Solana has recorded a 6% gain over the past 24 hours, driven by a surge in long positions and heightened market activity.

The increase in demand for leveraged long trades reflects renewed confidence in SOL’s short-term price recovery.

Solana’s Long/Short Ratio Reflects Growing Optimism for Price Surge

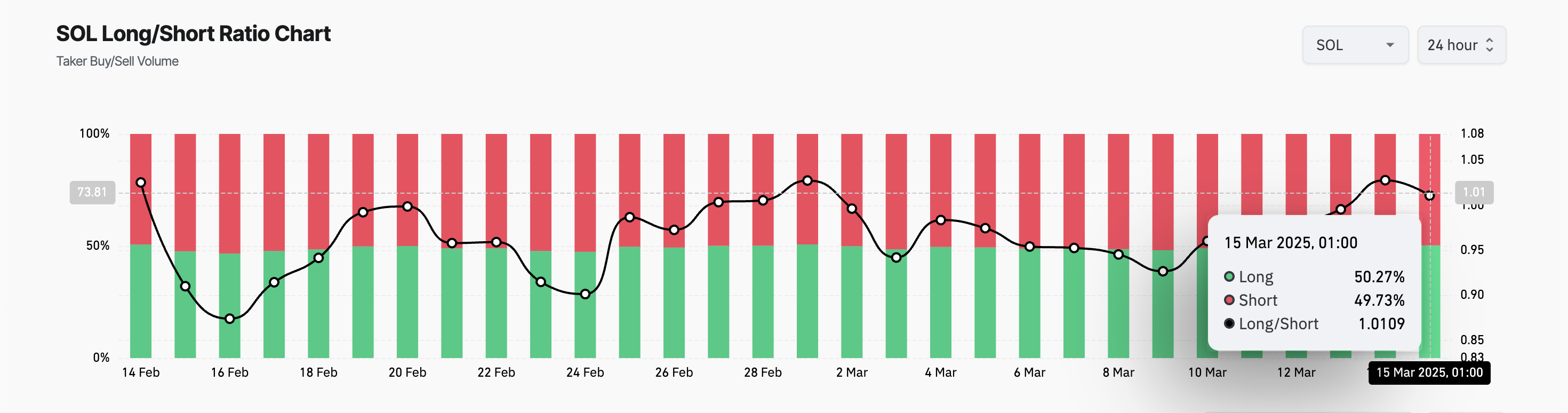

Solana’s long/short ratio highlights the resurgence in bullish bias toward the altcoin. At press time, this stands at 1.01.

An asset’s long/short ratio compares the number of long positions (bets that its price will rise) to short positions (bets that its price will fall) in a market. When the ratio is below one, traders are predominantly betting on a price decline.

Conversely, as with SOL, when this ratio is above 1, there are more long than short positions, indicating that traders are predominantly betting on a price increase.

This trend indicates that SOL futures traders are increasingly positioning themselves for further upside, reflecting the growing confidence in the coin’s short-term price recovery.

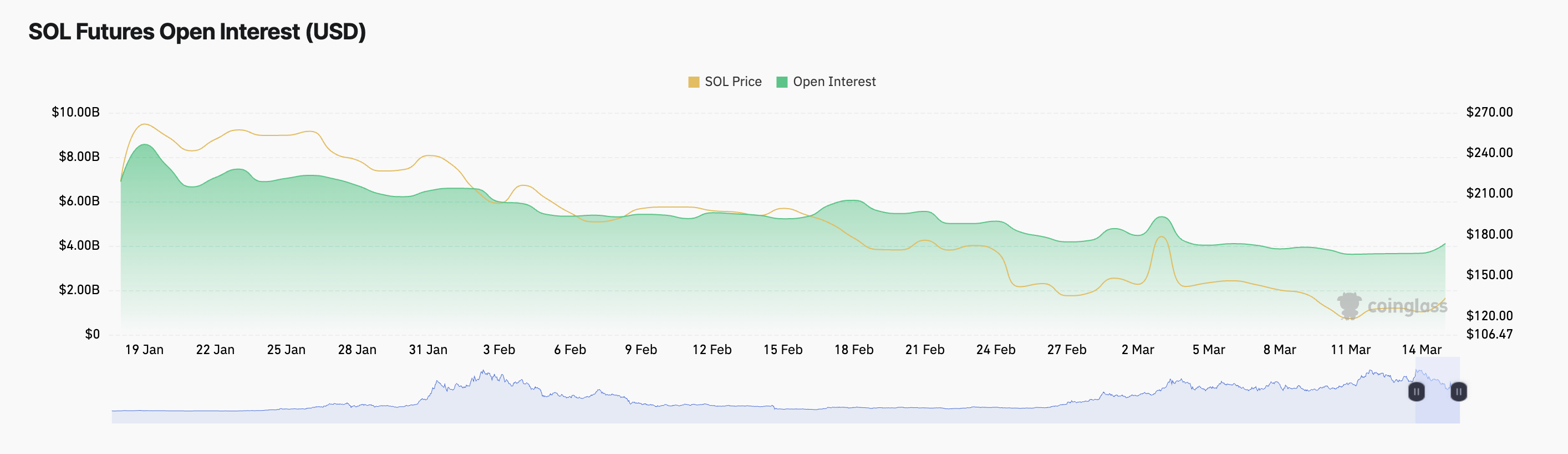

Additionally, the coin’s open interest has climbed. At press time, this is at $4.11 billion, having risen 11% over the past day.

An asset’s open interest measures the total number of outstanding derivative contracts, such as futures or options, that have not been settled. When open interest climbs, it signals increasing market participation and indicates strengthening trends as more traders enter positions rather than close them.

This trend suggests a fresh wave of capital entering the SOL derivatives market as traders’ optimism improves.

Will Strong Demand Push SOL Past $135 Resistance and Toward $160?

At press time, SOL trades at $133.01, just below the resistance at $135.58. If demand strengthens further, the coin could flip this resistance into a support floor, and its price could rally to $160.18.

On the other hand, if the bears regain market control and buying pressure dwindles, SOL could shed recent gains and drop to $126.32.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.