Cardano (ADA) has faced a lack of growth in recent weeks despite initially grabbing investors’ attention during a brief rally.

While ADA’s price action showed some promise, the momentum quickly faded, and now, despite entering an opportunity zone, ADA holders remain skeptical, and investor participation has dropped significantly.

Cardano Investors Need To Step Up

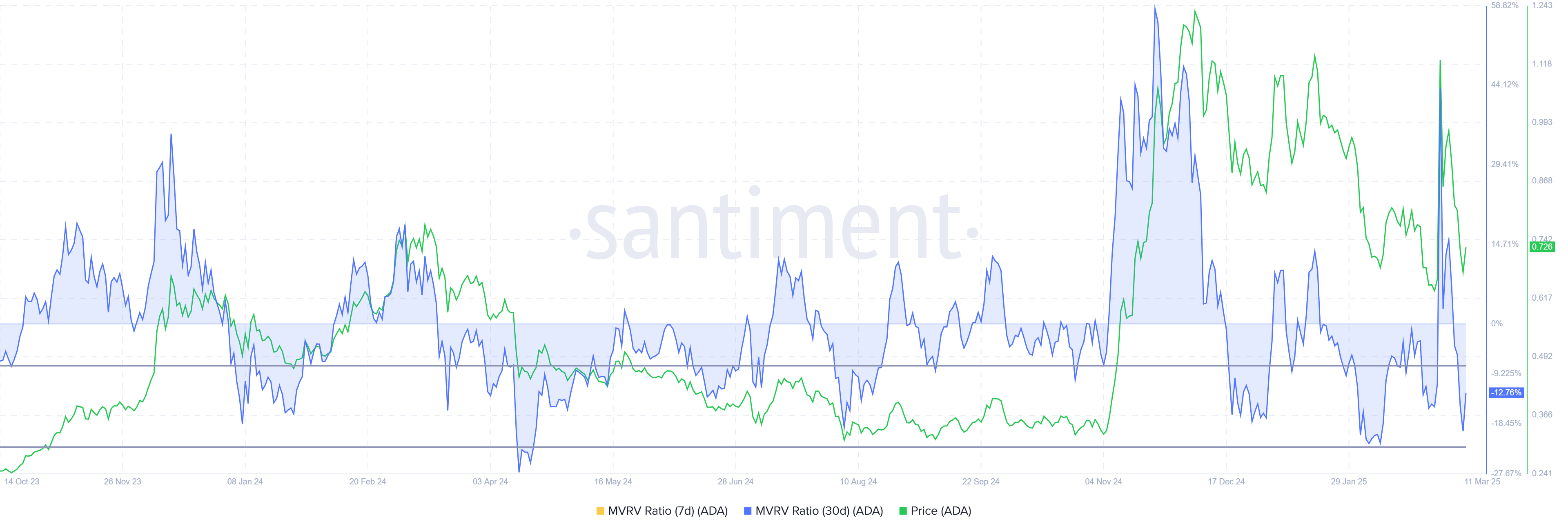

The Market Value to Realized Value (MVRV) Ratio for Cardano shows that ADA holders who purchased within the last month are currently facing 12% losses. This decline has brought ADA into the opportunity zone, which lies between -8% and -22%. Historically, this zone has been a reversal point for ADA, presenting a potential for recovery if investors decide to accumulate at low prices.

However, despite being in the opportunity zone, there is little indication that ADA holders are acting on this opportunity. The skepticism among investors, driven by the altcoin’s failure to sustain recent rallies, has made it difficult for ADA to capitalize on this potential recovery window.

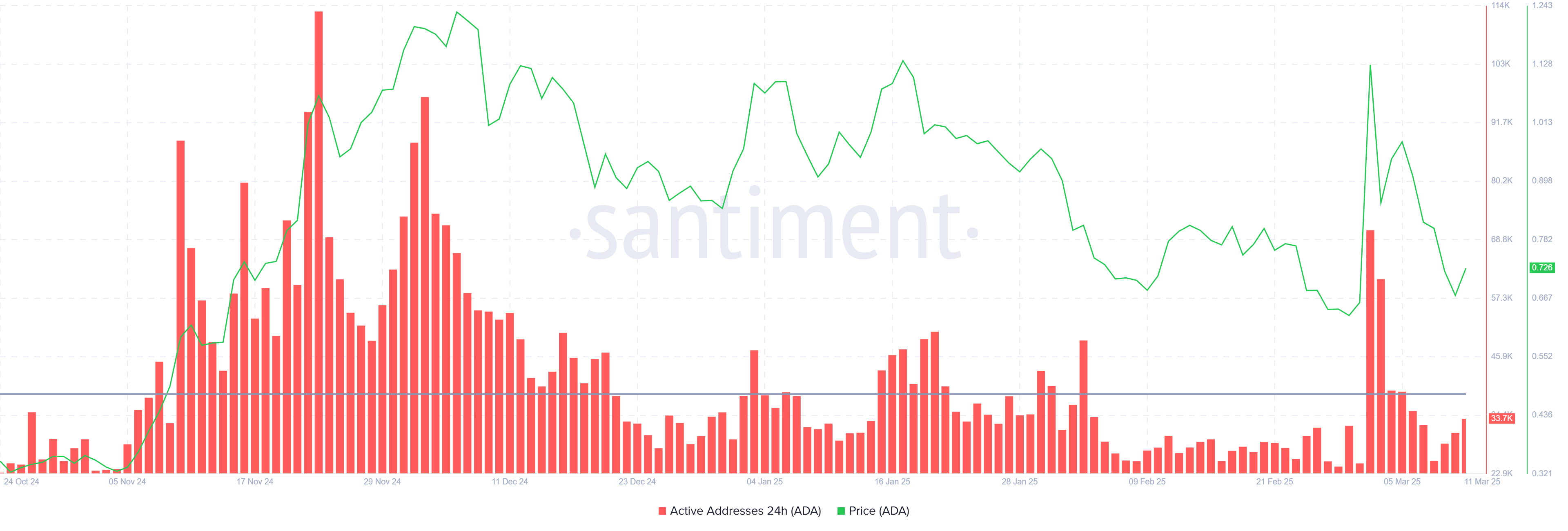

The overall macro momentum for Cardano has also been affected by diminishing participation. Active addresses on the network are currently below the average threshold of 38,600, with the count sitting at 33,700. This decrease in active addresses indicates a decline in investor participation and confidence.

During ADA’s brief rally at the beginning of the month, the number of active addresses surged, but the failure to sustain that momentum has caused skepticism to take over. With investor participation dwindling, ADA’s price could face further challenges if interest in the asset continues to wane.

ADA Price Is Facing Recovery Challenge

Cardano’s price is currently at $0.72 after falling 31% in the last few days. This decline followed ADA’s failure to breach the $0.99 level and flip it into support. The inability to reclaim this critical resistance level has led to further losses, and ADA is now struggling to recover.

As ADA moves farther away from the $1.00 price point, it continues to face challenges in terms of both investor confidence and broader market conditions. At this point, ADA is likely to experience consolidation above the $0.70 level, though a further drop to $0.62 remains a possibility, especially if investor sentiment remains weak.

However, if ADA manages to flip $0.77 into support, it could signal the beginning of a recovery. Successfully holding above this level could push the price back toward $0.85 or higher, invalidating the current bearish outlook. This would require renewed investor interest and a favorable shift in market conditions to support ADA’s upward movement.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.