HBAR has seen a notable 12% rise this week, recovering slightly from a significant 25.8% decline in mid-June. Despite this upward movement, the altcoin is still grappling with investor skepticism.

The market remains cautious, and HBAR faces challenges as it tries to regain previous price levels.

HBAR Traders Are Skeptical

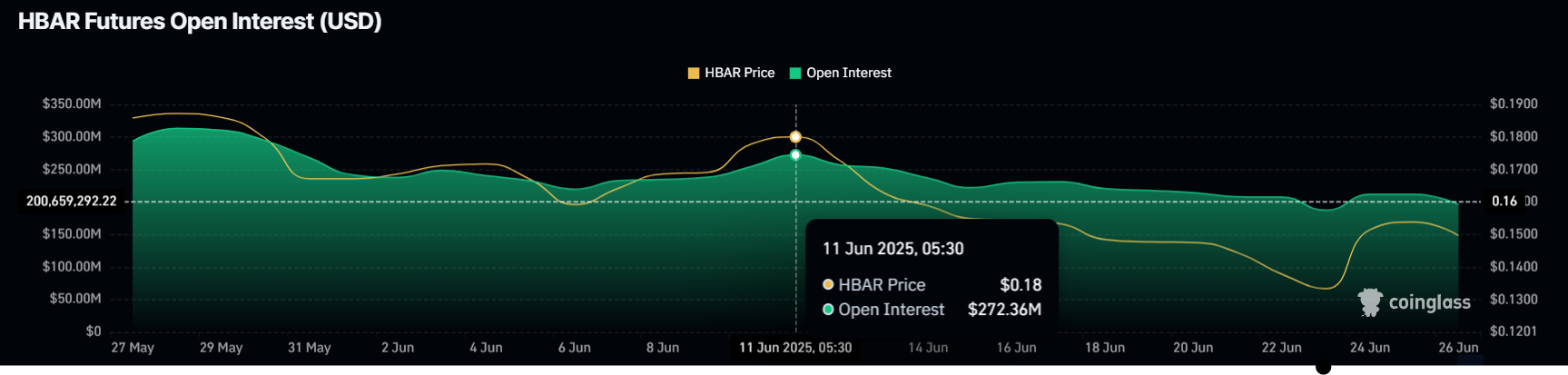

Over the last two weeks, HBAR’s Open Interest (OI) has dropped by nearly $80 million, signaling rising skepticism among traders. Initially triggered by the altcoin’s sharp price decline, the OI drop has continued into this week. The OI has fallen from $272 million to $194 million, suggesting that traders are pulling their funds from HBAR due to ongoing uncertainty in the market.

This decline in Open Interest reflects a lack of confidence, as fewer traders are willing to keep their positions in HBAR. The pullback from investors highlights the caution prevailing in the market, and the decreased OI is adding to the bearish sentiment.

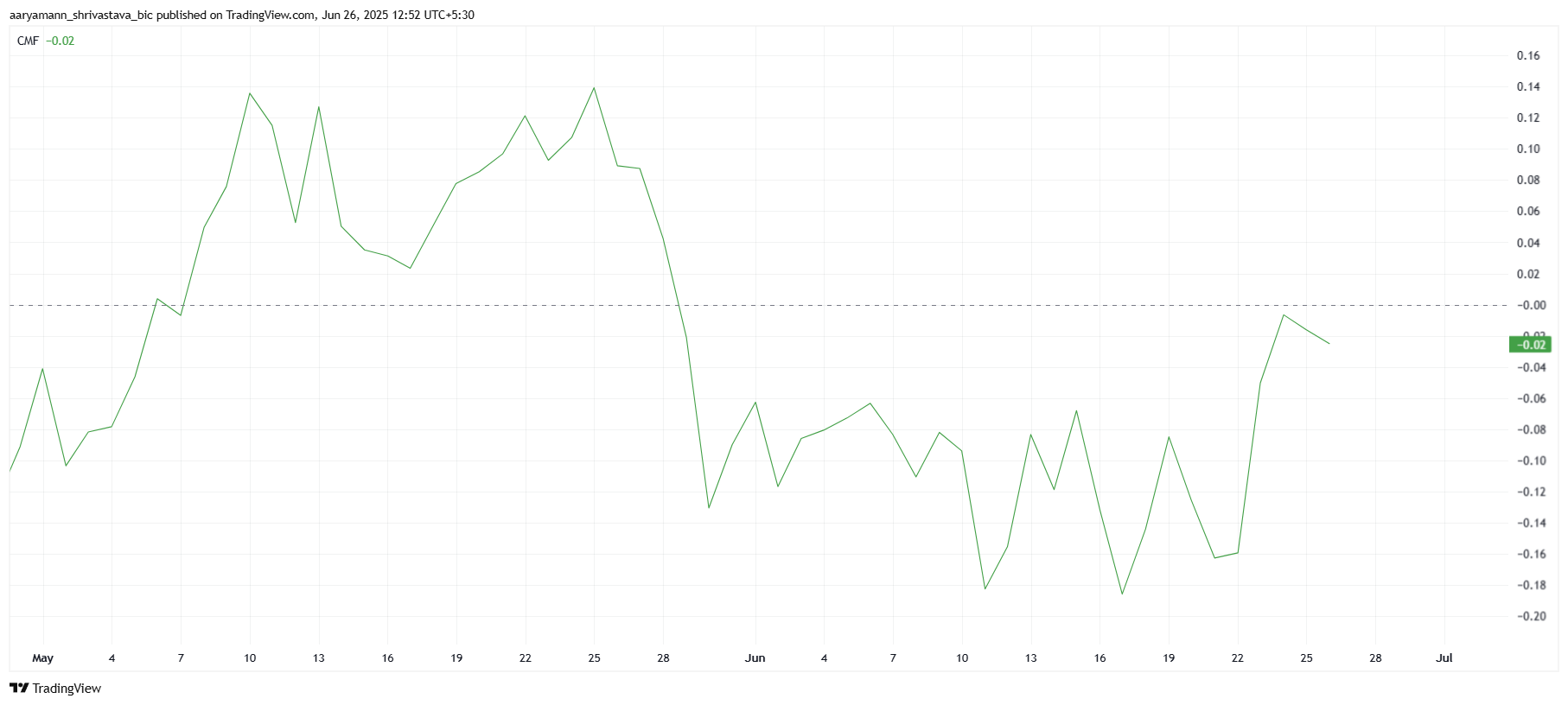

On a broader scale, technical indicators such as the Chaikin Money Flow (CMF) show a sharp spike this week, signaling an increase in inflows. The CMF’s rise suggests that there is renewed interest from investors, but it has not yet flipped the zero line into support.

While the increase in CMF is a positive sign, it is not yet enough to confirm a full market reversal. For HBAR to break its current trend, the CMF would need to cross above the zero line, signaling that buying pressure has fully overtaken selling.

HBAR Price May Not Move Sharply

HBAR is currently trading at $0.149, up nearly 12% this week. The altcoin is approaching the resistance level at $0.154, which will be critical in determining its short-term direction. If HBAR successfully flips this resistance into support, it could establish a strong foundation for further gains.

At the moment, support for HBAR remains mixed, and this uncertainty is likely to result in sideways movement. The altcoin could consolidate between $0.154 and $0.145, lacking the momentum to decisively break either level.

If bullish momentum continues, HBAR could breach $0.154 and flip into support. A successful push above this level would set the stage for a rise toward $0.163. Breaching this resistance would invalidate the current downtrend and also recover a portion of the 25.8% losses sustained earlier in the month, signaling a potential turnaround for HBAR.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.