The Bureau of Labor Statistics (BLS) released its CPI report on Tuesday, showing inflation slowed in April.

The Bitcoin price posted a modest reaction, as this turnout influences the Federal Reserve’s (Fed) path forward on interest rates.

US CPI Data: Bitcoin Price Moves Amid Cooling Inflation

The BLS released its Consumer Price Index (CPI) inflation report on Tuesday at 8:30 AM EST. As measured by the CPI, inflation in the US rose at an annual rate of 2.3% in April, slightly below the pace witnessed in March.

“U.S. CPI: +2.3% YEAR-OVER-YEAR (EST. +2.4%) U.S. CORE CPI: +2.8% YEAR-OVER-YEAR (EST. +2.8%),” Tree news reported

Notably, this year-over-year (YoY) increase marks the smallest reading since February. 2021. Key takeaways from the April CPI data include:

- April CPI inflation FALLS to 2.3%, below expectations of 2.4%.

- Core CPI inflation was 2.8%, which aligns with expectations of 2.8%.

- This marks the 3rd straight monthly decline in headline inflation.

- Inflation continues to cool down despite the trade war.

In the immediate aftermath, Bitcoin’s price recorded a modest surge, rising from $103,590 to trade for $103,721 as of this writing.

The muted reaction came as the overall market momentum was bullish. The latest inflation figures did not change sentiment; they came slightly below expectations.

CPI data, a critical economic indicator measuring inflation, influences the Fed’s monetary policy decisions. When CPI data shows rising inflation, markets typically anticipate interest rate hikes.

However, cooling inflation or easing inflationary pressures, as was the case in April, may increase calls for the Fed to cut rates soon. Such an action could weigh the dollar but boost interest in Bitcoin and crypto.

“CPI is one of the main indicators for the Fed, and this release could show whether tariffs are pushing inflation higher,” a user noted on X (Twitter).

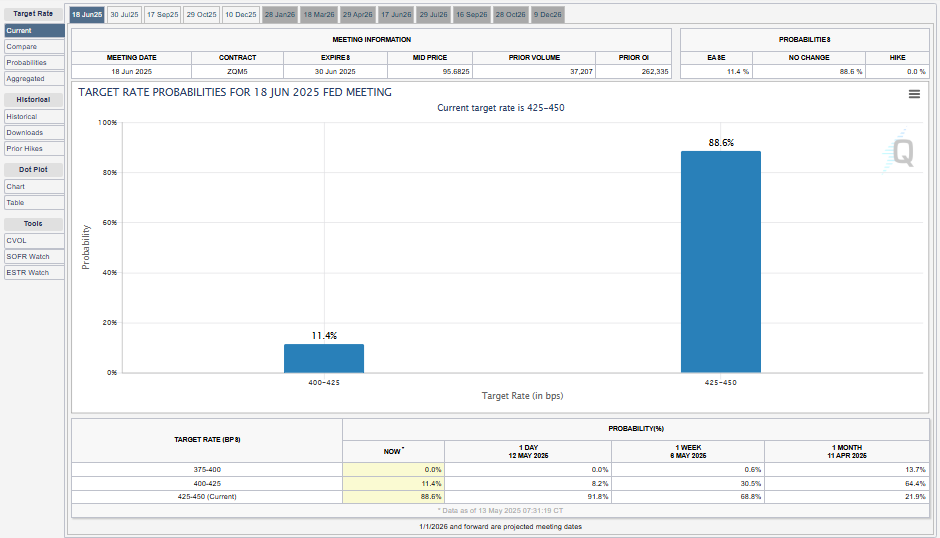

Following the CPI data, the CME FedWatch tool shows markets wager a 88.6% probability of the Fed keeping interest rates at the current 4.50% in the June 18 meeting.

Before the CPI data broke, markets saw a 91.8% chance of the Fed keeping rates steady. This drop, therefore, indicates optimism for further rate cuts.

CPI Data Shows First Signs Of Tariff-Related Inflation

During the post-policy meeting press conference, Fed Chair Jerome Powell noted that near-term inflation expectations had increased due to Trump’s tariffs. He also said that it was time for them to wait before adjusting the policy.

However, President Donald Trump is putting political pressure on the Fed, urging it to cut rates.

“The Fed would be MUCH better off CUTTING RATES as US Tariffs start to transition (ease!) their way into the economy. Do the right thing,” Trump wrote on Truth Social.

Against this backdrop, some speculate that the President may be right in pushing for interest rate cuts amid political battles over monetary policy.

“Could POTUS be right and Fed Chair Powell be wrong?,” Paul Barron quipped in a post.

Nevertheless, while today’s report does not show signs of tariff-related inflation, the general sentiment is that the full impact of the new policies on inflation could start showing after several months.

The Fed’s position is that the central bank would want to see potential tariff impacts appear in economic data before letting them shape the path of monetary policy.

“The risks of higher unemployment and higher inflation have risen, but they haven’t materialized yet. They really haven’t. They’re not really not in the data yet … Our policy’s in a very good place, and the right thing to do is await further clarity,” Powell stated.

Therefore, even weakness in payrolls next month could be temporary if tariff negotiations continue their positive momentum.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.