Solana (SOL) has shown stability in recent weeks, managing to avoid excessive losses. However, the altcoin has also struggled to bounce back, leading to a somewhat stagnant market position.

This could change with Solana being part of Grayscale’s potential Digital Large Cap ETF, which may boost its price.

Solana Hits Market Bottom

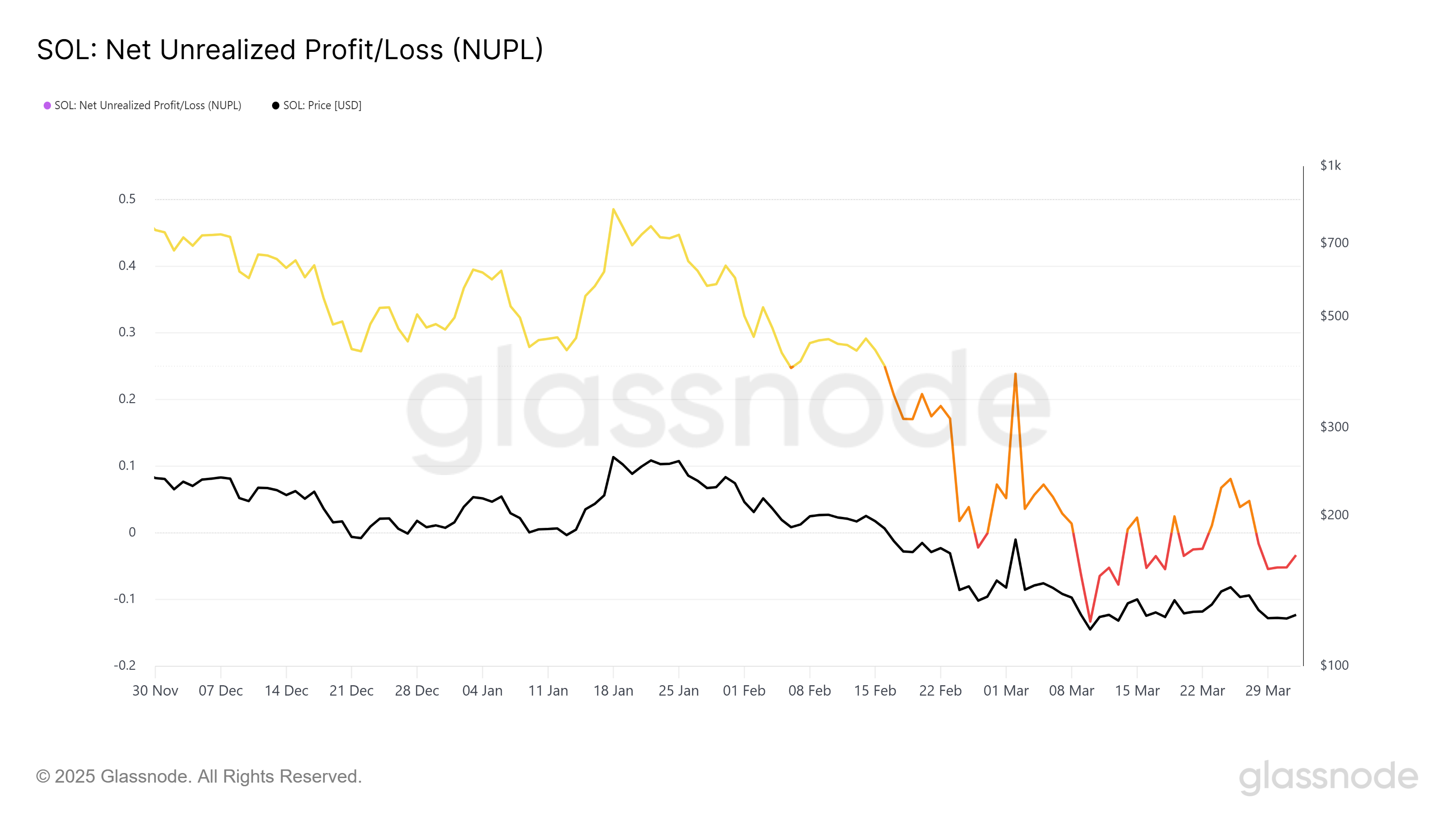

The Net Unrealized Profit/Loss (NUPL) indicator shows that Solana has entered a capitulation phase, a typical market bottom signal. This zone often marks a reversal point, where prices tend to bounce back. With the market sentiment at a low, many investors believe that Solana’s price could soon recover.

Moreover, Grayscale’s decision to file an S-3 form with the SEC to convert its Digital Large Cap Fund (GDLC) into an ETF is a pivotal development. This fund holds Bitcoin, Ethereum, XRP, Cardano, and Solana. If approved, this would be the first indirect ETF for Solana, providing new exposure for the altcoin.

The approval of such an ETF could trigger increased investor interest and potential price appreciation.

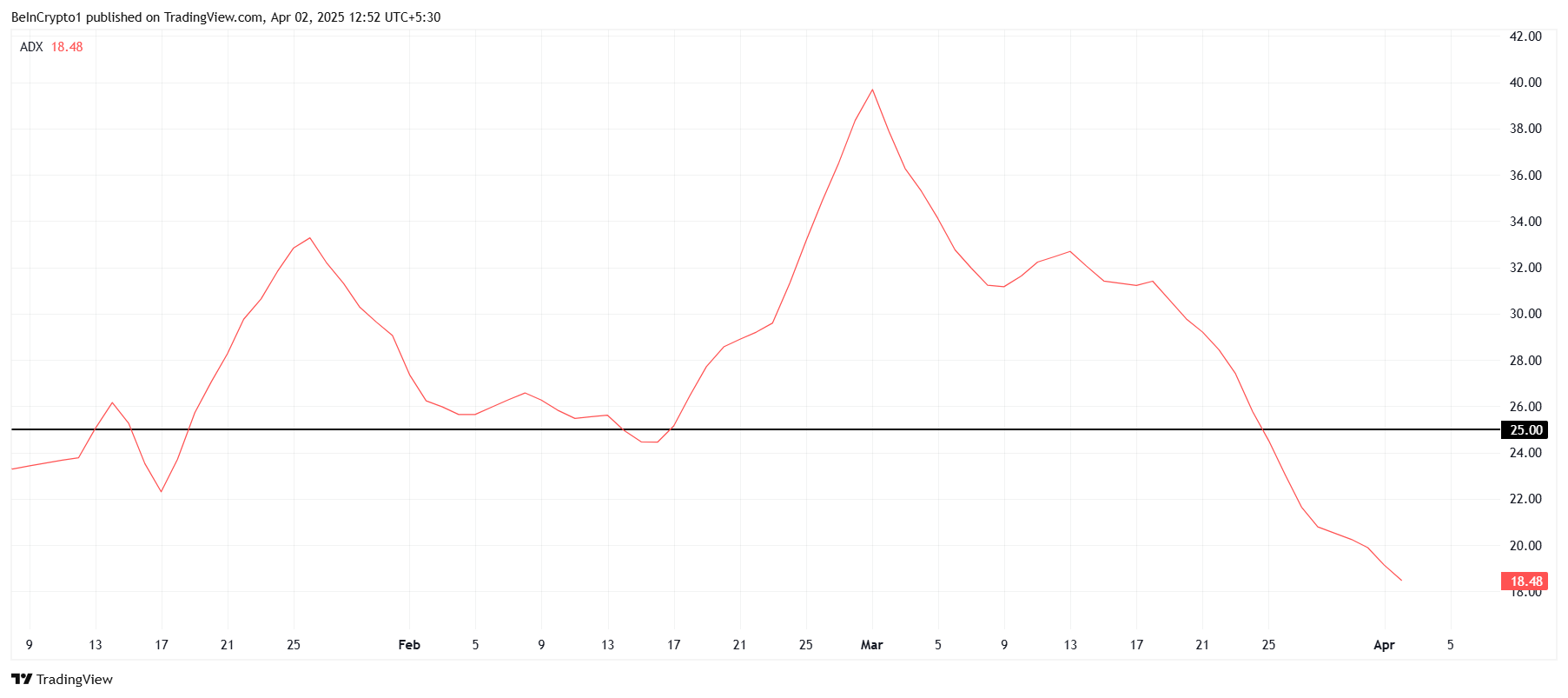

Solana’s overall macro momentum is showing signs of recovery. The Average Directional Index (ADX) has fallen below the 25.0 threshold, signaling that the previous downtrend has lost momentum. This suggests that Solana is no longer in a strong bearish trend, opening up an opportunity for a rally and a potential price uptrend.

Additionally, the technical landscape for Solana has become more stable. The ADX reading indicates that the downtrend has lost strength completely, leaving Solana positioned for a possible upward move. If the broader market stabilizes, Solana could experience further support, amplifying the chance of a rally.

SOL Price Aims At A Rise

Solana’s price is currently sitting at $124, just above the crucial support level of $123. This support has held firm for the last three weeks, indicating that Solana has found a base from which it can potentially rise. With the improved market conditions and the positive news surrounding the ETF, SOL is likely to see an upward push soon.

Considering the recent developments, including Grayscale’s ETF filing, Solana could jump towards $135. A successful breach and flip of this level into support could send Solana on a path to $148, potentially recovering much of the recent losses. This would solidify a more bullish trend for the altcoin.

However, if broader market cues remain weak and fail to support Solana’s growth, the altcoin might struggle to gain momentum. In such a scenario, Solana could fall below $123 and possibly reach $118, with $109 serving as the next key support.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.