Mantle (MNT) rallied over 12% in just a few hours, powered by growing network activity and a surge in stablecoin liquidity. But after closing in on a key resistance zone near $1.12, the Mantle price rally seems to be cooling.

Short-term momentum is fading, and price action risks turning sideways. Still, on-chain data shows buyers aren’t done yet; at least not until one key signal flips.

Buyers Stay in Control as Net Flows Remain Negative

Despite the recent pause in MNT’s rally, net exchange flows have stayed negative since launch. That means more MNT tokens are leaving exchanges than entering, a strong sign that traders are still choosing to hold rather than sell. This trend has remained intact even after the recent +12% surge, showing that retail conviction hasn’t faded.

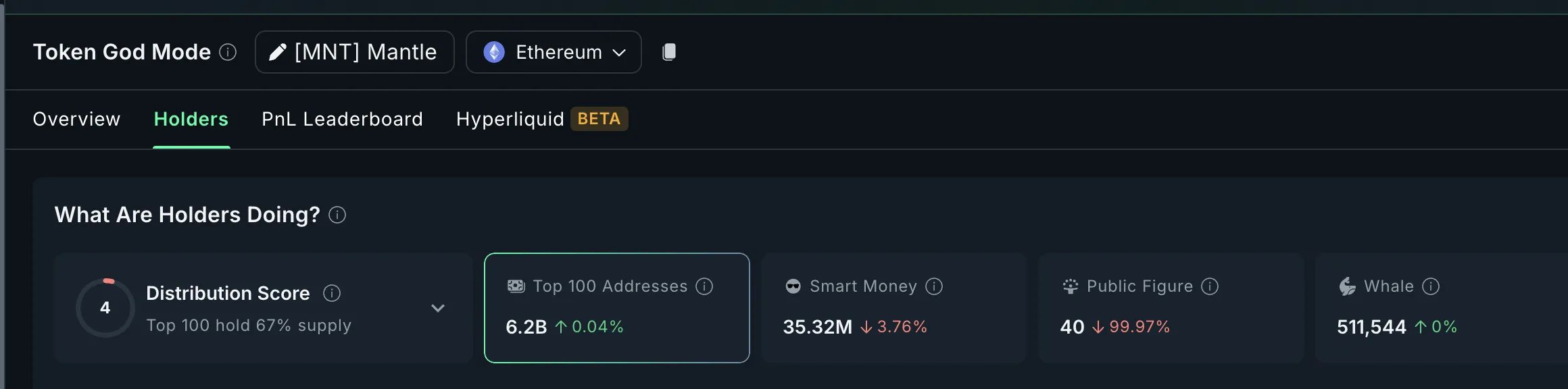

However, smart money wallets have shown signs of caution. Over the past 7 days, they dropped 1.33 million MNT, trimming holdings by 3.76%, according to Nansen.

In contrast, the top 100 addresses added 2.48 million MNT. This move suggests that larger holders are still confident despite some short-term Smart Money-led profit-taking.

This split sets the stage for consolidation. If smart money continues to trim and exchange outflows persist, we may see sideways action rather than a sharp correction. However, if profit-taking takes center stage with increased inflows, all while smart money continues to trim, a deeper dip could be on the cards.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Mantle Price Rallies, But Momentum Flashes Caution

The Mantle (MNT) price has seen a few local tops in recent weeks, each aligning with a spike in the Williams %R oscillator, a momentum indicator that helps identify when an asset becomes overbought (reading near 0) or oversold (near -100).

On July 27, Williams %R hit around -12, indicating strong overbought conditions. The MNT price dropped sharply in the following sessions.

Between August 4-5, the Mantle price rallied to above $0.94 (local top). The Williams %R formed a local top here as well. That top was lower than the one experienced on July 27. This meant that MNT entered a sideways phase shortly after, not a corrective phase.

Now, after the latest rally on August 7, Williams %R is back near the levels touched on July 27. This creates a familiar setup; similar readings have preceded sharper corrections.

Williams %R is a fast-reacting momentum indicator that spots short-term overbought or oversold levels. Unlike RSI, it responds quicker to local tops, making it ideal for tracking sudden rallies like Mantle’s.

If this pattern repeats, MNT could revisit $0.94 or $0.84 before its next major move. However, if profit-taking kicks in, and netflows flip positive (indicating tokens moving to exchanges), the pullback could be steeper. A break under $0.67 invalidates the bullish structure.

While the broader market sentiment is still bullish, these momentum shifts hint that MNT might need to cool off, at least temporarily, before making another attempt at a sustained breakout above $1.12.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.