Many Asian countries, such as Vietnam, Singapore, Thailand, and others, are demonstrating positive steps toward building a comprehensive legal framework for the crypto sector.

With a large user base and increasingly clear regulatory frameworks, Asia is emerging as a promising region for the industry in 2025.

Overview of Crypto Regulations in Asia

Several Asian countries, including Malaysia, Thailand, Japan, South Korea, and Vietnam, have been reviewing changes and issuing crypto-related policies. Hong Kong and Singapore are leading the way in establishing clear legal frameworks to attract investment and innovation.

More recently, Vietnam has also been hastening efforts to finalize its legal framework before the end of March.

Specifically, the Monetary Authority of Singapore (MAS) recently granted 30 companies “Major Payment Institution—MPI” licenses related to digital payment tokens. The nation’s regulatory framework balances innovation with consumer protection, ensuring a secure and responsible crypto ecosystem.

Meanwhile, Hong Kong has issued 10 companies “Virtual Asset Trading Platform Licenses.” In mid-2023, Hong Kong amended its legal framework for cryptocurrency exchanges, assigning the Securities and Futures Commission (SFC) the responsibility of vetting and licensing. This country is accelerating crypto licensing with the approval of 4 new exchanges.

Another emerging nation in the Asian region, Vietnam, has requested that the Ministry of Finance urgently finalize a pilot resolution to regulate activities related to virtual and tokenized assets before March 13, 2025.

“Complete the pilot resolution dossier to manage activities related to virtual assets and tokenized assets, and report to the Standing Government before March 13, 2025,” an official statement from the Vietnam government announced.

Moreover, Thailand recently approved and permitted USDT to be traded domestically. Updated regulations to enhance flexibility for digital asset businesses will take effect on March 16, 2025.

“USDT is officially approved in Thailand,” Tether’s CEO stated in an announcement.

Asia’s Potential in The Crypto Sector

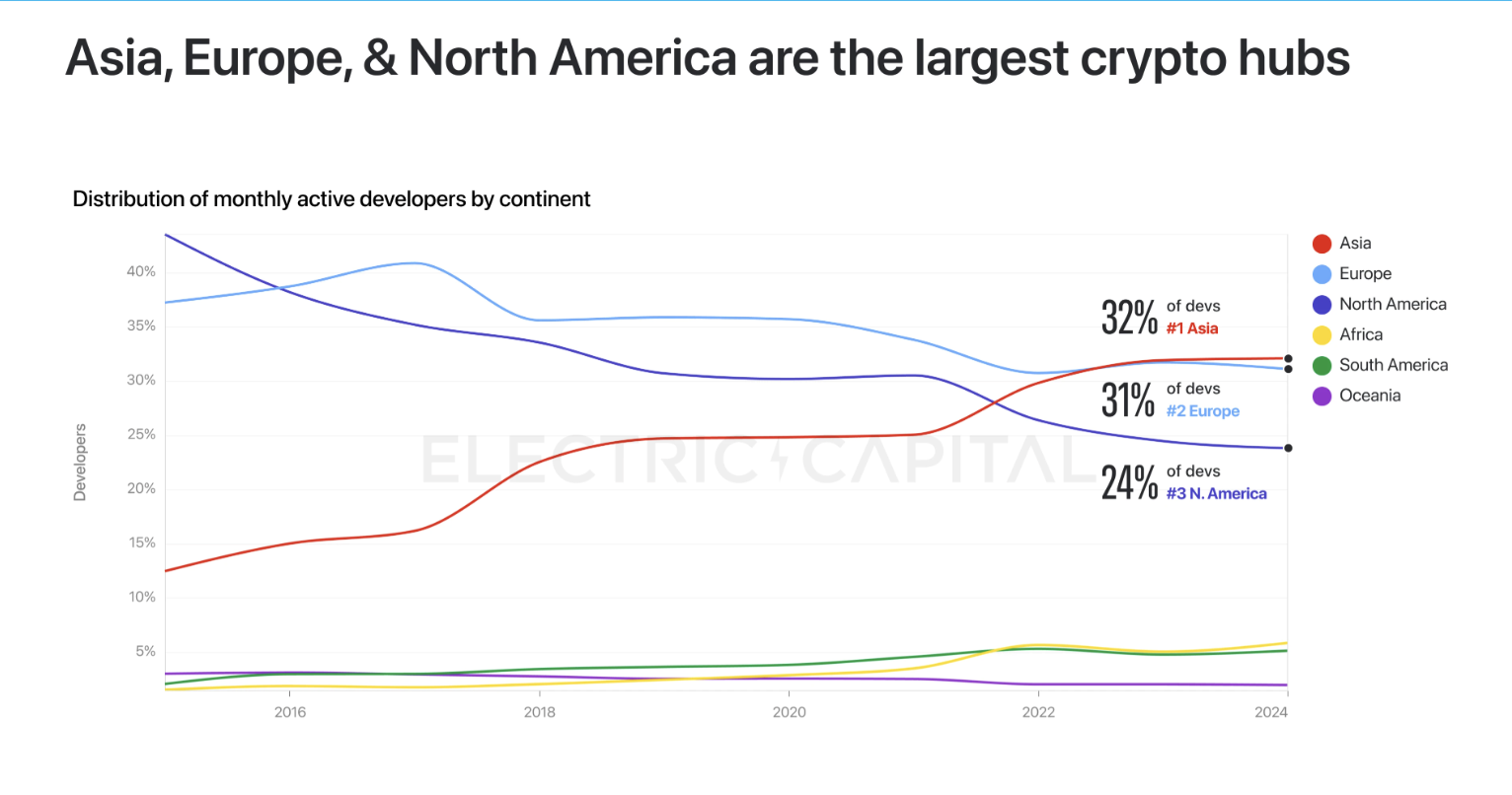

According to Electric Capital data, Asia is the number one continent regarding crypto developer share. North America has dropped from the top spot to third place. The United States remains the leading country with a 19% crypto developer share, down from 38% in 2015.

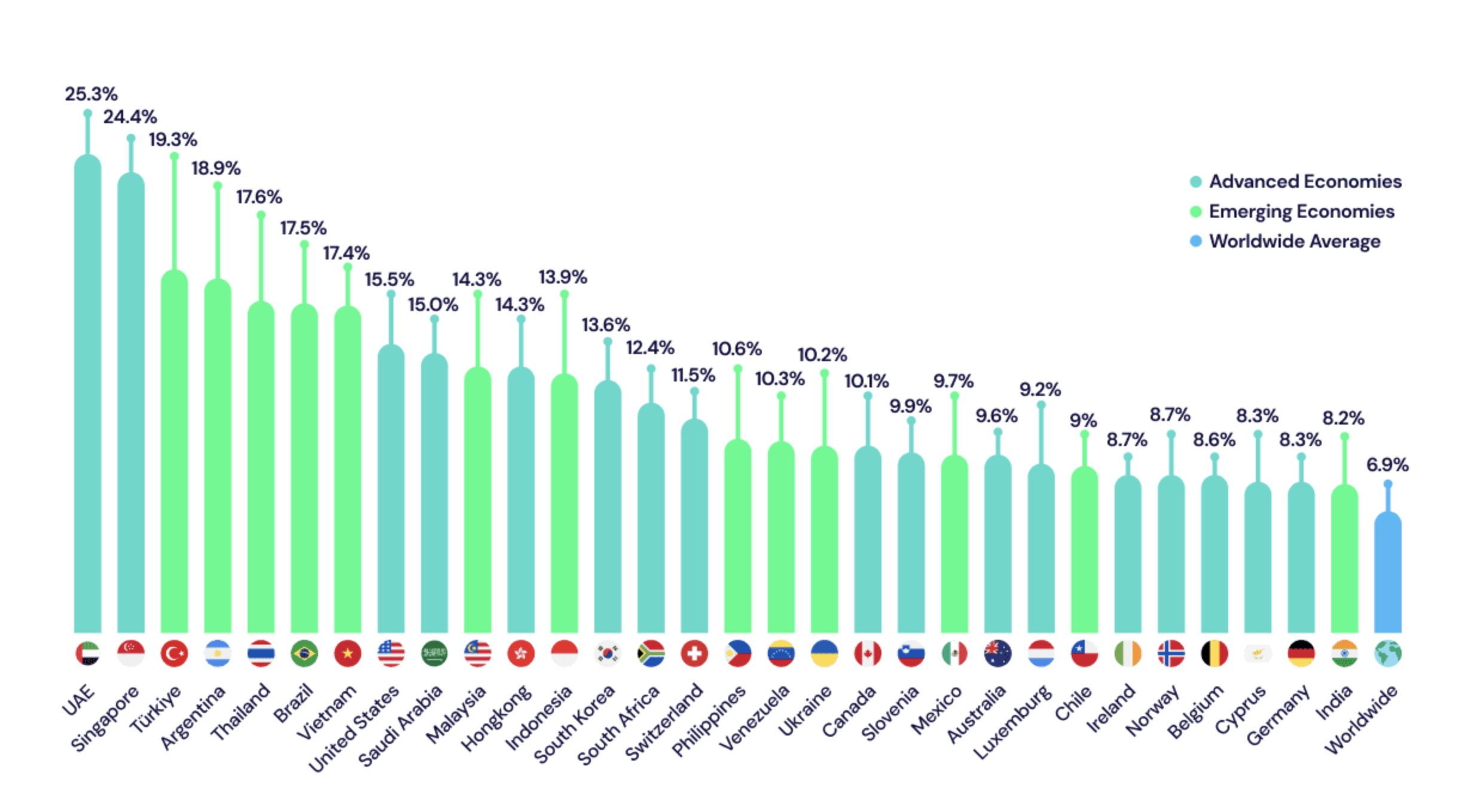

Data from Triple-A shows that several Asian countries are currently among the leaders in cryptocurrency ownership rates. Singapore holds the top position on this list, followed by Thailand, Vietnam, Malaysia, Hong Kong, and others.

While Singapore and Hong Kong are making significant strides, some countries still lack a unified legal framework. This fragmentation challenges regional cooperation and prevents illegal activities such as money laundering.

A clear legal framework would attract more global companies to Asia. The case of El Salvador serves as an example as Tether officially relocated its headquarters to take advantage of favorable legal corridors.

However, a fully developed legal corridor also creates barriers for small or less transparent projects. Projects like Pi Network (PI), criticized by Bybit CEO Ben Zhou as “more dangerous than meme coins,” have raised concerns about transparency. Singapore’s Interior Minister warns citizens to avoid cryptocurrencies.

If successful, Asia could surpass the United States and Europe to become the global cryptocurrency hub, thanks to progressive regulations and a dynamic market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.