Ethereum ETF approval in the U.S. represented an opportunity for traditional investors to access Ethereum. After years of anticipation, regulators finally gave the green light to funds that let you invest in Ether (ETH) through the stock market. This means you can now gain exposure to Ethereum’s price without the hassle of managing a crypto wallet. This guide highlights some of the best Ethereum ETFs out there and explains how to select one that suits your portfolio goals.

KEY TAKEAWAYS

➤ Ethereum ETFs let you invest in Ether’s price through regulated, exchange-listed funds without using crypto wallets.

➤ U.S. Ethereum ETF approval in 2024 gave investors safer, simpler access to Ethereum via standard brokerages.

➤ Global markets like Canada and Europe adopted spot Ethereum ETFs well before the U.S. caught up.

➤ Factors to consider while comparing ETFs include fees, issuer credibility, custody setup, and whether it’s spot or futures-based.

- Best Ethereum ETFs in 2025

- Top ETH ETFs compared

- How to choose the best Ethereum ETF that suits your portfolio goals

- What Ethereum ETFs are and why their approval matters

- How Ethereum ETF approval unfolded in the U.S.

- What global Ethereum ETF markets look like today

- Ethereum ETFs have changed the game for investors

- Frequently asked questions

Best Ethereum ETFs in 2025

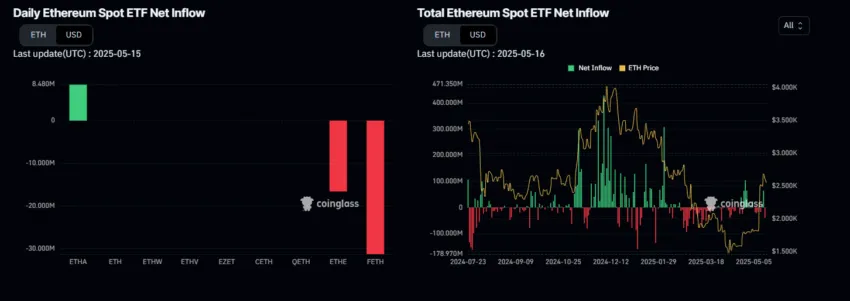

These are some of the best Ethereum ETFs to consider as of 2025, following the wave of U.S. Ethereum ETF approval in mid-2024. Each offers unique advantages based on fees, custodianship, and issuer credibility.

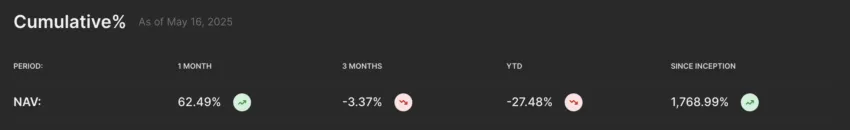

1. iShares Ethereum Trust (ETHA)

Quick facts:

- Issuer: BlackRock

- Type: Spot ETF

- Listed on: Nasdaq

- Launch: July 2024

- Expense ratio: 0.25% (0.12% promotional)

- Custodian: Coinbase Custody

- Administrator: BNY Mellon

Overview:

BlackRock’s iShares Ethereum Trust (ETHA) is one of the most high-profile spot Ethereum ETFs launched after U.S. regulators approved direct Ether-holding funds in July 2024. Managed by the world’s largest asset manager, ETHA provides direct exposure to Ethereum by holding the underlying asset in cold custody.

At launch, ETHA attracted strong demand due to BlackRock’s brand strength and early promotional pricing. The fund charges a standard 0.25% expense ratio, temporarily reduced to 0.12% to encourage initial inflows.

ETHA tracks Ether’s price closely with daily NAV updates and holdings transparency. Its high liquidity, low fees, and backing by a major institutional player make it one of the top Ethereum ETF choices in the U.S. market.

In a nutshell:

➤ Ideal for retirement accounts or brokerages that don’t support direct crypto purchases.

➤ Combines low fees with institutional-grade security and brand trust.

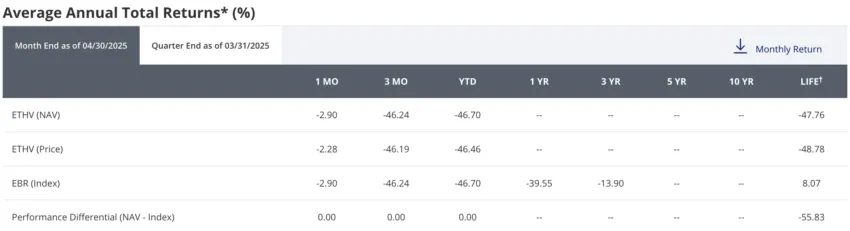

2. VanEck Ethereum ETF (ETHV)

Quick facts:

- Issuer: VanEck

- Type: Spot ETF

- Listed on: Cboe BZX

- Launch: July 2024

- Expense ratio: 0.20% (fee waived initially)

- Custodian: Gemini Trust Company

Overview:

VanEck’s Ethereum ETF (ETHV) was one of eight spot Ethereum ETFs approved in July 2024. The firm had been an early advocate for crypto ETFs, and this fund provides direct exposure to Ether by holding it in secure custody.

ETHV initially waived its 0.20% management fee to attract investors. Gemini provides custodial services, offering strong compliance and asset security.

What stands out is VanEck’s commitment to transparency. The firm actively publishes crypto research and educational content, which makes it easier for you to stay informed. NAV and holdings are updated daily.

In a nutshell:

➤ Strong contender for fee-conscious investors.

➤ Good fit for tax-advantaged portfolios.

3. Fidelity’s Ethereum Fund (FETH)

Quick facts:

- Issuer: Fidelity Investments

- Type: Spot ETF

- Listed on: NYSE

- Launch: July 2024

- Expense ratio: 0.25%

- Custodian: Fidelity Digital Assets

Overview:

Fidelity’s Ethereum Fund (FETH) delivers direct exposure to Ethereum via physical Ether held in institutional-grade cold storage. As one of the largest asset managers in the U.S., Fidelity brings strong brand trust and execution quality.

The ETF is competitively priced at 0.25%, with daily transparency reports and tight price tracking. It fits seamlessly into tax-advantaged accounts like IRAs and is available through most brokerage platforms.

Fidelity Digital Assets handles custody, combining crypto-native systems with traditional finance oversight.

In a nutshell:

➤ Excellent option for Fidelity users.

➤ High credibility with a strong track record in asset management.

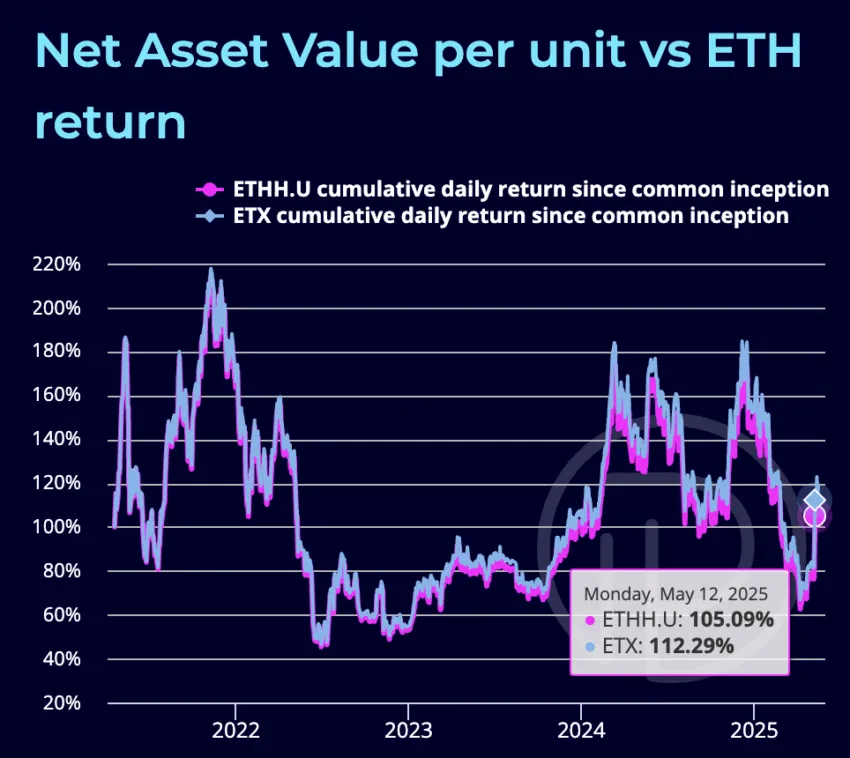

4. Purpose Ether ETF (ETHH)

Quick facts:

- Issuer: Purpose Investments

- Type: Spot ETF

- Listed on: Toronto Stock Exchange

- Launch: April 2021

- Expense ratio: ~1.00%

- Custodian: Gemini Trust Company

- Region: Canada

Overview:

Purpose Ether ETF (ETHH) made history in 2021 as the world’s first spot Ethereum ETF. It holds Ether in cold storage and tracks Ethereum’s market price on a near 1:1 basis.

The 1.00% fee is higher than newer U.S. offerings but reflects its early market entry. The fund is regulated under Canadian securities law and has a strong audit trail.

With over three years of operational history, ETHH has proven itself across multiple crypto cycles. It’s a solid option for Canadians or U.S. investors with access to the TSX.

In a nutshell:

➤ Proven stability with long-term live data.

➤ Suitable for TFSA and RRSP accounts.

5. 21Shares Ethereum ETP (AETH)

Quick facts:

- Issuer: 21Shares

- Type: Spot ETP (European structure)

- Listed on: SIX Swiss Exchange

- Launch: March 2019

- Expense ratio: ~1.49%

- Region: Europe

- Custodian: Coinbase (among others)

Overview:

21Shares’ Ethereum ETP (AETH) is one of the earliest Ethereum investment products globally. Structured as an exchange-traded product, AETH holds physical Ether and tracks its price, net of fees.

Although the fee sits around 1.49%, the fund provides convenience and regulation within European financial markets. It trades in multiple currencies and is available across E.U., U.K., and Swiss brokerages.

21Shares is a well-known issuer in Europe’s crypto ETP space and conducts regular audits and asset verification.

In a nutshell:

➤ Ideal for European investors avoiding unregulated exchanges.

➤Long-running track record and trusted issuer.

6. CI Galaxy Ethereum ETF (ETHX)

Quick facts:

- Issuer: CI Global Asset Mgmt & Galaxy Digital

- Type: Spot ETF

- Listed on: Toronto Stock Exchange

- Launch: April 2021

- Expense ratio: 0.40%

- Region: Canada

- Custodians: Gemini, Galaxy Digital

Overview:

ETHX is a joint effort between traditional investment firm CI Global Asset Management and crypto-native player Galaxy Digital. It offers spot Ether exposure with direct holdings and cold wallet security.

The 0.40% fee makes it one of the more cost-effective options in Canada. ETHX trades in CAD and USD and is available in registered accounts, including RRSP and TFSA.

The dual-management model brings together compliance rigor and technical blockchain expertise, making this ETF stand out in Canada’s Ethereum investment market.

In a nutshell:

➤ Lower fees than many international competitors.

➤ Strong backing from both TradFi and DeFi sides.

7. Bitwise Ethereum ETF (ETHW)

Quick facts:

- Issuer: Bitwise Asset Management

- Type: Spot ETF

- Listed on: U.S. exchange (Cboe or NYSE)

- Launch: July 2024

- Expense ratio: 0.20%

- Custodian: Coinbase (likely)

Overview:

ETHW is one of the U.S. spot Ethereum ETFs launched in 2024 and is backed by Bitwise, a digital asset manager focused solely on crypto. The fund holds Ether directly and aims to provide 1:1 price tracking minus fees.

The ETF publishes daily NAV updates and maintains strong asset transparency, backed by regulated custodians. Bitwise supports the ETF with deep crypto research and regular investor education, which gives you insight into both Ethereum and the fund’s performance.

While it lacks the brand power of BlackRock or Fidelity, Bitwise has earned credibility in crypto-native circles. This fund appeals to investors who want exposure plus ongoing market context.

In a nutshell:

➤ Low-cost, research-backed crypto fund.

➤ Appeals to detail-oriented Ethereum holders.

Top ETH ETFs compared

| Fund name | Type | Issuer | Fees (Expense ratio) | Listing region | Launch date |

| iShares Ethereum Trust (ETHA) | Spot ETF | BlackRock | 0.25% (0.12% promo) | U.S. | July 2024 |

| VanEck Ethereum ETF (ETHV) | Spot ETF | VanEck | 0.20% (fee waived initially) | U.S. | July 2024 |

| Fidelity Ethereum Fund (FETH) | Spot ETF | Fidelity Investments | 0.25% | U.S. | July 2024 |

| Purpose Ether ETF (ETHH) | Spot ETF | Purpose Investments | 1.00% | Canada | April 2021 |

| 21Shares Ethereum ETP (AETH) | Spot ETP | 21Shares | 1.49% | Europe | March 2019 |

| CI Galaxy Ethereum ETF (ETHX) | Spot ETF | CI Global AM & Galaxy Digital | 0.40% | Canada | April 2021 |

| Bitwise Ethereum ETF (ETHW) | Spot ETF | Bitwise Asset Management | 0.20% | U.S. | July 2024 |

How to choose the best Ethereum ETF that suits your portfolio goals

All Ethereum ETFs aim to track the price of Ether, but a few details can make a big difference depending on your goals. Here’s how to decide which one suits you best.

Spot or futures: Know what you’re actually getting

If you are investing for the long haul, go with a spot Ethereum ETF. These funds hold actual Ether and offer tighter price tracking. They are generally more efficient and transparent, especially in stable market conditions.

Futures-based ETFs, on the other hand, rely on derivative contracts. They may trail slightly behind spot performance due to rolling costs and market fluctuations. If you are outside the U.S. or Canada and don’t have access to spot products, a futures-based ETF can still work — but expect a more complex structure and potentially higher fees.

Look beyond the sticker price on fees

Most new U.S. spot Ethereum ETFs launched with promotional fee waivers. Some offer near-zero fees for the first year. Once those expire, fees can jump to around 0.20%–0.25%, which is still competitive.

Canadian and European ETFs tend to charge more, especially older ones. A fund that charges 1% annually might not sound like much, but over several years, that adds up. If two ETFs offer similar exposure and reliability, pick the cheaper one — it’s free performance.

Brand names matter when trust is on the line

You are not just buying Ether exposure. You’re also trusting the issuer to store, manage, and secure the assets properly. That’s why many lean toward well-established firms like BlackRock, Fidelity, or VanEck. These issuers bring reputational weight and usually partner with top custodians.

Larger funds also tend to be more liquid, which means lower trading costs when entering or exiting a position. If that matters to you, pick ETFs with higher assets under management and stronger daily volumes.

Make sure it fits your account and location

It’s not just about the ETF itself — it’s also about whether you can access it. U.S.-listed ETFs are built for U.S. accounts. If you are based in Europe or Canada, you’ll find local listings like ETHX, ETHH, or AETH more practical.

Also, double-check whether your brokerage or retirement account allows crypto ETFs. Some IRAs or financial advisors may limit your options or require extra paperwork.

Don’t overlook the tax angle

Spot Ethereum ETFs simplify crypto taxation compared to holding ETH directly. Still, tax rules vary depending on your country and account type.

In the U.S., ETFs generally follow capital gains rules similar to stocks. Futures-based ETFs may be treated differently, sometimes as commodity partnerships with blended long-term and short-term rates. In Canada, placing an ETF in a TFSA or RRSP can shelter gains, but only if it’s a Canadian-listed fund. Europe has its own tax regimes depending on the jurisdiction.

If your investment is sizable, check with a tax professional. Otherwise, know that ETFs make record-keeping far easier than trading on-chain.

What Ethereum ETFs are and why their approval matters

An Ethereum ETF gives you access to the price performance of Ether, the native token of the Ethereum network, without needing to own or manage cryptocurrency directly.

You buy it like a regular stock or mutual fund, through your standard brokerage account. There are two kinds: spot ETFs, which hold actual Ether in custody, and futures-based ETFs, which use derivative contracts instead.

Spot Ethereum ETFs are more straightforward and tend to track Ether’s price more accurately. Futures ETFs are more complex, and while they served as somewhat of a stopgap pre spot approval, they often come with higher fees and some tracking slippage.

Until 2024, there was no U.S. Ethereum ETF approval for spot funds. If you wanted regulated exposure, you had to use crypto trusts or offshore ETFs, which weren’t ideal. The approval of spot Ethereum ETFs in the U.S. finally fixed that gap.

You can now access Ether through familiar investment platforms, with improved fee structures, better liquidity, and strong regulatory oversight.

That shift changed everything. The Ethereum ETF approval didn’t just create new products — it made Ether accessible for retirement accounts, passive portfolios, and cautious investors who otherwise avoided direct crypto. And with big issuers like BlackRock and Fidelity behind these ETFs, confidence in the category surged.

How Ethereum ETF approval unfolded in the U.S.

Getting spot Ethereum ETFs approved in the U.S. was not easy. For years, the SEC pushed back, citing concerns about market manipulation and custody risks.

Futures-based Ethereum ETFs finally made their debut in late 2023. These held CME Ether futures contracts and gave investors limited exposure through a regulated product, but it wasn’t the real deal.

The real turning point came in early 2024 when the SEC approved several spot Bitcoin ETFs. That opened the door for spot Ethereum ETFs. By mid-2024, the SEC signaled a shift in position. The regulatory body approved Ethereum ETF listings in May 2024, and the funds began trading in late July after receiving the final S-1 approvals.

This wave of Ethereum ETF approvals included funds from major issuers: BlackRock (iShares), VanEck, Fidelity, Invesco, Franklin Templeton, Bitwise, and 21Shares. Even Grayscale moved to convert its long-standing Ethereum trust into a proper ETF.

With approval secured, these funds launched under tickers like ETHA, ETHV, and FETH. That meant you could now gain clean, direct exposure to Ether using the same investment account you use for stocks. You no longer had to worry about wallets, private keys, or custodial risk.

Competition among issuers kicked off a price war. Fees dropped fast — some as low as 0.12% — with many providers waiving fees altogether for the first year.

That shift made it easier than ever for you to choose the best Ethereum ETF based not only on brand but also on cost and performance.

What global Ethereum ETF markets look like today

While the U.S. took its time, several countries moved earlier with Ethereum ETF offerings. Canada, for instance, was faster to act. Back in April 2021, it approved the world’s first spot Ether ETFs, with Purpose Ether ETF (ETHH), CI Galaxy Ethereum ETF (ETHX), and others listing on the Toronto Stock Exchange.

These Canadian ETFs directly hold Ether and helped show the world that regulated crypto funds could work. Their fees started high — ETHH charges around 1% — but competition brought that down. CI Galaxy, for example, launched at just 0.40%, making it more attractive for cost-conscious buyers.

Meanwhile, in Europe, the story started even earlier. Swiss firm 21Shares launched an Ethereum ETP in 2019, well before most retail investors even knew about crypto ETFs.

These ETPs trade on regulated European exchanges like SIX Swiss and Deutsche Börse Xetra. While they are similar to ETFs, European regulators use different naming conventions. Most hold Ether directly and are listed in local currencies.

So, to cut a long story short, as of May 2025, Ethereum ETF approval has become a global reality. From Australia to Switzerland to Brazil, multiple regions now offer their own spot Ethereum investment vehicles — each shaped by local regulations.

Ethereum ETFs have changed the game for investors

The approval of Ethereum ETFs — especially in the U.S. — marks a major shift in crypto investing. These funds let you gain exposure to ETH’s price without handling wallets or exchanges. Whether spot- or futures-based, Ethereum ETFs aim to make ETH investment accessible, regulated, and low-cost. This new route levels the playing field by offering a simple way to add Ethereum to your portfolio using familiar tools. If you are considering one, start by focusing on fees, structure, and issuer credibility.

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Always do your own research (DYOR).

Frequently asked questions

What is a spot Ethereum ETF?

Has the U.S. approved spot Ethereum ETFs?

What are the benefits of investing in an Ethereum ETF?

How do international Ethereum ETFs compare to U.S. ones?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.