After a strong 26% gain over the past week, Pudgy Penguins (PENGU) is now hovering just below a crucial resistance level.

While much of the altcoin market cools down, PENGU price looks poised to break out. Only if it can push past one key wall. A deeper look at bullish strength, liquidations, and price charts shows the token might still have room to run.

PENGU Bulls Are In Complete Control

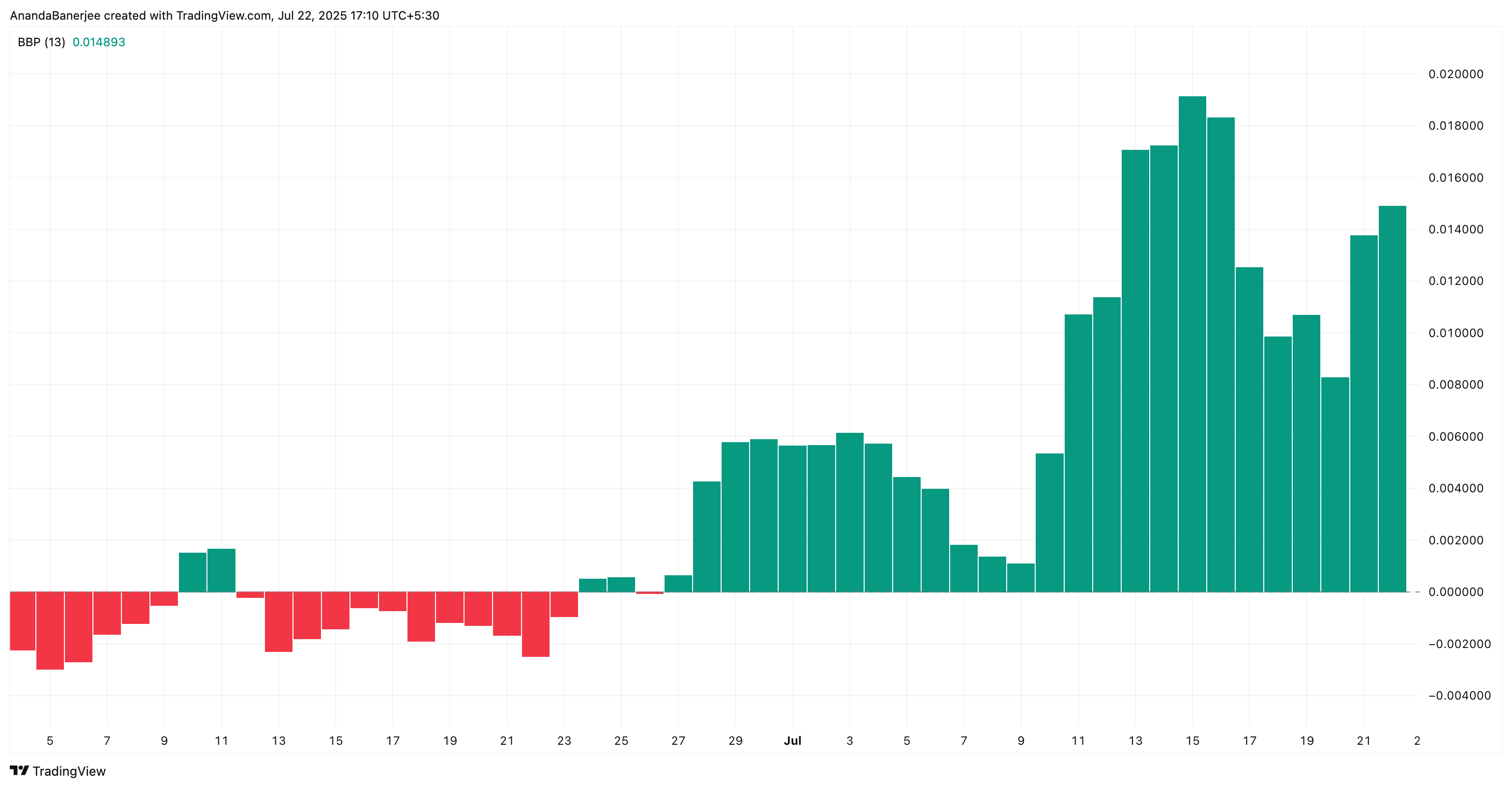

Even though PENGU dropped around 2% in the past 24 hours, the bulls still seem to be holding the reins. The Bull-Bear Power (BBP) index, which compares recent highs and lows to measure market strength, is currently flashing green, at around 0.0148. This level suggests buyers still have the upper hand, despite a short-term dip.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

In simple terms, when BBP is positive, bulls are stronger than bears. And Pengu’s BBP has remained above zero since late June, even as prices hovered below key resistance. That steady strength could be a sign that any dip is just part of a cooldown before another leg up.

If BBP stays positive while price climbs past resistance, it might confirm that PENGU still has momentum. But if BBP flips negative, it could warn of a deeper pullback ahead.

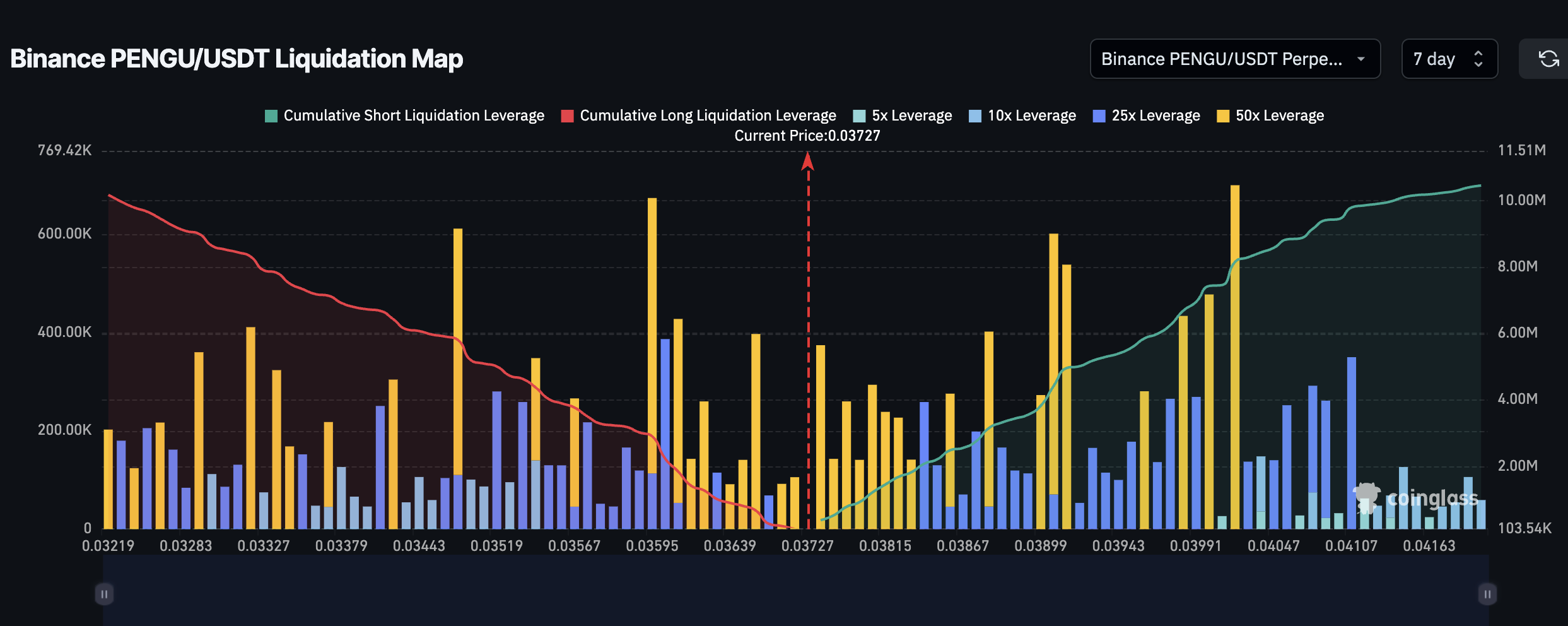

7-Day Liquidation Map Shows Short-Biased Setup

PENGU is currently trading around $0.036. The 7-day liquidation map shows cumulative short liquidation leverage building up to $10.46 million versus $10.18 million for longs; a slight bias toward short positions. Do note that there isn’t much to choose between Longs and Shorts, and a price push in either direction can decide the next leg for PENGU.

However, as bulls are in power and that too by a sizable margin, as established by the BBP index, the price action could impact the short positions more than the long.

If the price crosses $0.039, led by bulls breaking key resistance level, and even nears $0.042, a major liquidation cluster of shorts gets triggered. That would reduce downward pressure and potentially propel the PENGU price to the next key price level.

The liquidation map shows a build-up of short positions; if PENGU’s price moves up fast, those betting against it may be forced to buy back, pushing the price even higher.

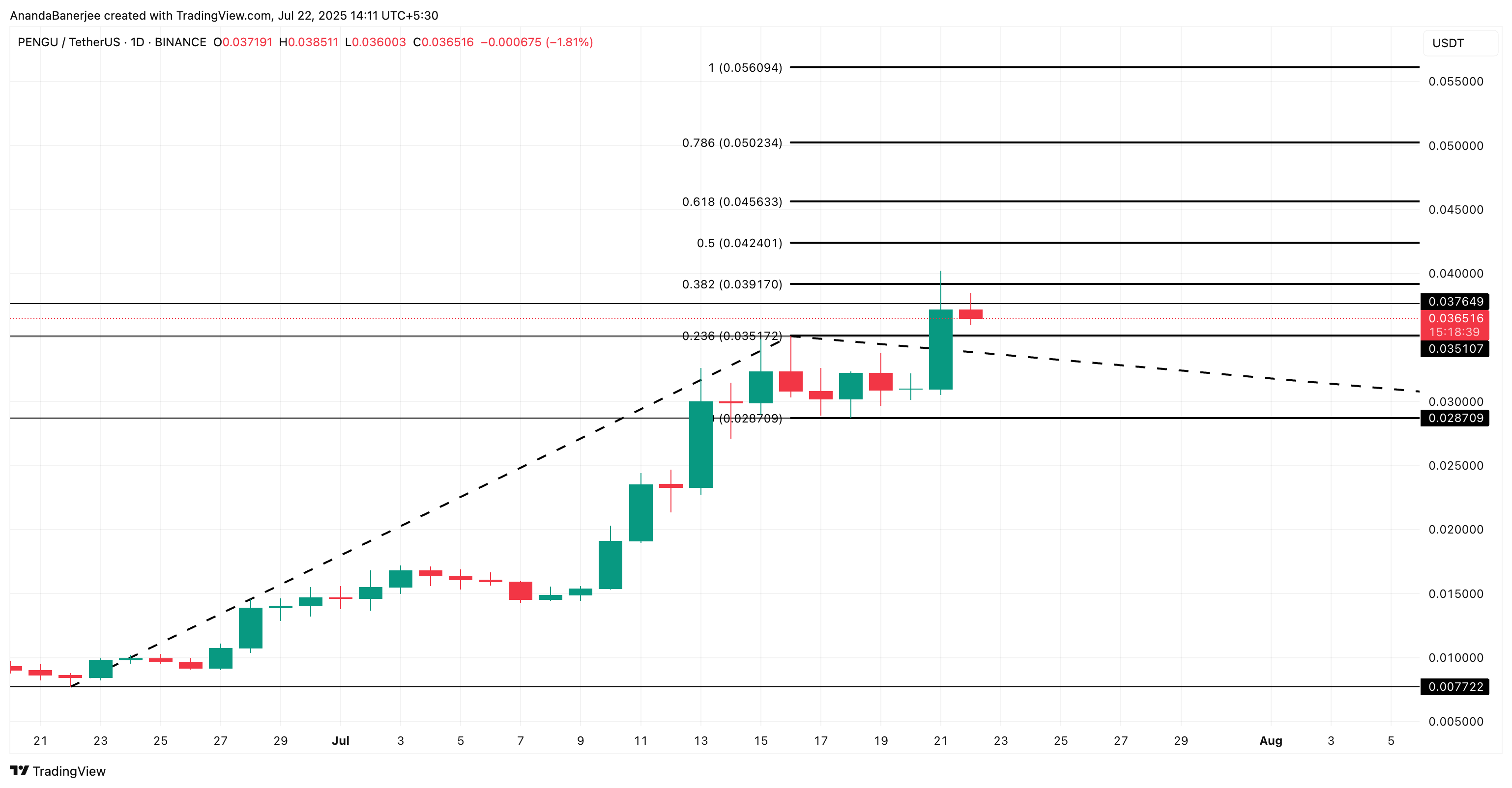

PENGU Price Action Hints at a 38% Upside

Technically, the PENGU price has tested the 0.382 Fibonacci level near $0.039 twice and failed to break above cleanly. It now trades just under that resistance. Do note that besides the Fib extension resistance, a key resistance of $0.037 also exists.

The chart uses the Trend-based Fibonacci extension tool. It connects the swing low of $0.0077 to the last swing high of $0.035 and then to the immediately retraced price level of $0.028. This tool helps chart the next price targets for a coin/token in an uptrend.

If PENGU price manages a clean breakout above $0.037, $0.039, and then $0.042 (the 0.5 Fib zone), it opens the path to $0.045 first, a 25% surge. If that breaks, the next key resistance point, or rather target, would be $0.050, the 0.786 Fibonacci level. That would be a 38% rally from current prices around $0.036.

Validation for this move comes from declining bear power, building short positions, and strong chart structure. The bullish trend would get invalidated if PENGU breaks the $0.035 resistance-turned-support. Or if it continues to drop to touch the retracement zone of the Fibonacci extension: the $0.028 mark.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.