Shiba Inu has been stuck in a persistent downtrend, with recovery attempts consistently failing. The meme coin has struggled to break through key resistance levels, and investor sentiment remains lackluster due to ongoing losses.

With limited support from investors, SHIB now finds itself reliant on the performance of Bitcoin for any potential rebound.

Shiba Inu Investors Need Help

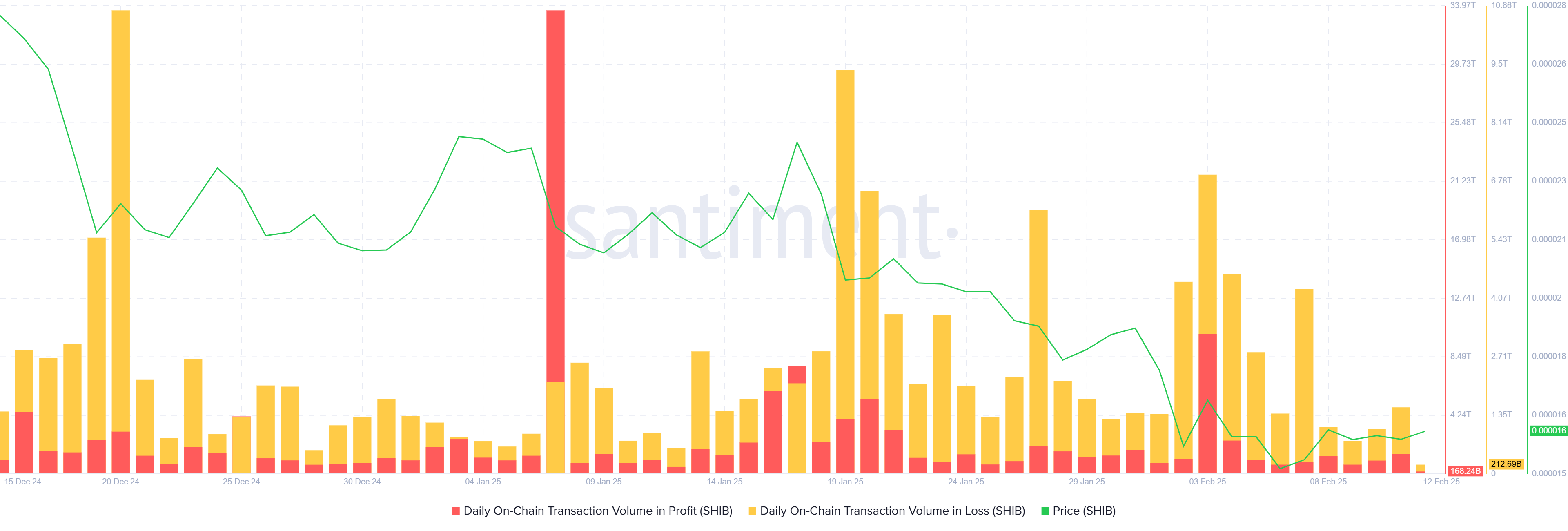

Over the past month and a half, losses in transactions have far outweighed those in profit for Shiba Inu. This reflects the ongoing bearish sentiment, as more investors are in a position of loss than profit. The dominance of losing transactions further dampens market confidence, leaving many hesitant to participate in network activities.

As a result of this bearish outlook, investor behavior has shifted, with many pulling back from conducting transactions on the network. This cautious approach results in lower trading volume, which puts additional pressure on SHIB’s price. Until the sentiment changes or market conditions improve, Shiba Inu is likely to continue facing downward pressure.

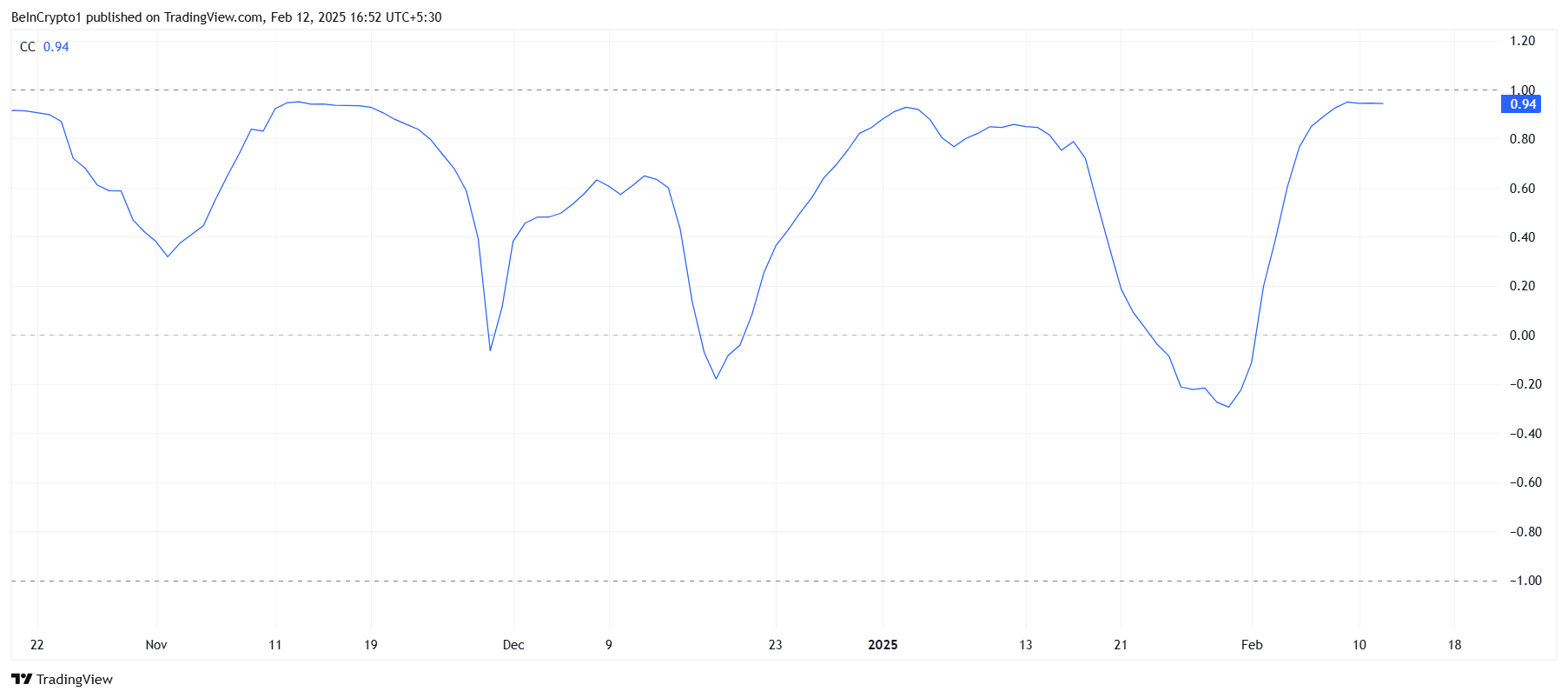

Shiba Inu shares a strong correlation with Bitcoin, with a 0.94 correlation coefficient. This suggests that SHIB could follow Bitcoin’s price movements, especially if Bitcoin continues to show strength. Should Bitcoin break the crucial $100,000 barrier, it could signal a period of growth for the broader crypto market, including Shiba Inu.

This close relationship with Bitcoin offers Shiba Inu a potential path to recovery. If Bitcoin rallies, it could provide the necessary momentum to lift SHIB from its downtrend. However, SHIB’s reliance on Bitcoin also means that its recovery is contingent on Bitcoin’s performance in the coming weeks.

SHIB Price Prediction: Stuck Within A Range

Shiba Inu is currently priced at $0.00001591, having been stuck under the $0.00001676 resistance for the past week. The coin has endured a month-long downtrend, pushing it to its current price level. Without a significant shift in market sentiment, SHIB is unlikely to breach this resistance in the short term.

If the bearish market conditions persist, Shiba Inu may continue to consolidate below the $0.00001676 resistance. However, holding above the $0.00001462 support level could provide SHIB with some stability, preventing further downside and allowing for a potential slow recovery if broader market conditions improve.

Should Bitcoin recover and pull Shiba Inu along with it, SHIB could breach the $0.00001676 resistance and rise toward $0.00002000. A successful push above this key level would open the door for further growth, potentially marking the start of a new bullish phase for the meme coin.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.