Ethereum (ETH) has shown signs of recovery after a sharp decline caused by the Bybit hack, which impacted its price. Despite this bounce back, ETH is still down nearly 18% over the past 30 days, reflecting continued volatility.

Notably, ETH’s RSI has rebounded to 58.6 from a low of 39.2 during the sell-off, indicating renewed buying pressure. This recovery in RSI suggests that market sentiment is gradually improving, potentially setting the stage for further price gains if momentum persists.

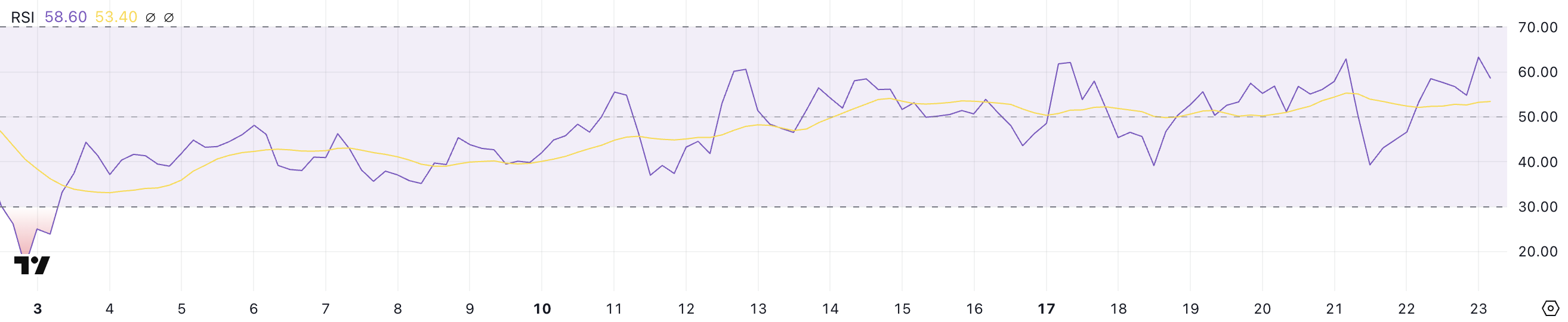

ETH RSI Has Recovered From the Recent Dip

ETH’s RSI is currently at 58.6, a notable increase from the 39.2 level it reached after the Bybit hack significantly impacted its price.

The recovery in RSI reflects the buying momentum ETH has gained since the sharp decline.

This upward movement in RSI suggests that buying pressure has returned, helping Ethereum price stabilize and potentially paving the way for further price gains if momentum continues.

RSI, or Relative Strength Index, is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100, with thresholds at 30 and 70.

An RSI below 30 is generally considered oversold, indicating potential buying opportunities, while an RSI above 70 is considered overbought, signaling a possible price correction.

ETH’s RSI is currently at 58.6, positioned in a neutral zone but leaning towards bullish momentum. This level suggests Ethereum still has room to grow before reaching overbought territory, potentially leading to continued price appreciation as buying interest remains steady.

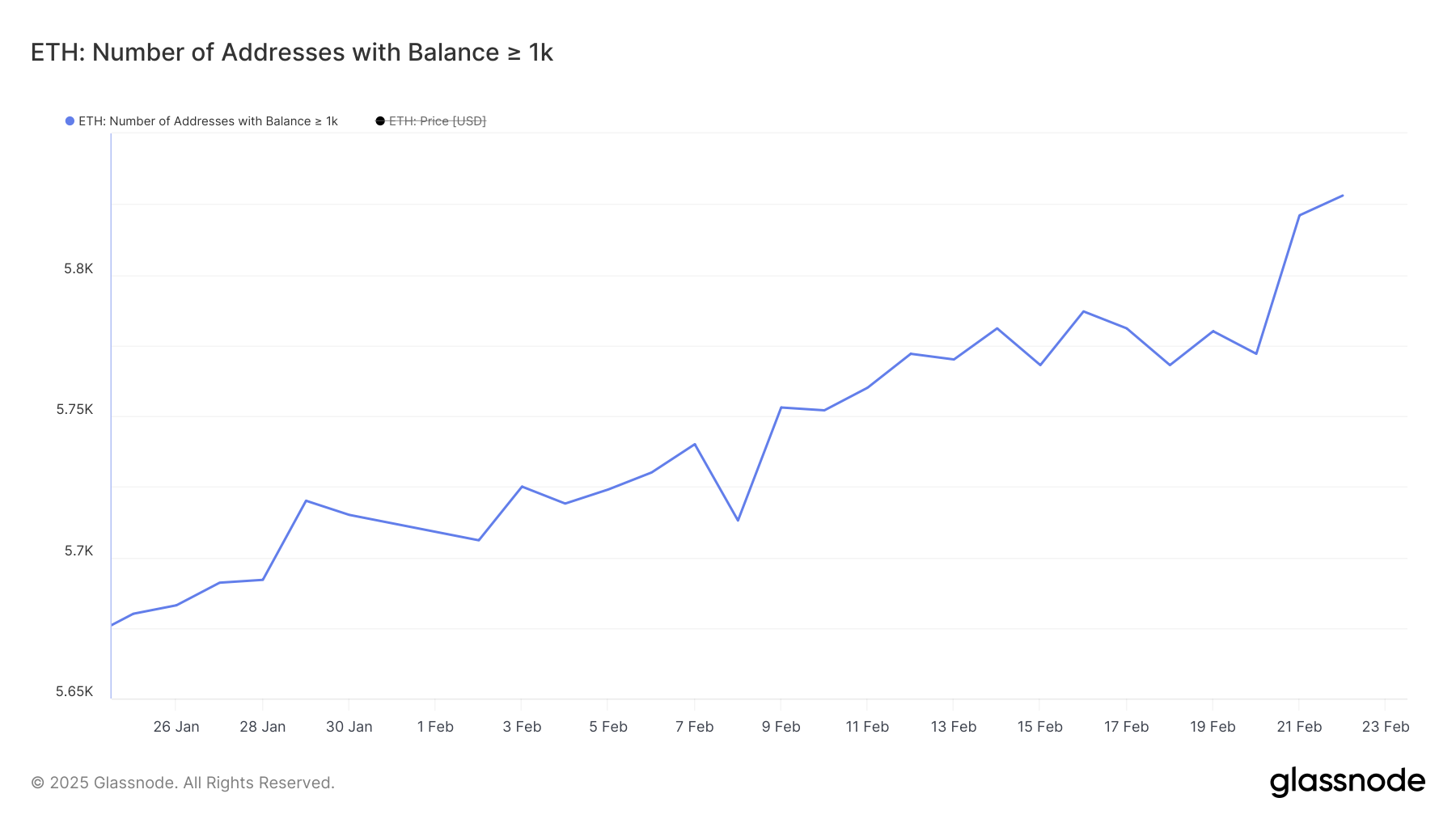

Ethereum Whales Accumulated After Bybit Hack

The number of Ethereum whales – addresses holding at least 1,000 ETH – has been rising steadily over the past month, increasing from 5,680 on January 25 to 5,828 on February 22.

This marks the highest level since December 2023, signaling renewed interest and accumulation among large holders. The increase in whale addresses suggests that institutional investors or high-net-worth individuals are building positions, potentially anticipating future price gains, especially between February 21 and February 22, when ETH prices decreased following the Bybit hack.

This growing accumulation could provide a solid foundation for ETH’s price to rise.

Tracking Ethereum whales is crucial because their buying and selling behavior can significantly impact the market.

When whales accumulate, it reduces the circulating supply, potentially driving prices up as demand meets reduced availability. Conversely, when they sell, it can create significant downward pressure on prices.

Currently, the rise in whale addresses indicates growing confidence and a bullish sentiment among large investors.

Although this is the highest level since December 2023, it is still relatively low compared to historical data. This suggests there is room for more accumulation. If this trend continues, it could lead to a sustained upward movement in ETH price as demand outpaces supply.

Will Ethereum Finally Rise Back Above $2,900?

Ethereum’s EMA lines suggest that a golden cross could form soon. A golden cross typically signals a bullish trend and potential upward momentum.

If this occurs, Ethereum could first test a price level near its long-term line (the blue line in the chart) around $2,876. Breaking this resistance could open the door for a move to $3,020.

If the uptrend continues with strong momentum, ETH could even reach as high as $3,442.

However, ETH has struggled to reclaim levels above $2,900 in recent attempts, signaling possible resistance and market hesitation.

If it fails to break through once more and a downtrend begins, ETH price could test the $2,551 support level. Losing this support could result in a sharper decline, potentially falling to $2,159.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.