A recent CoinGecko report reveals that publicly traded blockchain companies represent 5.8% of the total cryptocurrency market capitalization.

This suggests the crypto industry’s predominantly private nature. Meanwhile, diversification efforts are underway, as are potential initial public offerings (IPOs) capable of tilting the scales.

Publicly Traded Blockchain Companies in Crypto

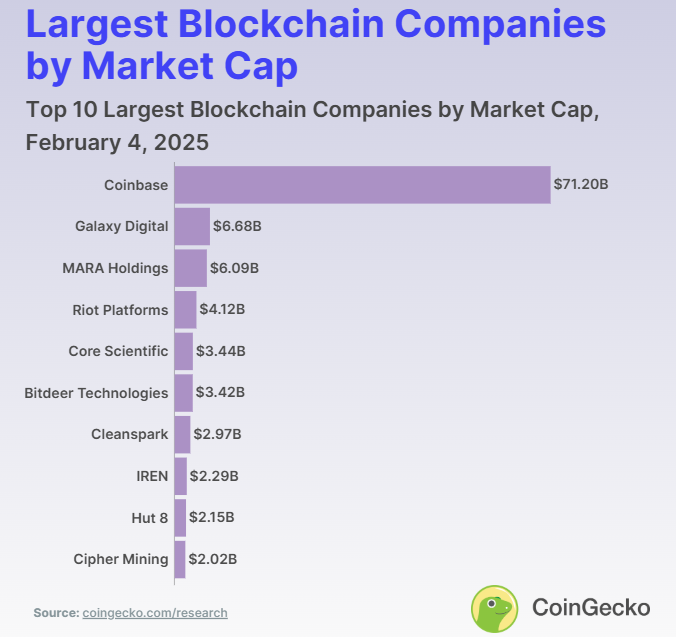

The report, released on February 4, shows only 46 notable publicly traded blockchain companies. The majority, 24 in total, are listed on NASDAQ, with Coinbase (COIN) leading by a significant margin. Coinbase, the largest US-based crypto exchange, boasts a market cap of $71.2 billion.

As the table indicates, Coinbase’s valuation is more than ten times that of the second-largest company, Galaxy Digital (GLXY), which stands at $6.68 billion.

The New York Stock Exchange (NYSE) hosts only two blockchain-focused firms: Bit Mining (BTCM) and Hyperscale Data (GPUS). The latter recently rebranded from Ault Alliance (AULT) to emphasize its shift from cryptocurrency mining to providing artificial intelligence (AI) data center infrastructure. This reflects a broader industry trend of diversification.

In Canada, 47 blockchain companies are listed across various exchanges. The Toronto Stock Exchange (TSX), TSX Venture, and the Canadian Securities Exchange (CSE) are key highlights. However, many of these firms have micro-cap valuations under $10 million or are exchange-traded funds (ETFs). Galaxy Digital stands out as a significant entity listed solely on the TSX.

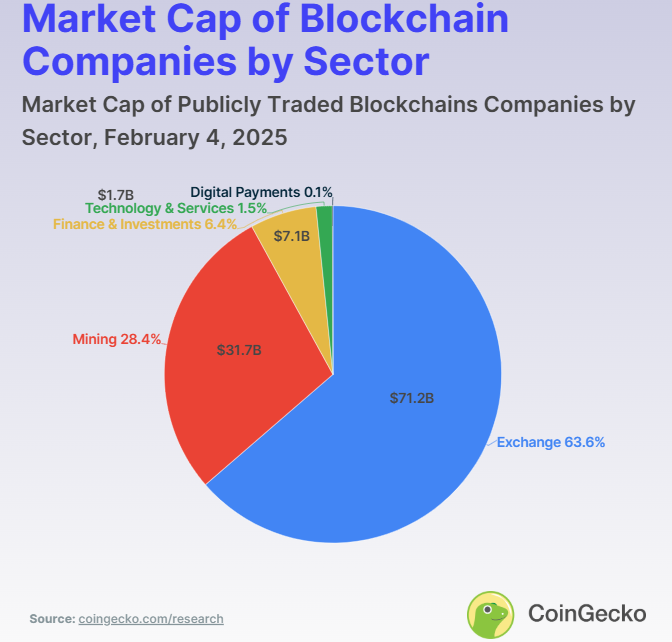

Meanwhile, publicly traded blockchain companies are classified into five primary sectors. Cryptocurrency mining operations are the most prevalent, accounting for 25 of the 46 companies.

Notable mining firms include Marathon Digital Holdings (MARA), which has a market cap of $6.09 billion; Riot Platforms (RIOT), which has a market cap of $4.12 billion; and Core Scientific (CORZ), with a valuation of $3.44 billion.

Diversification Strategies and Upcoming IPOs

The CoinGecko report also indicates several mining companies diversifying into high-performance computing (HPC) and AI data centers. It ascribes the shift to Bitcoin’s fourth halving, which reduced mining rewards from 6.25 BTC to 3.125 BTC.

As part of the diversification, firms like Core Scientific are leveraging their server scaling and infrastructure maintenance expertise. This helps the firm, among others like Hut 8 Mining (HUT), TeraWulf, HIVE Digital Technologies, and CleanSpark, to explore these emerging sectors.

This data highlights the relatively small footprint of publicly traded companies within the expansive crypto market. Despite the industry’s fast-paced growth, the diversification strategies of key players suggest a calculated future.

Looking ahead, several crypto companies plan to enter public markets, potentially increasing the sector’s representation. BitGo, a leading cryptocurrency custodian managing over $100 billion in assets, is reportedly considering an IPO in the second half of 2025.

The crypto custodian’s move aligns with a broader trend of crypto firms exploring public listings amid favorable regulatory developments. Furthermore, industry observers anticipate that companies like Circle, Kraken, and Gemini may pursue IPOs in 2025 in light of the current US administration’s pro-crypto policies.

“Among the possibilities are…the re-opening of the initial public offering (IPO) window for late-stage digital asset companies like Circle and Kraken…,” Ark Invest wrote recently in a newsletter.

These developments could significantly bolster the presence of blockchain companies in public markets, offering investors more avenues to engage with the growing crypto industry.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.