Solana (SOL) has shown limited price movement recently despite a substantial accumulation of the token. The price has remained relatively stable in May, likely due to the altcoin’s overheating.

While this stagnation is a sign of caution, the market is optimistic, which could lead to potential gains for Solana in the near future.

Solana Investors Continue Accumulation

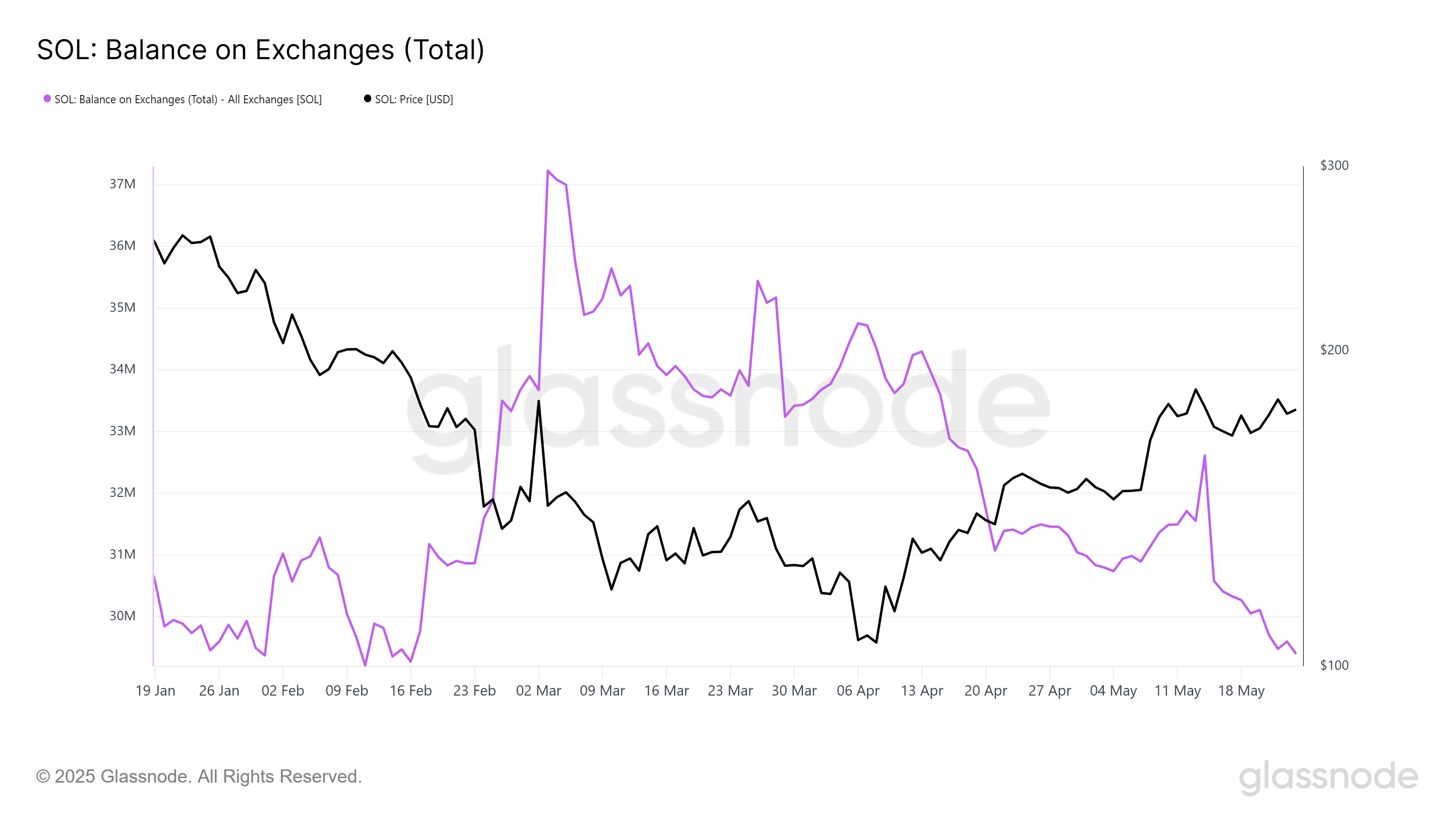

Over the past 10 days, the balance of Solana on exchanges has dropped by 2.2 million SOL, valued at approximately $381 million. This decline in supply indicates that investors have been accumulating Solana during this period.

The ongoing accumulation is likely driven by a mix of factors, including the broader bullish market sentiment, fear of missing out (FOMO), and the expectation of future price appreciation.

This reduction in supply reflects increased investor confidence, with many choosing to hold rather than sell their SOL. As more investors accumulate the token, the supply on exchanges decreases, potentially creating upward pressure on the price in the long run.

Solana’s overall market momentum shows signs of potential volatility. Technical indicators, such as the Bollinger Bands, reveal that the bands are narrowing.

This tightening of the bands is a classic signal of a potential squeeze, which often precedes a surge in price volatility.

Should the squeeze result in a bullish breakout, Solana could see a rise in price, especially with the broader market showing positive momentum.

However, the narrowing of the Bollinger Bands also suggests that a period of consolidation could occur before any significant move.

SOL Price Needs To Break Out

Solana’s price has been moving sideways for much of May, likely due to the token overheating in the previous weeks. However, this cooling-off period could create an opportunity for a bullish move.

As the broader market continues to show positive signals and the accumulation trend persists, Solana may rise from its current consolidation phase.

At $173, Solana is testing critical support levels. To initiate a rally, Solana would need to secure $178 as support. If it manages to break above $180 and successfully breaches $188, it could indicate the start of an uptrend.

A successful breakout above these levels would signal further upward potential.

On the other hand, if Solana fails to maintain support at $178, it could fall below the $168 mark, potentially reaching $161. Such a decline would invalidate the bullish thesis and suggest further downside risk for the token.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.