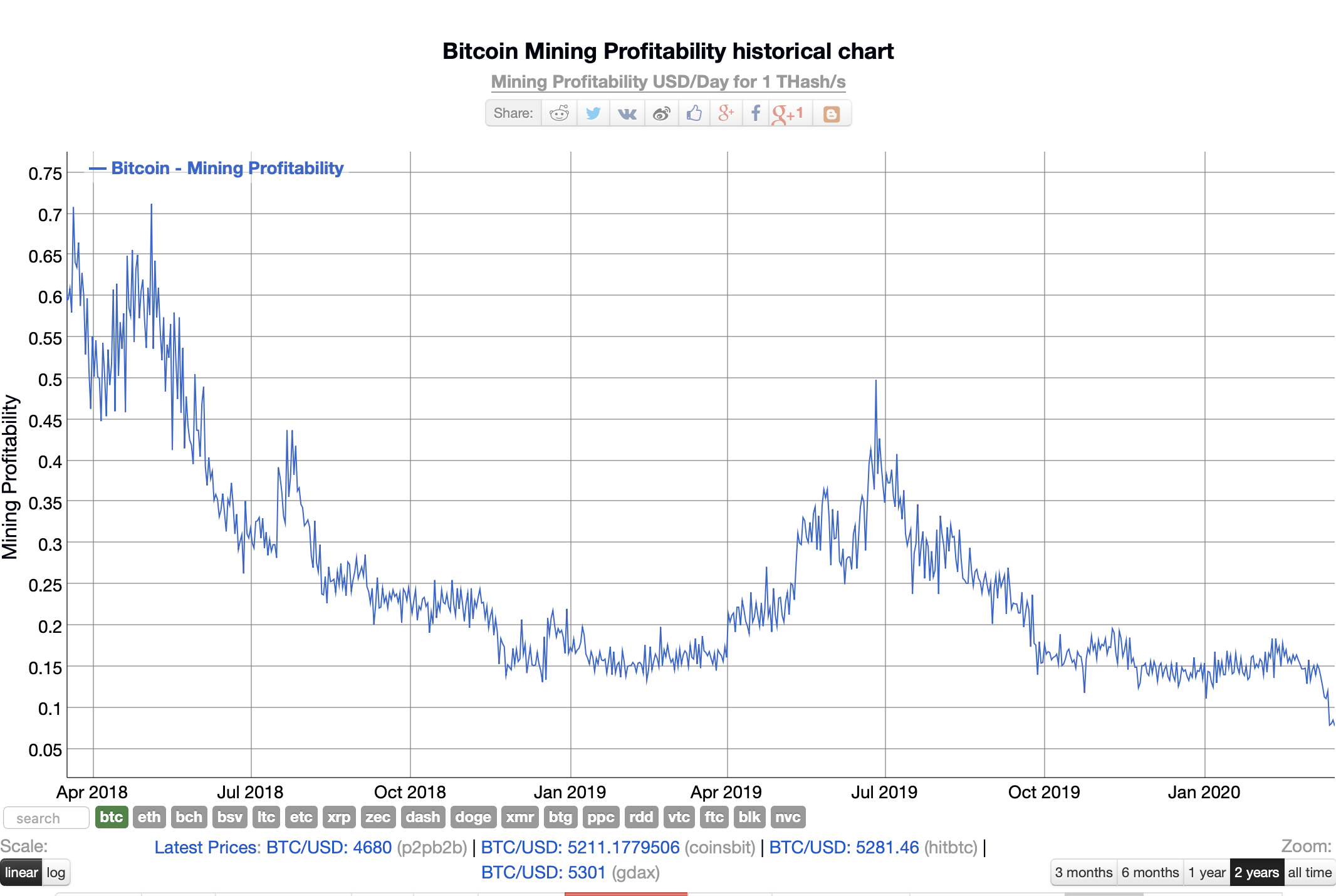

Mining Profitability Declines

Another metric that has taken a hit given the recent price collapse for Bitcoin is mining profitability. According to BitInfoCharts, the amount of USD per day earned by miners has plummeted since the start of this month. The drastic drop is shown below. That puts Bitcoin’s current mining profitability at levels not seen in years. Many miners will likely be forced to capitulate if current prices continue, bringing Bitcoin into uncharted territory. With the halving coming up, miners will see their rewards further cut by half – which may mean that many are selling off their mining rewards now in fear of what’s to come.

For now, the short-term future is uncertain. However, Bitcoin’s network health still remains strong, for now.

That puts Bitcoin’s current mining profitability at levels not seen in years. Many miners will likely be forced to capitulate if current prices continue, bringing Bitcoin into uncharted territory. With the halving coming up, miners will see their rewards further cut by half – which may mean that many are selling off their mining rewards now in fear of what’s to come.

For now, the short-term future is uncertain. However, Bitcoin’s network health still remains strong, for now.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Advertorial

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

READ FULL BIO

Sponsored

Sponsored